Succession planning is vital for entrepreneurs in competitive Bells, Texas, aiming to sell their thriving businesses. By proactively crafting a tailored plan, owners can ensure operational stability, maximize sale value, and attract local buyers seeking established enterprises. Bells' robust economy and diverse industries offer strategic advantages when selling, allowing owners to secure their financial future while capitalizing on market opportunities. A well-structured succession strategy involves identifying successors, cultivating leadership, managing taxes, and setting clear goals, facilitating a seamless transition for businesses in this Texas metropolis. Navigating legal and tax implications through professional guidance is essential, with options like LLC formation enhancing asset protection. Networking, industry events, and business brokers help connect owners with local investors, ensuring accurate valuation and a smooth sale process.

Texas business owners, are you planning for the future? Understanding succession planning is crucial for ensuring your beloved Bells, Texas enterprise thrives beyond your tenure. This comprehensive guide navigates the key aspects of selling your business in a competitive market. From identifying potential buyers and legal considerations to strategic valuation and smooth transition tips, we empower you to make informed decisions. Discover how to maximize your legacy and secure a prosperous future for your Bells, Texas business.

- Understanding Business Succession Planning in Texas

- Why Consider Selling Your Business in Texas?

- Key Elements of a Successful Succession Plan

- Legal and Tax Considerations for Texas Business Owners

- Identifying Potential Buyers and Valuation Strategies

- Ensuring a Smooth Transition: Implementation Tips

Understanding Business Succession Planning in Texas

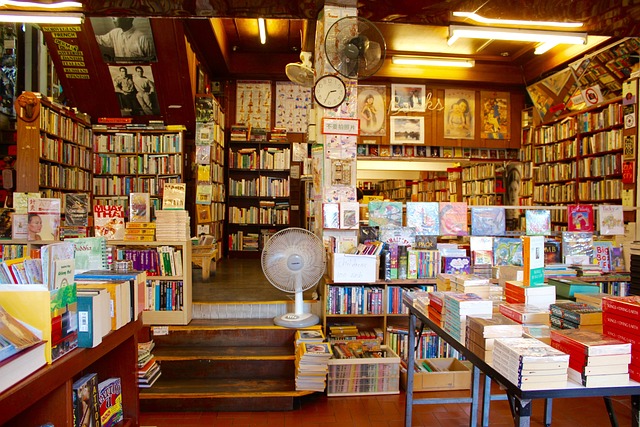

In the dynamic landscape of business, succession planning is a crucial aspect for any entrepreneur in Texas looking to navigate the future. This process involves strategizing and preparing for the transition of ownership and management within a company, ensuring its longevity and stability. For those considering selling their business in Bells, Texas, understanding succession planning becomes vital. It’s not just about finding a buyer; it’s a comprehensive strategy that guarantees a smooth shift, maintains operations, and maximizes value.

Succession planning in Texas encompasses various elements, including identifying potential successors, developing leadership skills, creating exit strategies, and managing tax implications. Entrepreneurs can create a plan tailored to their unique business needs, whether it’s passing the reins to family members, promoting key employees, or attracting external investors. By proactively addressing these aspects, business owners can ensure a seamless transition, attract potential buyers interested in established Texas enterprises, and ultimately achieve their goals of selling their successful ventures.

Why Consider Selling Your Business in Texas?

Selling your business in Texas can be a strategic move for several reasons, especially if you’re looking to secure a comfortable future while maximizing its value. The state’s robust economy and favorable business environment make it an attractive location for both buyers and sellers. With a diverse range of industries thriving, including energy, technology, healthcare, and agriculture, there’s a wide pool of potential purchasers seeking to expand or diversify their operations.

Bells Texas offers a unique opportunity for business owners to connect with prospective buyers interested in acquiring established enterprises. This selling process allows you to pass on your legacy while reaping the benefits of a strong market. Whether you’re retiring, looking to downsize, or simply wanting to explore new ventures, selling can be a game-changer, providing financial security and opening doors to new possibilities.

Key Elements of a Successful Succession Plan

A well-crafted succession plan is crucial for businesses in Texas looking to ensure a smooth transition, especially when considering selling the company. The key elements involve clear goals and objectives, identifying potential successors, and creating a structured timeline. By defining specific roles and responsibilities, business owners can prepare their team for future leadership positions, fostering a seamless handover process.

Additionally, a comprehensive plan should address legal considerations, including ownership transfer mechanisms and tax implications. Engaging with professionals like attorneys and accountants is essential to navigate these complexities. Bells Texas, known for its entrepreneurial spirit, offers valuable resources for business succession planning, ensuring that companies can maintain their legacy while attracting potential buyers interested in long-term growth.

Legal and Tax Considerations for Texas Business Owners

When Texas business owners consider selling their company, understanding legal and tax implications is crucial. The state of Texas offers various options for business succession, each with its own set of rules and regulations. For instance, forming a limited liability company (LLC) can provide both asset protection and flexibility during the transition process.

Tax considerations are another vital aspect to navigate. As a Bells Texas business owner, you’ll want to explore how your business structure impacts tax liabilities. Selling a business may trigger capital gains taxes, so consulting with an accountant or tax advisor is essential. They can help optimize tax efficiency throughout the succession planning process, ensuring compliance and minimizing financial burdens when selling your Texas-based company.

Identifying Potential Buyers and Valuation Strategies

When it comes to Texas business succession planning, identifying potential buyers is a crucial step in ensuring a smooth transition. For owners considering selling their Bells, Texas-based businesses, understanding the market and target audience is essential. This process involves researching potential buyers who align with the company’s values, culture, and strategic direction, whether they are local entrepreneurs, corporate entities, or private equity firms. Networking, industry events, and business brokers can be valuable resources to connect with prospective purchasers.

Valuation strategies play a pivotal role in this phase. Business owners must determine a fair asking price by evaluating various factors such as revenue streams, market position, intellectual property, and asset value. Engaging experienced professionals like accountants and appraisers can provide insightful analyses and help negotiate terms with potential buyers. The right valuation approach ensures that the business is presented attractively to Bells Texas sell my business prospects while maintaining a realistic perspective for all parties involved.

Ensuring a Smooth Transition: Implementation Tips

Ensuring a smooth transition is paramount when planning for the future of your Texas-based business, especially if you’re considering selling it. The process involves careful strategizing and implementation to maintain the health and value of the enterprise while preparing for change. Start by documenting your business’s procedures and policies; this creates a clear manual for the incoming owner or manager, streamlining operations during and after the transition.

Engage with trusted advisors, such as lawyers and accountants, who can provide expert guidance tailored to your specific situation. They can assist in creating a succession plan that aligns with your goals and ensures compliance with legal requirements. Additionally, maintain open communication with key stakeholders, including employees, partners, and customers. Regular updates and transparent dialogue help foster understanding and minimize disruptions during the transition, ultimately facilitating a successful sale or handover of your Bells Texas business.

In conclusion, planning for the future of your Texas-based business is essential, especially when considering a sale. This article has guided you through the various aspects of business succession planning, from understanding the process to navigating legalities and identifying potential buyers. By following the key elements outlined, including strategic implementation, you can ensure a smooth transition, making it an exciting time for both business owners and prospective buyers in Bells, Texas, looking to sell or pass on their successful enterprises.