Rolling over a 401(k) to a Gold IRA diversifies retirement savings with physical gold, offering tax-deferred growth and protection against inflation. Individuals with qualified 401(k) plans can transition at any time, strategically choosing market volatility periods for better outcomes. Strict adherence to IRS rules, proper documentation, and timely action (within 60 days) ensure penalties are avoided, while a self-directed Gold IRA custodian facilitates direct investment in gold bullion or related assets.

“Thinking of converting your 401k to a Gold IRA? This comprehensive guide is your roadmap for navigating this powerful retirement strategy. We break down the complex process, from understanding the basics to eligibility requirements and the benefits that come with diversifying your retirement savings into precious metals.

Learn about timing considerations, follow a step-by-step plan for executing the rollover, and discover why some investors are turning to Gold IRAs as a strategic move for their future financial security.”

- Understanding the 401k to Gold IRA Rollover Process

- Eligibility and Timing for a Smooth Transition

- The Benefits of Converting Your Retirement Savings

- Step-by-Step Guide: Executing the Rollover Successfully

Understanding the 401k to Gold IRA Rollover Process

The process of rolling over a 401k to a Gold IRA is a strategic move for retirement planning, allowing individuals to diversify their investment portfolio with physical gold. This rollover involves transferring funds from a traditional 401k account to a self-directed Gold IRA, offering an opportunity to invest directly in gold bullion or gold-related assets. Understanding this process is crucial as it ensures a smooth transition and maximizes the benefits of gold as a potential asset class.

During the rollover, you’ll need to select a qualified Gold IRA custodian, who will facilitate the transfer of funds and manage your gold investments. The custodian will work with your 401k administrator to ensure the direct rollover, maintaining the tax-advantaged status of the funds. This process involves careful planning and attention to detail to avoid potential penalties or delays.

Eligibility and Timing for a Smooth Transition

When considering a 401k to Gold IRA rollover, understanding eligibility and timing is crucial for a smooth transition. Generally, any individual with a qualified 401k plan can roll it over into a Gold IRA provided they meet specific IRS guidelines. This includes active or retired workers, self-employed individuals, and even some types of small business owners. The key is to ensure the rollover complies with tax regulations, avoiding penalties and taxes.

Timing plays a significant role as well. It’s best to conduct the rollover during periods of lower market volatility for optimal results. Many experts suggest waiting until the end of the year when market fluctuations are typically at their lowest. Additionally, maintaining proper documentation and following IRS rules strictly is essential to ensure the process goes smoothly and to take advantage of tax-free growth opportunities offered by a Gold IRA.

The Benefits of Converting Your Retirement Savings

Converting your retirement savings from a traditional 401(k) to a Gold IRA (Individual Retirement Account) offers significant advantages for securing your financial future. This rollover option allows investors to diversify their portfolios by including a tangible asset like gold, which has historically proven to be a valuable hedge against inflation and market volatility. By rolling over your 401(k) into a Gold IRA, you gain access to a more robust investment strategy that can potentially enhance long-term growth and provide stability.

The benefits extend beyond diversification. A Gold IRA offers tax advantages, including tax-deferred growth, meaning you pay no taxes on the gains until retirement. This is especially beneficial for those concerned about their tax bracket changing in the future. Furthermore, gold is a global asset with intrinsic value, ensuring that your retirement savings are not tied to the performance of any one stock market or economy. This shift towards tangible assets can provide peace of mind and offer a more secure retirement planning experience.

Step-by-Step Guide: Executing the Rollover Successfully

Executing a 401k to Gold IRA rollover requires careful planning and execution, but with the right approach, it can be a smooth transition for your retirement savings. Here’s a step-by-step guide to ensure success:

1. Assess Your Options: Start by understanding the specifics of your current 401k plan and the Gold IRA you’re considering. Research different providers and compare their fees, investment options, and minimum requirements. This will help you make an informed decision.

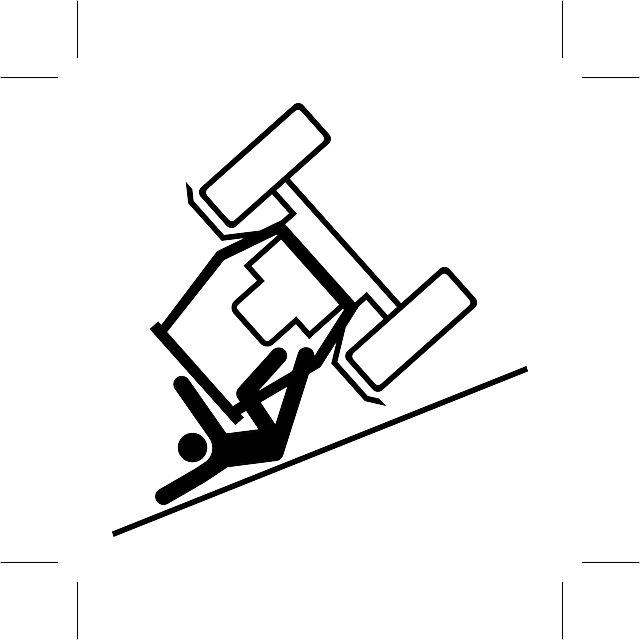

2. Inform Your Employer: If you’re still employed, notify your HR department about your intention to rollover your 401k to a Gold IRA. They can provide guidance on the process and any necessary paperwork. Ensure all funds are fully distributed from your 401k before initiating the rollover.

3. Choose a Rollover Method: There are two primary methods: direct rollover or trustee-to-trustee transfer. A direct rollover is straightforward, where your 401k funds are transferred directly to your new Gold IRA account. A trustee-to-trustee transfer involves the help of a third party, typically an attorney or financial advisor, ensuring the transaction complies with IRS rules.

4. Complete Required Documentation: Gather all necessary forms from both your current 401k administrator and the Gold IRA provider. Fill them out accurately and completely. This may include tax forms and authorization documents to ensure a seamless transfer.

5. Initiate the Rollover: Once all documentation is in order, you or your designated representative can initiate the rollover. Ensure the funds are transferred within the allowed timeframe (usually 60 days) to avoid potential penalties or taxes.

Converting your 401k to a Gold IRA can be a strategic move for retirement planning, offering unique benefits such as diversifying your portfolio and potentially preserving wealth. By understanding the eligibility criteria and optimal timing, you can ensure a smooth transition. This comprehensive guide has outlined the steps involved in the rollover process, empowering you to make an informed decision about your future financial security. Remember, when considering a 401k to Gold IRA rollover, it’s crucial to consult with professionals for personalized advice tailored to your individual circumstances.