Delta 9 Gummies in Vermont: A Legal Guide to Purchase, Dosage, and Storage

In Vermont, Delta 9 THC gummies are a popular and legal choice for both medical and recreational users, provided they comply with state hemp laws that cap THC content at 0.3% by dry weight. Consumers must familiarize themselves with these regulations and understand the importance of purchasing from credible sources that provide lab test results to ensure product safety and compliance. It's essential to stay informed about local laws regarding possession limits and public consumption, as well as to be aware of dosage guidelines to have a safe and legal experience. The state's dynamic market encourages responsible consumption and the pursuit of products with certifications like organic or non-GMO, reflecting individual values. With the recent legalization of Delta 9 THC products, Vermont offers a range of gummies with different flavors and effects, and the industry is expected to grow with an emphasis on consumer safety, product quality, and market sustainability. As regulations evolve, it's crucial for users to engage with knowledgeable dispensaries for tailored guidance on product selection and storage to maintain the efficacy of their Delta 9 gummies within the legal framework established by Vermont.

Delta 9 gummies have emerged as a popular consumption method for adults seeking the effects of cannabinoids in a convenient, discreet form. As their popularity grows, understanding the legal landscape for these products, especially within the state of Vermont, becomes paramount for residents interested in exploring this option responsibly. This article serves as a comprehensive guide to navigating the world of delta 9 gummies, offering insights on sourcing them legally, determining appropriate dosages, and maintaining their potency and safety at home. We’ll also look ahead to the evolving legal framework surrounding these products and how it may influence consumer experiences in Vermont.

- Understanding Delta 9 Gummies: A Legal Guide for Vermont Residents

- Sourcing Delta 9 Gummies Legally in Vermont: Where to Buy and What to Look For

- Dosage and Effects: Navigating the Right Amount of Delta 9 Gummies for Your Experience

- Storing and Handling Delta 9 Gummies: Ensuring Potency and Safety at Home

- The Future of Delta 9 Gummies in Vermont: Legal Landscape and Consumer Expectations

Understanding Delta 9 Gummies: A Legal Guide for Vermont Residents

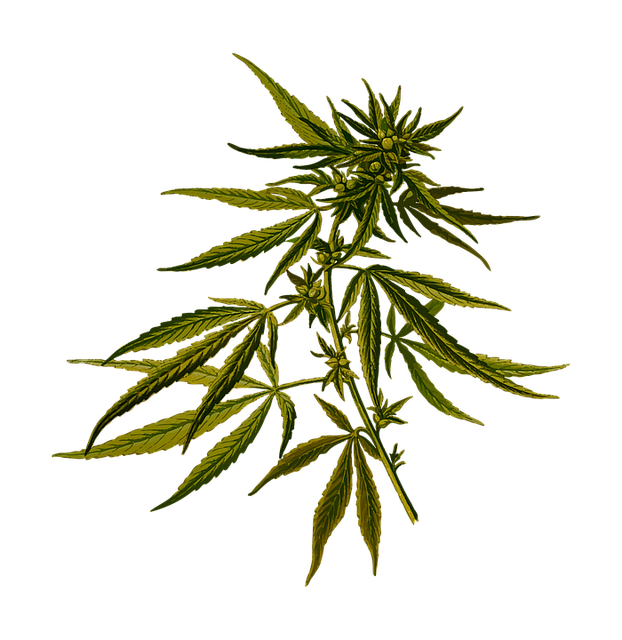

Delta-9 tetrahydrocannabinol (Delta 9 THC) gummies have become a popular consumption method for both medicinal and recreational users in Vermont. As of the latest legal updates, Delta 9 THC is legal in Vermont under certain conditions. For residents looking to legally purchase and consume these gummies, it’s crucial to be well-versed in the state’s regulations. Vermont’s legal framework allows for the possession and use of Delta 9 products derived from hemp that contain no more than 0.3% THC on a dry weight basis. This legislative threshold differentiates hemp from marijuana, which remains under stricter control. Residents should only purchase Delta 9 gummies from reputable sources that provide lab test results confirming their THC content and purity to stay compliant with state laws. It’s also important to be aware of the dosage guidelines to ensure a safe experience, as well as to understand the differences between hemp-derived and marijuana-derived Delta 9 products. For those considering the use of Delta 9 gummies, adhering to Vermont’s legal framework is paramount for a compliant and responsible consumption experience. Always verify the most current regulations, as state and federal laws can evolve over time.

Sourcing Delta 9 Gummies Legally in Vermont: Where to Buy and What to Look For

In Vermont, where Delta 9 THC gummies have been legalized for adult use, discerning consumers are navigating an evolving marketplace to source these products responsibly and effectively. When looking to purchase Delta 9 gummies within the state’s legal framework, it’s crucial to identify reputable dispensaries or licensed cannabis retailers that comply with Vermont’s regulations. These establishments not only offer legally procured Delta 9 gummies but also ensure product safety and quality. Patrons should look for stores with a transparent compliance history and those that provide lab test results verifying the potency and purity of their Delta 9 products. Additionally, staying informed about local laws regarding possession limits and public consumption is essential for a legal and pleasant experience. Vermont’s recreational cannabis program is relatively new, and its market is still maturing; therefore, consumers should prioritize purchasing from licensed sources to avoid the risks associated with unregulated markets.

Furthermore, when sourcing Delta 9 gummies in Vermont, it’s important to consider not only the legal aspects but also the variety of products available. A wide array of options exists, from different flavors and strengths to various effects and formulations. Consumers should feel empowered to ask for certifications, such as organic or non-GMO, and inquire about the sourcing and production methods of their Delta 9 gummies. By doing so, they can make informed decisions that align with their personal preferences and values while enjoying the legal perks of cannabis consumption in Vermont. Always ensure that the dispensary you choose is up-to-date with the latest regulations and offers guidance on product selection based on your individual needs and state laws.

Dosage and Effects: Navigating the Right Amount of Delta 9 Gummies for Your Experience

Delta 9 gummies have become a popular choice for consumers looking to explore the effects of cannabinoids legally and responsibly. In states like Vermont, where delta 9 THC-containing products are legal, understanding the correct dosage is crucial for a safe and enjoyable experience. The psychoactive nature of delta 9 means that consuming an excessive amount can lead to overwhelming effects or adverse reactions. Therefore, it’s important to start with a low dose to gauge how your body will respond before considering an increase. Factors such as tolerance, body chemistry, and the desired effect should guide your dosing decision. For new users, a common recommendation is to begin with a gummy containing around 5-10 milligrams of delta 9 THC. This starting point allows for a gradual onset of effects, providing time to assess whether you need more or prefer to stick with the initial dose for a milder experience. It’s always best to wait and observe how your body feels before consuming additional gummies. In states where it is legal, such as Vermont, regulation ensures that packaging includes clear dosage instructions, which is an invaluable resource for consumers. Always adhere to the manufacturer’s guidelines and proceed with caution, especially if you are sensitive to THC or have specific health concerns. Remember that everyone’s metabolism and tolerance levels are different, so finding your personal ‘goldilocks zone’—just right for your experience—may require some experimentation within the legal limits provided by delta 9 products like gummies in Vermont.

Storing and Handling Delta 9 Gummies: Ensuring Potency and Safety at Home

Delta 9 gummies, a popular consumption method for cannabinol (CBD) and tetrahydrocannabinol (THC), require proper storage to maintain their potency and safety. In states like Vermont where delta 9 THC products are legal under certain conditions, understanding how to store these gummies is crucial for both efficacy and compliance with local regulations. To preserve the integrity of your delta 9 gummies, they should be kept in a cool, dry place away from direct sunlight and humidity. The ideal storage condition is typically a dark, airtight container or the original child-resistant packaging. This not only protects the gummies from degrading but also safeguards them from unauthorized access, which is particularly important if you have them in a household with children or pets. Additionally, ensure that these products are stored at a consistent temperature, as fluctuations can affect their chemical composition and potency over time. Proper handling and storage are key factors in enjoying the full benefits of delta 9 gummies while adhering to Vermont’s legal framework for their use. Always check the specific labeling and manufacturer’s guidelines for the most accurate and tailored advice regarding the storage of your particular delta 9 gummy product. By following these steps, you can help ensure that your delta 9 gummies remain effective and safe until consumption.

The Future of Delta 9 Gummies in Vermont: Legal Landscape and Consumer Expectations

In recent times, the legal landscape surrounding Delta 9 gummies has been evolving rapidly in Vermont. As of the latest legislative updates, Delta 9 THC products are legally permissible under state laws, provided they adhere to specific regulatory frameworks. This legalization opens a new chapter for consumers and businesses alike, with anticipation growing for the introduction of these gummies in both medical and recreational markets. Consumers in Vermont are increasingly looking forward to a wider array of cannabis-infused edibles that cater to diverse preferences and needs, with Delta 9 gummies being at the forefront due to their discreet and enjoyable form factor. The state’s regulatory bodies continue to refine guidelines to ensure consumer safety and product quality, which is paramount in establishing a sustainable market for these products. As such, stakeholders are closely monitoring the development of this emerging sector, with an eye on how it will shape up in terms of product innovation, accessibility, and compliance with state laws.

The trajectory of Delta 9 gummies in Vermont’s future is poised to be influenced by both consumer expectations and the ongoing legislative dialogue. Consumers anticipate a range of potencies, flavors, and effects from these gummies, reflecting a desire for personalized cannabis experiences. The burgeoning market also signals a demand for transparency in labeling and potency, as well as for products that are both efficacious and responsibly produced. As the industry matures, it is expected that Delta 9 gummies will become a staple in Vermont’s cannabis landscape, with manufacturers investing in research and development to meet these expectations while navigating the complex interplay between state and federal regulations. The future of Delta 9 gummies in Vermont hinges on the balance between regulatory compliance and consumer satisfaction, a challenge that the industry is well-equipped to address as it moves forward.

Delta 9 gummies have become a topic of interest for many Vermont residents seeking legal ways to experience cannabinoids. This article has provided a comprehensive guide on understanding, sourcing, dosing, and storing these products responsibly within the state’s legal framework. As regulations evolve, it’s clear that staying informed about the legal landscape regarding delta 9 gummies in Vermont is crucial for consumers. By adhering to the guidelines outlined here, residents can safely and legally enjoy the benefits of delta 9 gummies while anticipating future developments in this growing market. Remember to always prioritize safety and legality when incorporating such products into your routine.