Alice’s Guide to Retiring from Business in Texas: Valuing, Selling, and Securing Your Future

Alice, an experienced entrepreneur from Texas, successfully transitioned into retirement by strategically planning her exit and selling her business. She meticulously explored various retirement options under Texas law, including IRAs and 401(k)s, and consulted with a financial advisor specializing in retirement strategies for entrepreneurs in the state. Leveraging her professional network, Alice connected with a buyer who valued her business and understood its worth within the unique economic landscape of Texas, which includes sectors like energy, technology, agriculture, and healthcare. She structured the sale to ensure a comfortable cash flow post-retirement, considering tax implications and utilizing investment vehicles suitable for her risk tolerance and financial goals. Alice also took advantage of the Roth IRA option for potential tax-free income in retirement. By engaging with the local business community, using targeted advertising, and aligning with buyers who shared her values, Alice ensured a legacy that allowed her business to thrive under new ownership while she enjoyed her well-deserved retirement years. The process underscores the importance of understanding the nuances of the Texas market and the value of networking and professional guidance in achieving a successful transaction.

Retirement presents a significant juncture for Texas business owners, particularly those like Alice who are ready to transition from the daily grind of entrepreneurship. This article delineates a comprehensive strategy for Texas entrepreneurs looking to maximize their retirement through the successful sale of their ventures. We’ll navigate the unique facets of the Texas business market, offering insights into valuing your business and the legal requirements of selling. With a focus on financial planning and attracting the ideal buyer, this guide is tailored to ensure that Alice’s legacy and her bottom line are both set for a prosperous post-business era.

- Maximizing Your Retirement: A Step-by-Step Guide for Texas Business Owners Like Alice

- Navigating the Texas Business Market: Understanding Your Options

- Valuing Your Venture: Key Factors for Assessing Your Business's Worth in Texas

- Legal Considerations: The Necessary Steps to Legally Sell Your Business in Texas

- Financial Planning for Retirement: Strategies for Securing Your Future After Selling

- Finding the Right Buyer: Tailoring Your Sales Approach in the Texas Market

Maximizing Your Retirement: A Step-by-Step Guide for Texas Business Owners Like Alice

Alice, a seasoned entrepreneur from Texas, decided it was time to hang up her boots and retire after years of diligent work in her thriving business. To ensure that her retirement would be as comfortable and secure as her entrepreneurial journey, Alice set out to meticulously plan her transition. The first step for Alice was understanding the retirement options available under Texas law, including traditional IRAs, Roth IRAs, and the unique benefits of a Simplified Employee Pension (SEP) IRA or a Solo 401(k), given her status as a sole proprietor. She also explored the Texas DIRT (Dividends, Interest, Royalty, and Rents) Trust for tax-advantaged income strategies.

Alice’s next move was to consult with a financial advisor who specialized in retirement planning for Texas business owners. This expert guidance helped her assess the value of her business, identify potential buyers, and market “Alice Texas sell my business” effectively. With the help of a professional network, she found a buyer who appreciated the legacy and potential of her business. As part of the sale agreement, Alice structured a deal that provided her with a steady stream of income post-sale, which would be supplemented by her well-planned retirement accounts. By taking these calculated steps, Alice ensured that her transition into retirement was not just a financial decision but also a strategic one, allowing her to enjoy the fruits of her labor while maintaining her financial independence in the Lone Star State.

Navigating the Texas Business Market: Understanding Your Options

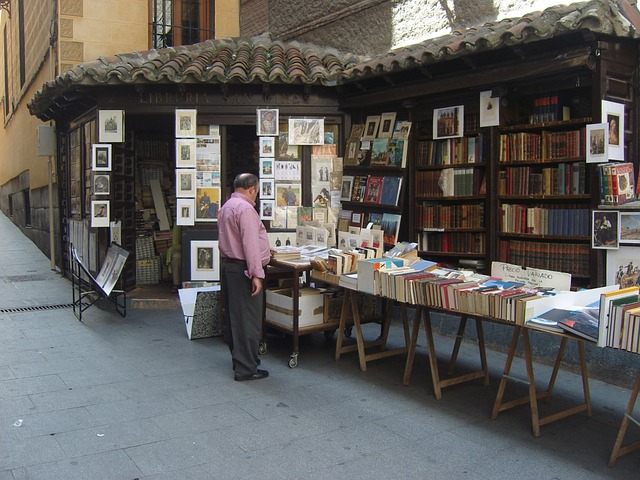

Navigating the Texas business market presents a unique set of opportunities and challenges for business owners looking to retire or sell their ventures. For individuals like Alice from Texas, who are contemplating selling their business, it’s crucial to familiarize oneself with the local economic climate and potential buyers. The Lone Star State boasts a diverse range of industries, from energy and technology to agriculture and healthcare, each offering distinct avenues for sale. Prospective sellers should consider the region’s economic trends, regulatory environment, and market demand when determining the optimal time and strategy for transitioning out of their business. Understanding the nuances of the Texas market is essential for securing a fair valuation and identifying buyers who align with the business’s culture and strategic direction. Networking within local business associations and leveraging professional brokerage services can provide valuable insights and connections, facilitating a smoother sale process. Alice Texas sell my business should start by assessing the business’s financial health, market position, and growth potential to attract serious buyers and achieve a successful transaction.

In Texas, the process of selling a business is not merely about finding a buyer; it’s about aligning with a successor who will uphold the business’s legacy and values. Sellers must navigate through various exit strategies, such as selling to an external buyer, transferring ownership internally, or merging with another entity. Each option carries its own set of implications regarding the continuity of operations, employee retention, and the seller’s post-transaction involvement. To maximize the business’s value, Alice should prepare detailed financial records, understand her business’s unique selling points, and establish a clear transition plan. Engaging with a professional who specializes in Texas business sales can provide tailored advice to ensure that Alice’s retirement is both financially secure and strategically sound. This professional guidance can be instrumental in facilitating a successful transition and achieving a satisfying retirement outcome.

Valuing Your Venture: Key Factors for Assessing Your Business's Worth in Texas

When contemplating retirement and the sale of your venture in Texas, understanding the value of your business is paramount. Alice Texas sell my business scenarios necessitate a comprehensive valuation that encompasses various critical factors. To accurately ascertain your business’s worth, one must consider the financial performance metrics, such as consistent revenue streams, profit margins, and cash flow analysis. These figures provide a solid foundation for valuation but are complemented by other elements unique to Texas’s business landscape.

In addition to financial performance, market trends, economic conditions, and industry-specific dynamics play a significant role in valuing your venture. Texas’s diverse economy means that oil and gas, agriculture, technology, and retail sectors each have their own influencing factors on value. For instance, a technology startup in Austin may be valued differently than a longstanding farm in the Rio Grande Valley due to differences in market demand, growth potential, and sector-specific risks. Furthermore, strategic assets such as intellectual property, customer base, and key supplier relationships can significantly impact your business’s valuation. Engaging with local experts who specialize in Texas business sales, like those familiar with Alice, can offer tailored insights and guidance to help you navigate this complex process and achieve a fair market value for your enterprise upon retirement.

Legal Considerations: The Necessary Steps to Legally Sell Your Business in Texas

When contemplating the sale of your business in Texas, it’s imperative to navigate the legal framework with precision. Alice Texas entrepreneurs looking to sell their businesses must adhere to a series of steps to ensure a compliant and smooth transition. The first step involves drafting a detailed business description and financial statement, which will provide potential buyers with a clear understanding of your company’s operations and profitability. This due diligence not only fosters transparency but also sets the stage for valuing the business accurately.

Once prepared, these documents should be presented alongside a well-crafted business prospectus that outlines the sale’s particulars. Texas law requires sellers to disclose all material facts about the business, including any legal entanglements or financial discrepancies. Engaging with a knowledgeable attorney in Alice, Texas, is crucial to ensure compliance with state and federal regulations, such as the Texas Securities Act, which governs how businesses can be offered for sale. Additionally, determining the correct valuation method for your business is vital, as it will influence the selling price and attract potential buyers. Legal considerations also extend to the structuring of the deal, whether it’s an asset sale or a stock sale, each with its own implications under Texas law. Prospective sellers should also consider the implications of any existing contracts or leases that will transfer to the new owner, ensuring these are accounted for in the sales agreement. Throughout this process, maintaining open communication with your legal representative is key to addressing any potential issues and facilitating a successful sale of your Texas business.

Financial Planning for Retirement: Strategies for Securing Your Future After Selling

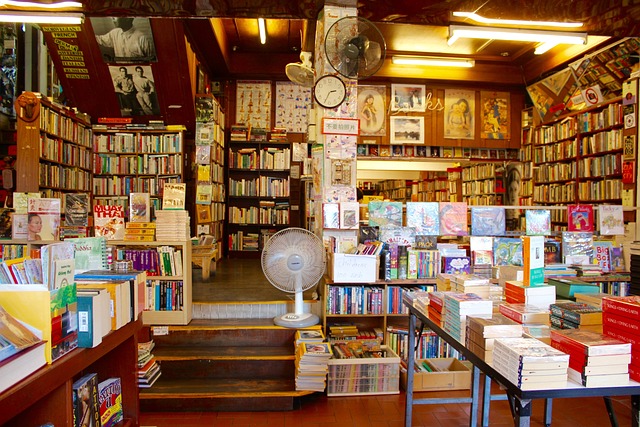

In Texas, entrepreneurs like Alice who are contemplating retirement after selling their businesses must prioritize financial planning to ensure a secure and comfortable future. A strategic approach involves assessing one’s current financial situation, including assets, liabilities, and cash flow. It’s advisable to consult with financial advisors who specialize in retirement strategies tailored to the Texas market. These professionals can help Alice understand the implications of selling her business, such as capital gains taxes and the timing of the sale, which are crucial factors in maximizing her retirement funds. Additionally, creating a diversified investment portfolio that aligns with her risk tolerance and financial goals is key. This might include a mix of stocks, bonds, real estate investments, and other vehicles that can provide both growth and income over time.

Furthermore, Alice should consider establishing an Individual Retirement Account (IRA) or a 401(k), especially if she didn’t have one during her business operations. These accounts offer tax advantages and can be instrumental in preserving the wealth she realizes from selling her business. Texas residents also have the option to invest in a Roth IRA, which can provide tax-free income during retirement. It’s important for Alice to regularly review and adjust her financial plan as needed, taking into account any changes in the economic landscape or personal circumstances. By doing so, she can navigate the transition from business ownership to retirement with confidence, knowing that her future is financially secured.

Finding the Right Buyer: Tailoring Your Sales Approach in the Texas Market

In the Lone Star State, where the market for businesses is as diverse as its landscapes, finding the right buyer for your enterprise is a pivotal step in ensuring a successful transition into retirement. Alice Texas entrepreneurs looking to sell their businesses must tailor their sales approach to align with the unique dynamics of the Texas market. This involves understanding the local economic climate, the preferences of potential buyers, and the nuances that differentiate the Texas market from others. A strategic approach might include networking within local business circles, leveraging relationships with commercial brokers who specialize in the area, and attending industry-specific events in Texas to identify and connect with buyers who are not only financially qualified but also a good cultural fit for your business. Utilizing targeted advertising and online platforms that cater to Texas businesses can further enhance visibility among serious buyers. By customizing your sales strategy to resonate with the Texas ethos and by showcasing the unique value proposition of your business, you increase the likelihood of attracting a buyer who shares your vision and commitment to excellence, ensuring a smoother transition for both parties involved.

Navigating the Texas market requires more than just a ‘for sale’ sign; it demands an informed, personalized approach. Alice Texas business owners

In conclusion, for Texas business owners like Alice contemplating retirement and the sale of their ventures, a strategic, well-informed approach is paramount. This guide has outlined critical steps to maximize your retirement while navigating the unique facets of the Texas business market. From understanding your business’s worth to legal requirements and finding the right buyer, each stage demands careful consideration and tailored strategies. Alice can take solace in knowing that with thorough financial planning and a comprehensive understanding of her options, securing a comfortable and fulfilling retirement is within reach. For those ready to sell “Alice Texas sell my business,” this article serves as a roadmap to making the transition smooth and profitable.