Maximize Your Kentucky Business Value: A Comprehensive Guide to Selling

When deciding to sell your business in Kentucky, a comprehensive understanding of the state's diverse economic sectors, including its leadership in agriculture and significant presence in manufacturing like automotive and aerospace, is vital. Kentucky's strategic central location for transportation and logistics enhances its appeal as a business hub, affecting how it values businesses. A detailed market analysis tailored to Kentucky's trends, competition, employment rates, and economic forecasts is essential for accurate valuation and positioning. Engaging with local experts and considering state-specific advantages such as tax incentives, regulatory environment, and intangible assets like brand recognition and a skilled workforce will help you achieve the best value when selling your business. Valuation methods including asset-based evaluations, earnings multiplier analyses, and discounted cash flow projections should be applied to reflect your business's unique financial profile. For an accurate valuation and to maximize appeal in the "sell my business Kentucky" market, it is advisable to work with professionals who are well-versed in Kentucky's regulations and guidelines. This approach ensures that all aspects of your business are considered, helping you secure a fair market price and attract serious buyers.

Entrepreneurs in Kentucky looking to sell their businesses have a unique landscape to navigate. This article demystifies the process of valuing your business correctly, ensuring you maximize your return in the Bluegrass State’s vibrant market. We delve into the local market dynamics, pivotal factors that influence valuation, and a detailed valuation methodology tailored for Kentucky businesses. Collaborating with seasoned appraisers and brokers is crucial to secure an accurate assessment of your enterprise’s worth, facilitating a smoother transition to new ownership. Whether you’re considering ‘sell my business Kentucky’ or preparing for future investment opportunities, this guide provides the insight necessary to make informed decisions.

- Understanding the Market Landscape for Selling Your Business in Kentucky

- Key Factors Influencing Business Valuation in the Bluegrass State

- The Step-by-Step Process of Valuing Your Kentucky Business for Sale

- Engaging with Professional Appraisers and Brokers for Accurate Valuations

Understanding the Market Landscape for Selling Your Business in Kentucky

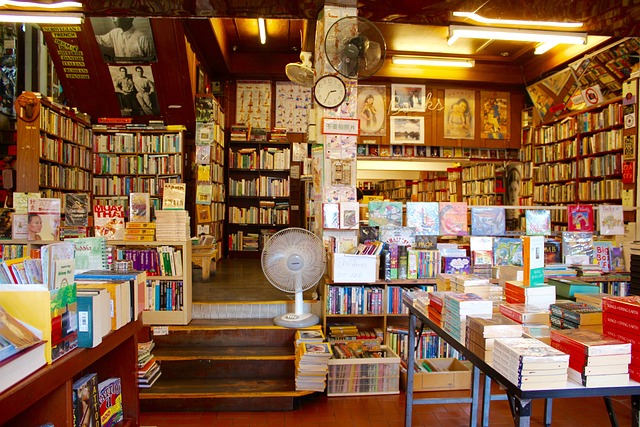

When considering the sale of your business in Kentucky, it’s crucial to have a thorough understanding of the local market dynamics. The Bluegrass State offers a diverse array of opportunities for businesses across various sectors, including manufacturing, agriculture, and services. To navigate this landscape effectively, you must first assess the prevalent industries and how they influence buyer interest and valuation. Kentucky’s economy is heavily influenced by its robust manufacturing sector, particularly automotive and aerospace, which can be a significant draw for potential acquirers. Agriculture also plays a vital role, with the state being a leading producer of soybeans and corn, potentially attracting investors interested in agribusiness ventures.

In addition to industry-specific factors, regional economic trends and local competition should inform your valuation strategy. Kentucky’s strategic location in the Midwest and South regions of the United States positions it as a transportation and logistics hub, which can impact your business’s accessibility and appeal to buyers. Understanding the nuances of the Kentucky market—such as regional growth patterns, employment rates, and economic forecasts—will help you position your business favorably in the marketplace. Engaging with local business brokers or advisors who specialize in Kentucky transactions can provide valuable insights into the current trends and help you determine the optimal time to sell your business for maximum value. Utilizing comprehensive market analysis and leveraging regional strengths will be key components in successfully valuing and selling your business in Kentucky’s unique market environment.

Key Factors Influencing Business Valuation in the Bluegrass State

When considering the valuation of a business in Kentucky, several key factors come into play that can significantly influence its market value. These factors are critical for individuals looking to sell their business in the Bluegrass State, as they contribute to the overall attractiveness and financial worth of the enterprise. One of the primary factors is the economic landscape of Kentucky itself, which includes the state’s industrial diversity ranging from manufacturing and agriculture to burgeoning tech sectors. This diversity can affect valuation by presenting a balanced risk profile to potential buyers.

Another influential factor is the business’s financial performance, including revenue streams, profit margins, and cash flow stability. A well-established track record of consistent financial performance can lead to a higher valuation. Additionally, strategic location plays a pivotal role; Kentucky’s proximity to major markets like Chicago and Atlanta, along with its central geographic position within the United States, can make businesses more attractive to buyers looking for regional expansion opportunities. Furthermore, the state’s regulatory environment and tax incentives should be considered, as they can impact operational costs and profitability. Lastly, intangible assets such as brand reputation, customer loyalty, intellectual property, and skilled workforce are often overlooked but can significantly contribute to a business’s value when selling in Kentucky. Understanding these factors is essential for business owners aiming to sell their business in Kentucky, ensuring they receive a valuation that reflects the true potential of their enterprise.

The Step-by-Step Process of Valuing Your Kentucky Business for Sale

When contemplating the sale of your Kentucky business, accurately valuing it is paramount to ensure a fair market transaction and to attract serious buyers. The process of valuing your Kentucky business for sale involves several methodical steps designed to ascertain the true worth of your enterprise. The first step is to gather comprehensive financial data. This includes income statements, balance sheets, cash flow statements, and any other relevant documents that reflect the financial health of your business. These records provide a clear picture of the profitability, operational efficiency, and financial stability of your venture, which are critical factors in determining value.

The next phase of the valuation process involves selecting and applying valuation methods that align with the nature of your Kentucky business and its industry. Common approaches include the asset-based method, which assesses the net asset value of the company; the earnings multiplier method, which analyzes the business’s earnings in relation to similar businesses sold in the market; and the discounted cash flow method, which projects future cash flows and discounts them back to present value. Each method has its own merits and should be chosen based on the specific characteristics of your business. Additionally, considering comparable sales and industry-specific multiples can provide a benchmark for valuation. It’s crucial to engage with a professional appraiser or a broker who specializes in business valuations within Kentucky to ensure that all aspects of your business are accurately considered and that you adhere to state-specific regulations and guidelines. This expert guidance will help you to value your Kentucky business correctly, positioning it attractively for potential buyers interested in “sell my business Kentucky” listings.

Engaging with Professional Appraisers and Brokers for Accurate Valuations

When considering the sale of your business in Kentucky, it’s crucial to approach valuation with precision and thoroughness. This article has outlined the market landscape, key influencing factors unique to the Bluegrass State, and a detailed step-by-step process for accurately valuing your Kentucky venture. Engaging with professional appraisers and brokers is not just a recommendation; it’s an integral step in ensuring your business’s worth is truly reflected in the market. By understanding these elements, you can make informed decisions and maximize your business’s value when you decide to sell my business in Kentucky. Remember to leverage local expertise and industry-specific insights to secure a fair and favorable outcome for your enterprise’s future.