Navigating Large Cat Breeds: Finding Your Ideal Feline Match

Large cat breeds like Maine Coons and Ragdolls require significant space, specialized care, and dedicated time due to their size and active natures. They have unique dietary needs and may necessitate larger living spaces. Owning them involves regular playtime, grooming, vet check-ups, and interactive sessions for well-being. Choosing a large breed aligns with your lifestyle; consider health challenges like joint strain and obesity. Provide ample space, vertical exploration, mental stimulation, proper nutrition, and regular veterinary care. Decide between adopting from shelters/rescues or buying from reputable breeders based on your preferences and goals.

Considering getting a large cat breed? This comprehensive guide is your perfect starting point. We’ll walk you through understanding these majestic creatures, exploring popular options like Maine Coons and Ragdolls, and helping you choose the purrfect match for your lifestyle. From health considerations to care requirements, we cover it all. Discover the benefits of adopting vs buying and find your new furry friend among the diverse world of large cat breeds.

- Understanding Large Cat Breeds: Characteristics and Needs

- Popular Large Cat Breeds: A Comprehensive Overview

- Choosing the Right Fit: Matching Personality with Your Lifestyle

- Health Considerations for Large Cat Breeds

- Care Requirements for a Happy and Healthy Large Cat

- Adopting vs Buying: Finding Your Perfect Feline Companion

Understanding Large Cat Breeds: Characteristics and Needs

Large cat breeds, while often awe-inspiring with their majestic presence, come with unique characteristics and needs. These feline giants require ample space to roam and play, reflecting their natural hunting instincts. Their robust builds demand regular exercise and mental stimulation to stay content and healthy. Owning a large cat breed is a significant commitment, necessitating dedicated time for play, grooming, and interactive play sessions.

Understanding these requirements is crucial when deciding on a pet. Unlike smaller breeds, large cats like Maine Coons or Ragdolls may need larger living spaces and specialized care. Their dietary needs can vary, with some requiring higher protein content to support their active natures. Additionally, regular vet check-ups are essential to manage potential health issues common in these larger breeds.

Popular Large Cat Breeds: A Comprehensive Overview

If you’re considering a large cat breed, there are several captivating options to explore. Breeds like the Maine Coon and Ragdoll are renowned for their gentle dispositions and impressive sizes, making them beloved family pets. The Maine Coon, originating from North America, stands out for its luxurious coat, tufted ears, and friendly nature. These cats can grow up to 15 pounds or more, ensuring they’re not just a pretty face but also a loyal companion.

Ragdoll cats, on the other hand, are known for their docile temperament and tendency to go limp when picked up—a trait that earned them their name. They typically weigh between 10 to 25 pounds, with long, silky fur and striking blue eyes. Both breeds require regular grooming due to their extensive coats but offer immense affection and an engaging presence, making them ideal choices for households seeking a large feline friend.

Choosing the Right Fit: Matching Personality with Your Lifestyle

When deciding on a cat breed, it’s crucial to match your lifestyle with their personality traits. While large cat breeds like Maine Coons or Ragdoll cats might be appealing due to their impressive size and affectionate nature, they also require more space and attention. If you live in a smaller apartment or have a busier schedule, these majestic creatures might not be the best fit. Conversely, breeds known for their independence, such as Siamese or Abyssinian cats, could thrive in such environments as they are content with regular playtimes and don’t necessitate constant companionship.

Consider your daily routine and home setup to ensure harmony with a potential feline companion. Active individuals who enjoy outdoor adventures might appreciate a breed that keeps up with their pace. However, if you’re looking for a lap cat to cuddle up with after long days, breeds known for their calm demeanor, like the Persian or Russian Blue, could be ideal. Matching your lifestyle and expectations with a cat’s personality will lead to a happier, healthier relationship for both you and your future furry friend.

Health Considerations for Large Cat Breeds

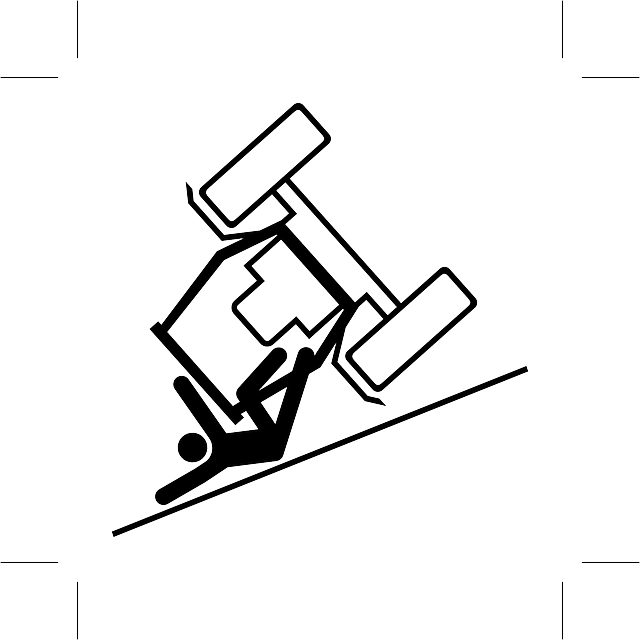

When considering a large cat breed, it’s essential to be aware of potential health concerns specific to their size. These feline friends, with their majestic builds, can be prone to certain medical issues. One common challenge is joint strain and mobility problems due to their substantial weight. Arthritis, hip dysplasia, and obesity are significant worries, necessitating a balanced diet and regular exercise routines to maintain their overall well-being.

Additionally, large cats may require specialized care for respiratory and cardiovascular health. Their larger frames can make them susceptible to conditions like asthma and heart disease. Regular veterinary check-ups, along with a commitment to their physical and environmental needs, are crucial in ensuring these majestic breeds lead happy, healthy lives.

Care Requirements for a Happy and Healthy Large Cat

Caring for a large cat breed requires a thoughtful approach to ensure their well-being and happiness. These majestic felines, known for their impressive size and robust builds, need ample space to roam and exercise. A spacious home with multiple levels is ideal, as it allows them to climb, jump, and explore vertically, mimicking their natural habitat. Regular play sessions are crucial to keep them active and mentally stimulated; interactive toys, scratching posts, and perches can greatly enhance their environment.

Proper nutrition is another key aspect of large cat care. They have specific dietary needs, often requiring higher protein levels compared to smaller breeds. High-quality commercial cat food formulated for larger cats is recommended. Additionally, providing fresh water at all times and ensuring easy access to litter boxes (preferably multiple) will contribute to their overall health and contentment. Regular veterinary check-ups are essential to monitor their growth, address any potential health issues, and ensure they receive the necessary vaccinations.

Adopting vs Buying: Finding Your Perfect Feline Companion

When considering a new feline friend, one of the first decisions to make is whether to adopt or buy from a breeder. Both options have their unique advantages and can lead you to find your perfect large cat breed match. Adopting from a shelter or rescue organization offers a second chance for cats who might otherwise be euthanized, providing loving homes for those in need. You’ll often find a diverse range of breeds and mixed breeds, including some rare and distinctive larger varieties. This option is ideal if you’re open to surprises and want to contribute to cat welfare.

On the other hand, purchasing from a reputable breeder allows you to choose specific traits and characteristics of your future companion. Many large cat breeds have dedicated breeders who prioritize health, temperament, and the preservation of breed standards. By buying from a trustworthy source, you can ensure your cat is healthy, socialized, and comes with all necessary paperwork. It’s a great option for those seeking a particular breed known for its unique traits or wanting a more controlled environment to meet their desired feline companion.

When considering a large cat breed, it’s essential to strike a balance between your lifestyle and their specific needs. By understanding the unique characteristics and care requirements outlined in this guide, you’re well-equipped to make an informed decision. Whether adopting or buying, remember that each breed has its own distinct personality and preferences. With the right match, a large cat can become a beloved and enriching addition to your home, offering companionship and endless joy for years to come.