Selling a Franchise in Texas: Your Guide Post-Abbott and Market Insights

Following Governor Greg Abbott's leadership, Texas has emerged as a top destination for franchise investment and expansion, characterized by strong economic growth and a favorable business climate. Entrepreneurs looking to buy or sell franchises will find opportunities across diverse sectors including retail, food service, healthcare, and technology in Texas. The state's substantial population ensures consistent consumer demand and a wide customer base, which is advantageous for new ventures seeking growth and profitability. For those considering the sale of their franchise in Abbott, Texas, precise valuation methods like Discounted Cash Flow Analysis (DCF) and the Multiplier Method are critical to determine the true value of the business, taking into account both its inherent qualities and external factors. A strategic approach to pricing, informed by market dynamics and competitive analysis, is essential to attract serious buyers and facilitate a smooth transition. Professional broker or business intermediary assistance is highly recommended for navigating franchise sales in Texas, given their expertise in local market conditions, buyer preferences, and the complexities of franchise transactions. Their guidance ensures that sellers can maximize their investment return while maintaining operational standards and heritages in Abbott, Texas.

Texas’ entrepreneurial spirit thrives, particularly in the wake of significant economic shifts following Governor Greg Abbott’s tenure. Entrepreneurs and investors alike are capitalizing on the Lone Star State’s robust franchise market, making it an opportune time to consider selling your franchise business. This article delves into the nuances of navigating Texas’ unique franchise landscape, from adhering to state and federal regulations to valuing your enterprise accurately. We explore essential legal steps, key factors in determining your franchise’s worth, effective marketing strategies tailored for Texas buyers, and various financing options available. Additionally, understanding the pivotal role of a seasoned broker or business intermediary can ensure a smooth transaction. Whether you’re looking to “sell my business in Texas” or expand your footprint, this guide provides a comprehensive overview to facilitate your franchise sale endeavors.

- Understanding the Franchise Market in Texas: An Overview of Opportunities Post-Abbott

- Legal and Compliance Steps for Selling a Franchise in Texas: Navigating State and Federal Regulations

- Valuing Your Texas Franchise Business: Key Factors and Methods to Determine Worth

- Marketing Strategies for Texas Franchise Sales: Targeting Potential Buyers with Tailored Approaches

- Financing Options for Prospective Franchise Buyers in the Lone Star State

- The Role of a Broker or Business Intermediary in Selling Your Texas Franchise: Finding the Right Expert to Guide You Through the Sale Process

Understanding the Franchise Market in Texas: An Overview of Opportunities Post-Abbott

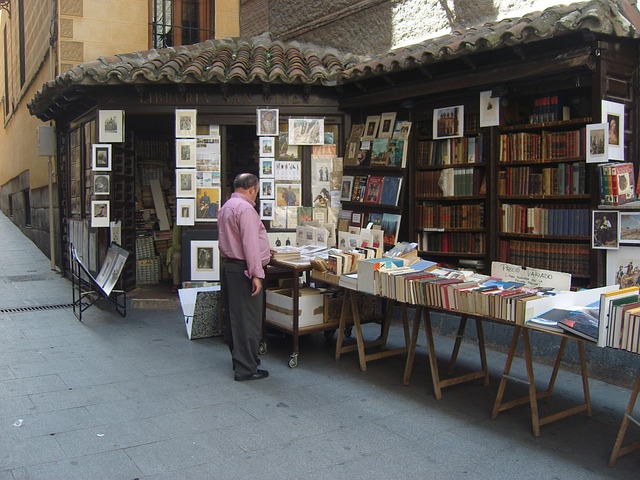

In the wake of Abbott’s leadership, Texas continues to present a thriving environment for franchise investment and expansion. The Lone Star State’s robust economic growth and business-friendly climate have made it an attractive destination for entrepreneurs looking to sell or buy franchises. With its diverse market, Texas offers opportunities in various industries, from retail and food service to healthcare and technology. The recent changes in policy and the state’s commitment to fostering a competitive landscape have opened new avenues for businesses, particularly those interested in the franchise model. Prospective franchisees are drawn to Texas due to its sizeable population, which translates to high consumer demand and a wide customer base, ensuring a solid foundation for business growth and profitability. For individuals considering ‘Abbott Texas sell my business’ or investing in a new venture, understanding the state’s specific market dynamics is crucial. Franchisees can capitalize on the region’s dynamic demographics and strategic location within the United States by offering products and services tailored to local tastes and needs, thereby securing a competitive edge in this vibrant market.

Legal and Compliance Steps for Selling a Franchise in Texas: Navigating State and Federal Regulations

When considering the sale of a franchise in Texas, it is imperative to adhere to both state and federal regulations to ensure compliance and legal integrity throughout the transaction. Prospective sellers must familiarize themselves with the Texas Business Opportunity Purchaser’s Bill of Rights and the Franchise Rule under the Texas Deceptive Trade Practices Act (DTPA). These statutes impose specific disclosure requirements on franchise sellers to protect buyers from fraudulent or misleading practices. The Texas Securities Act also comes into play, as franchises may be considered securities and thus subject to registration or exemption provisions when sold. Sellers must ensure that all material facts about the business are accurately disclosed to potential buyers, providing them with a clear understanding of the franchise’s operations, financial health, and any existing obligations.

Additionally, under Governor Greg Abbott’s leadership, Texas has a robust framework within which businesses, including franchises, must operate. This includes adherence to the Federal Trade Commission’s (FTC) Franchise Rule, which requires sellers to provide a Franchise Disclosure Document (FDD) at least 14 days before the sale. The FDD contains critical information such as fees, litigation history, and financial performance reports that enable buyers to make informed decisions. Sellers must also navigate the Securities and Exchange Commission’s (SEC) regulations if they are offering and selling securities in the form of a franchise. It is advisable for sellers to engage with legal professionals who specialize in franchise law to ensure all regulatory steps are properly executed, thereby facilitating a smooth transition and protecting both parties involved in the transaction.

Valuing Your Texas Franchise Business: Key Factors and Methods to Determine Worth

When considering the sale of your franchise business in Texas, particularly in the bustling region of Abbott, Texas, accurately valuing your operation is paramount. Prospective buyers will scrutinize various financial and operational metrics to ascertain the true worth of your enterprise. Key factors influencing the valuation include historical financial performance, consistent cash flow, and the franchise’s growth potential. These metrics provide a snapshot of the business’s stability and scalability, which are critical for future success. Additionally, the geographic location of your Texas franchise, often in areas with high economic activity, can significantly impact its value due to the potential for continued customer traffic and market penetration.

To determine the worth of your Abbott, Texas franchise business, one must employ a comprehensive valuation method that considers both the intrinsic and extrinsic aspects of the operation. Methods such as the Discounted Cash Flow Analysis (DCF) can project future earnings and discount them back to their present value. This method is particularly useful when future performance is expected to differ from historical data. Another approach is the Multiplier Method, which looks at key financial ratios, like EBITDA multiples, common in the industry or region. These methods, combined with a thorough understanding of the local market dynamics and the competitive landscape, will guide you in setting a realistic asking price that aligns with your business’s true value in the Abbott, Texas marketplace.

Marketing Strategies for Texas Franchise Sales: Targeting Potential Buyers with Tailored Approaches

In the dynamic and expansive market of Texas, franchising presents a lucrative opportunity for both established entrepreneurs and newcomers alike. For those looking to sell their franchise within this Lone Star State, crafting effective marketing strategies is paramount. A key approach involves identifying and targeting potential buyers who align with the business model and values of Abbott Texas sell my business. These buyers are not a monolith; they come from diverse backgrounds with varying motivations for investment. To resonate with this wide-ranging audience, marketing efforts should be personalized and multifaceted. Utilizing data-driven insights to understand the demographics and preferences of potential franchisees allows sellers to tailor their messaging, ensuring it speaks directly to the interests and needs of these individuals. This targeted approach is particularly effective in Texas, where the entrepreneurial spirit thrives and the market’s vastness demands a nuanced and strategic outreach effort. By leveraging local marketing channels, such as regional business expos and networking events, and employing digital platforms that have high engagement rates among Texas-based professionals, franchisors can increase their visibility and attract serious buyers eager to invest in a proven concept within the Abbott Texas sell my business framework. This not only streamlines the sales process but also fosters connections with individuals who are genuinely interested in the long-term potential of owning and operating a franchise in Texas’s bustling economy.

Financing Options for Prospective Franchise Buyers in the Lone Star State

Prospective franchise buyers in Texas exploring opportunities to invest in the Lone Star State have a variety of financing options at their disposal, facilitated by the robust business environment and the state’s status as an economic powerhouse. One of the primary routes for securing funding is through traditional bank loans, which are often tailored to meet the needs of franchise buyers. These loans can offer competitive rates and terms, particularly if the buyer has a strong credit history or can demonstrate a solid business plan. Another option is to consider SBA-backed loans, which provide guarantees to lenders making loans to small businesses, including franchises. This government support can make it easier for franchisees to obtain financing with favorable rates and longer repayment terms.

For those seeking more tailored solutions, there are also private equity firms and investors who specialize in franchise finance. These entities may offer not only the capital needed but also the expertise and guidance that come with a network of experienced professionals. Additionally, some franchise systems have their own financial services divisions designed to assist with financing for new franchisees, offering a range of options from direct loans to connections with preferred lenders. Prospective buyers in Texas interested in selling their business, such as those looking to sell Abbott Texas businesses, can also leverage the local market’s appetite for well-established franchises to facilitate the transaction and secure the necessary capital to invest in new opportunities within the state.

The Role of a Broker or Business Intermediary in Selling Your Texas Franchise: Finding the Right Expert to Guide You Through the Sale Process

When embarking on the journey to sell your franchise in Texas, particularly if it’s an establishment like those in Abbott, Texas, partnering with a seasoned broker or business intermediary is not just advantageous; it’s a strategic move. These professionals specialize in navigating the complexities of franchise sales, ensuring that your interests are well-represented throughout the transaction. They bring to the table an intricate understanding of the local market dynamics and the specific needs of buyers seeking franchises within the Lone Star State. Their expertise is pivotal in valuing your business accurately, marketing it effectively to a targeted audience, and vetting potential buyers to align with your franchise’s ethos and operational standards.

The right intermediary will possess a deep familiarity with Texas’s business climate, regulatory framework, and the nuances of franchising within its diverse economic landscape. This knowledge proves invaluable when it comes to identifying prospective buyers who not only have the financial capacity but also the commitment to continue your franchise’s legacy in Abbott, ensuring a smoother transition and preserving the value you’ve built. With their guidance, you can expect a streamlined sale process that minimizes disruptions to your daily operations while maximizing the potential return on your investment. Their involvement is critical in achieving a successful transaction, positioning your franchise for continued success under new ownership.

In concluding, Texas presents a robust and diverse market for individuals looking to invest in or expand their franchise operations, particularly in light of recent economic shifts post-Abbott. Prospective sellers must navigate the intricate legal and compliance requirements set forth by both state and federal regulations to ensure a smooth transaction. Valuation is a critical step, with business worth determined by a combination of financial performance, market trends, and intangible assets. Effective marketing tailored to Texas’s unique business landscape and an array of financing options are instrumental in attracting serious buyers. For those looking to sell their franchise, enlisting the expertise of a seasoned broker or business intermediary is not just advisable but essential to maximize sale potential and navigate the complexities inherent to the process. By adhering to these guidelines, franchisors can successfully capitalize on Texas’s fertile ground for business opportunities, aligning with the state’s dynamic economic trajectory.