Navigating Asset Sales: Seller’s Guide to Asset Disposition Legals and Strategy in Aldine, TX

In Aldine, Texas, executing an asset sale involves transferring select tangible and intangible assets from a business while potentially leaving behind certain liabilities. Sellers must adhere to the Texas Business Organizations Code, along with federal regulations, for a compliant and transparent transaction. Legal counsel well-versed in state statutes and case law is essential to navigate this process, ensuring due diligence and regulatory compliance, particularly concerning disclosure requirements, antitrust compliance, and contractual obligations. Valuation of assets is critical, and sellers should leverage local market trends and economic data for accurate assessment. Marketing the business effectively through both local and online channels is also vital to attract potential buyers. A strategic marketing approach combining community engagement with a robust digital presence can enhance visibility and interest. Due diligence is a cornerstone of the sale process, demanding meticulous asset valuation, thorough review of purchase agreements, and adherence to financial reporting standards. Post-sale, managing the transfer of titles, finalizing tax filings, and addressing any remaining obligations are key steps for sellers. Professional guidance throughout the entire process is crucial for a successful asset sale in Aldine, ensuring that both parties achieve a favorable outcome and facilitating a strategic transition for the seller post-transaction.

exploring the nuances of asset sale transactions within the Texan context, this comprehensive guide illuminates the path for Aldine-based business owners looking to ‘sell my business’ in Texas. From grasping the legal intricacies to mastering valuation strategies and effective marketing tactics, this article is a resourceful tool for sellers navigating the asset sale process in Aldine. It delves into the due diligence procedures unique to Texas closings, ensuring sellers are well-prepared for the journey ahead. Whether you’re seeking to maximize your business’s value or understand the post-sale implications, this guide offers vital insights tailored to the Texas marketplace.

- Understanding Asset Sales in Texas: A Guide for Sellers in Aldine

- The Legal Framework Governing Asset Sales in Texas

- Valuing Your Business: Key Considerations for an Asset Sale in Aldine, Texas

- Marketing Your Business for Sale in Aldine: Strategies to Attract Buyers

- The Due Diligence Process in Asset Sales: What to Expect as a Seller in Texas

- Closing the Deal: Finalizing Your Asset Sale in Aldine, Texas and Post-Sale Considerations

Understanding Asset Sales in Texas: A Guide for Sellers in Aldine

In the dynamic market of Aldine, Texas, asset sales present a strategic approach for businesses looking to divest their operations. Unlike selling a business entity as a whole (a stock sale), an asset sale, as detailed under Texas business law, involves the transfer of specific items such as inventory, equipment, and intellectual property. For sellers in Aldine considering ‘Aldine Texas sell my business,’ it’s crucial to comprehend that this transaction type allows for selective divestment, which can be particularly advantageous if certain liabilities are to remain with the company or if only a portion of the business is to be sold. The process necessitates careful planning and a thorough understanding of state and federal regulations to ensure compliance and optimal financial outcomes. Sellers should work closely with experienced legal and financial advisors who specialize in asset sales within Texas to navigate this complex process effectively. This guide aims to demystify the intricacies of asset sales for Aldine sellers, ensuring they are well-informed and prepared for a successful transaction. Key considerations include valuing assets accurately, identifying and transferring title to assets, and understanding the implications of tax obligations associated with an asset sale in Texas. By adhering to these steps and leveraging local expertise, sellers can streamline the process and maximize the value of their business assets in the thriving Aldine marketplace.

The Legal Framework Governing Asset Sales in Texas

In Texas, the legal framework governing asset sales is well-defined and structured to ensure fair and transparent transactions. The Texas Business Organizations Code, along with federal regulations such as those enforced by the Securities and Exchange Commission (SEC), provide comprehensive guidelines for businesses looking to sell their assets. Sellers in Aldine, Texas, seeking to liquidate assets must adhere to these rules, which include detailed disclosures, compliance with antitrust laws, and fulfilling all contractual obligations. The Texas Property Code also plays a pivotal role in asset sales by outlining the processes for transferring real estate or tangible personal property. For businesses in Aldine considering an asset sale, it is imperative to consult with legal counsel well-versed in Texas’s unique statutes and case law to navigate the process smoothly. This ensures that all due diligence is performed, and all transactions are compliant with state and federal regulations.

The asset sales process in Texas is further facilitated by local laws that govern public records and notices, which are essential for transparency and protecting the interests of all parties involved. Additionally, the State of Texas offers resources through the Comptroller’s office to assist businesses with tax considerations associated with asset sales. For those in Aldine, Texas sell my business transactions, it is crucial to consider the implications on state and local taxes, as well as the potential need for restructuring post-sale. Prospective buyers and sellers must also be aware of the Texas Deceptive Trade Practices Act, which protects against fraudulent or deceptive sales practices, ensuring a level playing field throughout the transaction process. Legal guidance is key in this intricate process to ensure compliance and protection of your interests during an asset sale in Texas.

Valuing Your Business: Key Considerations for an Asset Sale in Aldine, Texas

When considering an asset sale in Aldine, Texas, valuing your business accurately is paramount. Prospective buyers will scrutinize every aspect of the assets on offer to ensure they are acquiring value commensurate with their investment. It’s essential to assess tangible and intangible assets, including real estate, equipment, intellectual property, and customer lists, to determine their fair market value. This due diligence not only reflects the true worth of your business but also sets the stage for a successful transaction. In Aldine, a dynamic market with a diverse economic landscape, understanding the local economic trends and comparable sales is crucial. Local factors such as regional demand, industry-specific regulations, and tax implications must be considered to navigate the sale effectively. For business owners in Aldine, Texas looking to “sell my business,” aligning with experienced brokers or advisors who specialize in asset sales within the region can provide valuable insights and ensure that your business is accurately valued for a smooth transition to new ownership.

Marketing Your Business for Sale in Aldine: Strategies to Attract Buyers

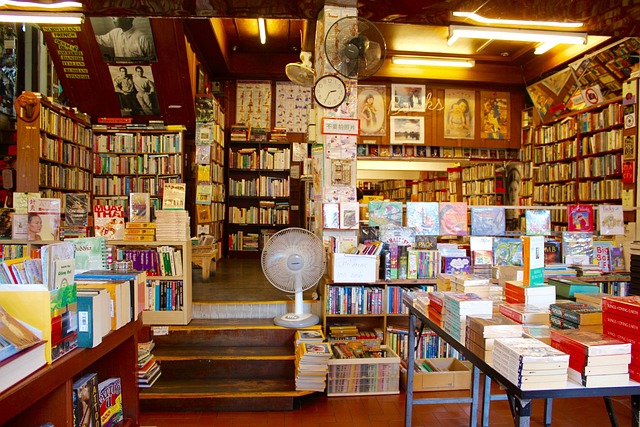

When positioning your business for sale in Aldine, Texas, employing strategic marketing is pivotal to attract potential buyers. Firstly, leveraging local knowledge and networks can be advantageous; engage with the Aldine community and Chamber of Commerce to maximize exposure. Utilize online platforms, particularly those frequented by businesses seeking acquisition opportunities, such as business-for-sale websites with a regional focus. Emphasize your business’s unique selling points, aligning them with the interests of prospective buyers. Highlighting financial performance and growth potential through detailed records and market analysis will provide a compelling narrative for why an investor should consider ‘Aldine Texas sell my business.’

Furthermore, ensure your business presentation is polished and professional; a well-crafted business profile can make a significant difference. Consider professional valuation services to ascertain the fair market value of your enterprise, which will lend credibility to your sale and appeal to serious investors. Additionally, if your business has a strong online presence or digital assets, these should be prominently featured in your marketing materials, as they can be particularly attractive to buyers looking for a foothold in the digital marketplace. By combining targeted local marketing with a robust online presence, you can effectively attract buyers interested in ‘Aldine Texas sell my business’ and facilitate a successful transaction.

The Due Diligence Process in Asset Sales: What to Expect as a Seller in Texas

When contemplating the sale of assets within the state of Texas, particularly in areas like Aldine Texas sell my business, understanding the due diligence process is paramount for sellers. This meticulous evaluation phase allows potential buyers to scrutinize all associated assets, liabilities, and operational facets to ensure a well-informed acquisition decision. As a seller in Texas, you can expect this process to be thorough and detail-oriented, with the aim of providing a clear and accurate picture of what is being offered for sale.

The due diligence process typically involves a comprehensive review of legal documents, financial records, contracts, and other significant business assets. Sellers should prepare all relevant documentation ahead of time, including past tax returns, contracts with clients and suppliers, and detailed inventory lists. It’s also advisable to compile information on any intellectual property or proprietary technology that forms part of the sale. Throughout this process, Texas law mandates transparency and honesty, ensuring both parties operate within a legal framework. Sellers in Aldine Texas looking to navigate asset sales should consider engaging legal and financial professionals who are well-versed in Texas business laws to facilitate a smooth and efficient due diligence period. Their expertise will be invaluable in addressing any questions or concerns raised by potential buyers, ultimately leading to a successful transaction.

Closing the Deal: Finalizing Your Asset Sale in Aldine, Texas and Post-Sale Considerations

In the process of closing an asset sale in Aldine, Texas, due diligence is paramount. Sellers looking to dispose of their assets within this bustling market should be well-prepared for the rigorous steps involved in finalizing the deal. The transaction commences with a thorough valuation of the assets on offer, followed by the execution of a definitive purchase agreement that outlines all terms and conditions of the sale. Both parties must meticulously review this document to ensure clarity and mutual understanding. Once the agreement is signed, the focus shifts to fulfilling the pre-closing obligations, which may include inventory appraisals, asset allocation, and ensuring compliance with state and federal regulations. It’s crucial to engage a knowledgeable real estate attorney and an experienced accountant during this phase to navigate the complexities of Texas law and financial reporting standards.

Post-sale considerations are equally significant for a smooth transition. After the deal is sealed, the seller must manage post-closing duties such as transferring titles, finalizing tax filings, and settling any remaining obligations tied to the assets sold. It’s advisable to maintain open communication with the buyer to address any issues that may arise during the transition period. Additionally, sellers in Aldine, Texas, should consider the impact of the sale on their personal finances, including the reinvestment of proceeds or planning for future income streams. For those who have sought professional guidance throughout the process, this continuity ensures a strategic approach to life after “Aldine Texas sell my business,” providing peace of mind and a clear path forward. Whether you’re a small business owner or a larger enterprise, navigating the asset sale landscape in Aldine requires careful planning and execution.

When considering the sale of your business assets in Aldine, Texas, it is crucial to navigate the legal landscape, accurately value your enterprise, and effectively market to prospective buyers. This guide has outlined the comprehensive process from understanding asset sales dynamics within the state to successfully closing the deal while addressing post-sale considerations. By adhering to the legal framework, carefully evaluating your business’s worth, employing strategic marketing tactics, and diligently engaging with potential purchasers during due diligence, you can effectively ‘sell my business in Aldine, Texas.’ This guide equips you with the knowledge necessary to make informed decisions and facilitate a smooth transition.