Delta 9 THC Gummies: Legal and Beneficial Uses in Idaho

Delta 9 THC gummies are legally available in Idaho under specific conditions outlined by the 2018 Farm Bill, which allows for hemp-derived products with less than 0.3% THC. In Idaho, these gummies can be a legal option for adults seeking relief from conditions like chronic pain, anxiety, and insomnia, due to their psychoactive effects. It's crucial for consumers to procure these products from reputable sources to ensure they meet state regulations and contain the correct THC levels. The gummies offer a controlled dosing experience, making them a popular choice among those who prefer a discreet method of cannabis consumption. However, users must stay informed about the evolving legal status of these products as laws can change, potentially introducing new restrictions. Safety, dosage management, and compliance with both state and federal laws are paramount when enjoying delta 9 THC gummies in Idaho. Consumers should approach their use responsibly, adhering to guidelines for storage, consumption, and avoiding driving under the influence. Delta 9 THC gummies provide a legal way to experience cannabis's benefits in Idaho, with careful consideration of individual reactions and the importance of following regulations to ensure safety and legality.

Delta 9 gummies have emerged as a popular consumption method for those interested in the potential wellness and therapeutic benefits of cannabinoids, particularly within the context of states where their use is regulated and legal, such as Idaho. This article delves into the nuanced legal landscape surrounding Delta 9 THC gummies in Idaho, offering clarity on their status. We will explore the scientific underpinnings that highlight the potential health advantages these gummies may offer, backed by emerging research. Additionally, we provide guidance for discerning high-quality products amidst a growing market and tips for safe and responsible consumption to fully realize Delta 9 THC gummies’ benefits. Join us as we navigate this evolving realm of wellness with a focus on Idaho’s regulatory framework.

- Delta 9 Gummies: Exploring the Legal Landscape and Benefits in Idaho

- Understanding Delta 9 THC Gummies: A Safe, Regulated Option for Consumers

- The Science Behind Delta 9 THC Gummies: Potential Health and Wellness Advantages

- Navigating the Market: How to Choose High-Quality Delta 9 THC Gummies in Idaho

- Maximizing Benefits: Tips for Responsible Consumption of Delta 9 THC Gummies

Delta 9 Gummies: Exploring the Legal Landscape and Benefits in Idaho

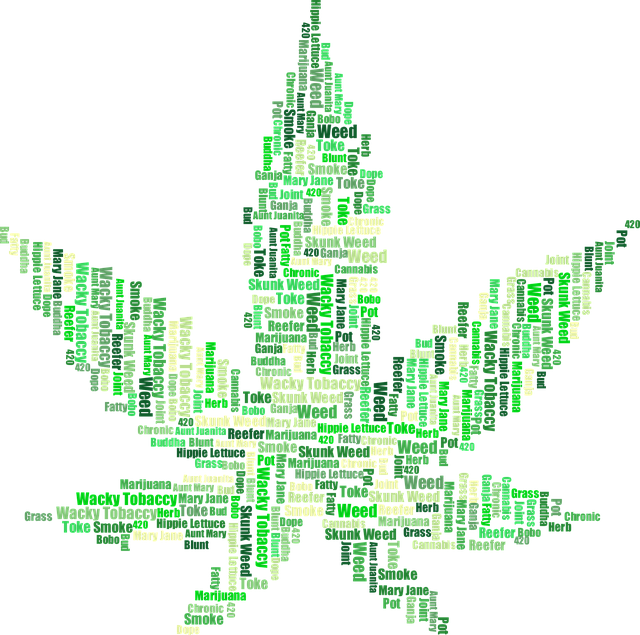

Delta 9 gummies, a popular edible form of cannabis infused with THC, have gained attention across various states in the U.S., including Idaho. As of the latest information, the legal status of delta 9 THC gummies in Idaho is nuanced. While Idaho maintains a strict stance against recreational marijuana, delta 9 THC derived from hemp that contains less than 0.3% THC is legally permitted under the 2018 Farm Bill. This federal legislation paved the way for the cultivation and sale of hemp and its derivatives, including delta 9 gummies, provided they adhere to the aforementioned THC concentration. However, it’s crucial for consumers in Idaho to stay informed as state laws can evolve and may impose additional restrictions. The benefits of delta 9 gummies are subject to individual experiences; they are often praised for their potential to alleviate various conditions, such as chronic pain, anxiety, and insomnia. Users report that the gummies’ effects are long-lasting due to the edible form’s absorption rate through the digestive system. For those in Idaho considering delta 9 THC gummies, it is essential to purchase from reputable sources to ensure safety and efficacy, as the market may contain products that do not meet the legal THC concentration or that are mislabeled. Understanding both the legal landscape and the potential benefits of delta 9 gummies can help users navigate this area with informed decisions in compliance with state and federal regulations.

Understanding Delta 9 THC Gummies: A Safe, Regulated Option for Consumers

Delta 9 tetrahydrocannabinol (THC) gummies have emerged as a popular and discreet consumption method for adults seeking the effects of cannabis in a regulated, legal format. For those in states where delta 9 THC gummies are legal, such as Idaho, these edibles offer a controlled dosing experience that allows consumers to understand and manage their intake effectively. The state’s regulations ensure that these products are tested for purity and potency, providing users with a safe option that aligns with the legal framework established by state laws. These gummies are infused with delta 9 THC, the primary psychoactive component of cannabis, known for its euphoric and relaxing effects. Consumers can enjoy a variety of flavors while experiencing the beneficial aspects of cannabis in a responsible manner. The consistency and accuracy of dosing provided by gummies make them an excellent choice for both novice and experienced users who are looking to incorporate delta 9 THC into their wellness routines, all within the bounds of legal compliance as set forth by Idaho’s regulations.

The Science Behind Delta 9 THC Gummies: Potential Health and Wellness Advantages

Delta 9 tetrahydrocannabinol (THC) gummies, a cannabis-infused edible, have garnered attention for their potential health and wellness benefits. The science behind these gummies revolves around the interaction of Delta 9 THC with the body’s endocannabinoid system, which plays a role in regulating various physiological processes, including pain, inflammation, and stress responses. Users in states where Delta 9 THC is legal, such as Idaho, may explore these gummies for relief from conditions like chronic pain, anxiety, and insomnia. The psychoactive effects of Delta 9 THC can provide a sense of relaxation and euphoria, which may help alleviate symptoms associated with these conditions. Additionally, preliminary studies suggest that cannabinoids like Delta 9 THC may have neuroprotective properties, potentially benefiting individuals with neurodegenerative diseases. However, it is crucial for consumers to understand the legal status of Delta 9 THC products in their jurisdiction before use, as regulations vary by state and federal laws. In Idaho, for instance, the legal landscape regarding cannabis-related products, including Delta 9 THC gummies, is specific and restrictive, with only certain forms permitted under state law. Users are advised to consult local laws and healthcare providers when considering the use of Delta 9 THC gummies for health and wellness purposes.

Navigating the Market: How to Choose High-Quality Delta 9 THC Gummies in Idaho

When exploring the market for high-quality Delta 9 THC gummies in Idaho, it’s crucial to navigate with both due diligence and a discerning eye. As of the latest regulations, Delta 9 THC products derived from hemp are legal in Idaho, provided they contain less than 0.3% THC on a dry weight basis. This regulatory framework allows consumers to make informed choices about their consumption experiences. To ensure you’re selecting a product that aligns with both legal standards and your personal preferences, it’s important to start by researching brands that are transparent about their sourcing and production processes. Look for companies that provide detailed lab test results, as these serve as evidence of purity, potency, and the absence of contaminants. Additionally, consider the reputation of the manufacturer, customer reviews, and the variety of options they offer. This will help you identify Delta 9 THC gummies that not only meet Idaho’s legal requirements but also provide a consistent and enjoyable experience. Always prioritize products from reputable sources to avoid any confusion or compliance issues regarding legality in your state. By doing so, you can confidently enjoy the benefits of Delta 9 THC gummies, knowing you’ve chosen a high-quality, compliant product within the legal framework set by Idaho.

Maximizing Benefits: Tips for Responsible Consumption of Delta 9 THC Gummies

Delta 9 tetrahydrocannabinol (THC) gummies offer a discreet and enjoyable way to experience the effects of cannabis legally in certain regions, such as Idaho. To maximize the benefits while ensuring safe and responsible consumption, it’s crucial to approach their use with both knowledge and caution. Firstly, understand the legal status of delta 9 THC gummies in your area; in Idaho, products must contain less than 0.3% THC to be considered legal hemp extracts. Dosage plays a pivotal role in optimizing the experience; start with a low dose to assess individual sensitivity before gradually increasing as needed. Pay close attention to the onset and duration of effects, which can vary based on factors like metabolism and tolerance. It’s also wise to consume these gummies in a safe, comfortable environment where their effects can be fully appreciated without concern for safety or legality. Additionally, be mindful of the timing of consumption, avoiding operation of vehicles or machinery under the influence. Storing delta 9 THC gummies securely and out of reach of children and pets is another key aspect of responsible use. By adhering to these guidelines and staying informed about both the legal framework and personal body’s response, consumers can fully enjoy the potential benefits of delta 9 THC gummies while prioritizing safety and compliance with regulations in Idaho.

Delta 9 THC gummies present a novel and legally permissible option for adults in Idaho seeking wellness and recreational benefits. This exploration has underscored the importance of understanding the product, its science-backed advantages, and how to discern high-quality options within the market. Responsible consumption is key to maximizing these benefits, as outlined in our guide. For those residing or visiting Idaho, delta 9 gummies can be a safe, regulated choice when approached with knowledge and caution. It’s clear that these gummies offer a range of potential advantages, which could include relief from various conditions, enhanced mood, and improved overall well-being—all within the bounds of state law. As with any consumption, it is advisable to start with low doses and be mindful of individual responses. With this information at hand, consumers in Idaho can now make informed decisions about incorporating delta 9 THC gummies into their routines.