Research indicates that THCA (Tetrahydrocannabinolic Acid), a non-psychoactive cannabinoid found in raw cannabis and hemp, holds promise for managing anxiety due to its interaction with the endocannabinoid system. Highlighted as particularly beneficial, THCA is noted for its anxiolytic properties without the psychoactive effects of THC, which it converts into when heated. The best THCA strains for anxiety relief are those with a high THCA content and minimal THC, such as Sour Space Candy, Doughhead OG, Elev8 Hemp Flower, Cherry Pie, and Harlequin, which also contain calming terpenes like myrcene, limonene, and linalool. Users should start with a low dosage of THCA flower, typically 5-10 mg, and increase gradually based on personal sensitivity, not exceeding 25-100 mg daily. Safety is paramount, with the need for individual consultation with healthcare providers, especially for those with pre-existing conditions or taking other medications. Proper storage of THCA flowers is also crucial to maintain their potency. In essence, THCA can be a beneficial addition to an anxiety management regimen when used responsibly and in accordance with safety guidelines, offering a natural alternative to traditional treatments.

Exploring the therapeutic properties of cannabis has led to a growing interest in THCA (Tetrahydrocannabinolic Acid), particularly its potential benefits for managing anxiety. This article delves into the multifaceted relationship between THCA flower and anxiety relief, offering insights into its effects, safety considerations, and how to harness its anxiolytic properties effectively. We’ll guide you through selecting the best THCA strains for anxiety, understanding their interaction with the endocannabinoid system, and integrating them into your anxiety management routine. From dosage advice to legal implications, this comprehensive overview aims to empower you with knowledge to make informed decisions about using THC-A flower safely and responsibly.

Understanding THCA Flower and Its Potential Benefits for Anxiety Relief

THCA, or tetrahydrocannabinolic acid, is a non-psychoactive cannabinoid found in raw cannabis plants, which is the precursor to THC, the well-known psychoactive compound. As research evolves, there is growing interest in the potential therapeutic properties of THCA, particularly its role in anxiety management. Preliminary studies suggest that certain THCA strains may offer anxiety relief due to their interaction with the body’s endocannabinoid system, which regulates mood and stress responses. The entourage effect, a phenomenon where cannabinoids work synergistically, is believed to enhance these benefits. For individuals seeking natural remedies for anxiety, identifying the best THCA strains for anxiety can be crucial. Strains like sour space candy and escaper are often highlighted for their calming effects, promoting a state of relaxation without the high associated with THC. Users report feelings of tranquility and focus, which can be particularly beneficial for managing anxiety-related symptoms. As with any dietary supplement or therapeutic approach, it is advisable to consult with a healthcare professional before incorporating THCA flower into an anxiety management regimen, ensuring safe and effective use based on one’s unique health profile.

Key Points to Consider When Choosing THCA Strains for Anxiety Management

When exploring THCA flower strains for anxiety management, it’s crucial to consider several key factors that can influence their efficacy and your experience. The best THCA strains for anxiety often possess a balance of cannabinoids and terpenes that promote relaxation without causing sedation or paranoia, which can exacerbate anxious feelings. For instance, sativa-dominant strains with high THCA content, such as Sour Space Candy or Durban Poison, are known for their uplifting and energizing effects. However, these may not be suitable for everyone, particularly those sensitive to the more stimulating effects of sativas.

Indica-dominant strains like Pink Kush or Blackberry Kush can offer a more calming and sedative experience, which might be preferable for individuals experiencing intense anxiety. The terpene profile of these strains plays a significant role in their ability to manage anxiety; myrcene, linalool, and limonene are terpenes commonly found in THCA flowers that have a relaxing effect. It’s advisable to experiment with different strains to determine which one aligns best with your personal needs and the type of anxiety you’re dealing with. Always start with a low dose to gauge how your body responds before considering higher doses, and consult with a healthcare professional if you have any concerns or questions about incorporating THCA flower into your anxiety management regimen.

Top THCA Strains for Anxiety: A Comprehensive Overview

Delta-9 THC, the primary psychoactive component in cannabis, has long been studied for its potential therapeutic effects. However, recent research has increasingly focused on THCA, or tetrahydrocannabinolic acid, a non-psychoactive precursor to THC found in raw cannabis plants. This shift is particularly notable in the realm of managing anxiety disorders. THCA is believed to possess anxiolytic (anxiety-reducing) properties without the psychoactive effects associated with Delta-9 THC. As a result, individuals seeking relief from anxiety may find solace in certain strains that are particularly rich in THCA.

Among the best THCA strains for anxiety, Sour Space Candy stands out for its uplifting and calming effects without inducing paranoia or heightened anxiety, which can sometimes occur with Delta-9 THC. Another notable strain is Suzy Q, known for its soothing properties that help alleviate stress and nervousness. These strains are often recommended by experts in the field due to their high levels of THCA, coupled with a balanced terpene profile that enhances their anxiolytic effects. Additionally, Lemon OG Haze is another strain that offers a cerebral lift alongside its calming influence, making it ideal for those looking to manage anxiety while maintaining focus and clarity of mind. Users should approach the use of these strains with caution, as individual responses to cannabinoids can vary significantly, and it’s always advisable to consult with a healthcare professional before incorporating any new substance into one’s wellness regimen.

The Science Behind THCA’s Interaction with the Endocannabinoid System

Delta-9-tetrahydrocannabinolic acid (THCA) is the non-psychoactive precursor to the well-known cannabinoid THC found in the Cannabis sativa plant. Its potential therapeutic properties, particularly for anxiety, stem from its interaction with the human body’s endocannabinoid system (ECS). The ECS is a complex cell-signaling system identified in the early 1990s, comprising three core components: endocannabinoids, receptors, and enzymes. This system plays a critical role in regulating a range of physiological processes, including sleep, mood, appetite, immune functions, and pain sensation.

THCA interacts primarily with the two main cannabinoid receptors, CB1 and CB2. While CB1 receptors are predominantly found in the brain, CB2 receptors are more abundant in peripheral organs, especially the immune system. Research suggests that THCA binds preferentially to these receptors, potentially offering anxiolytic (anti-anxiety) effects without the psychoactive side effects associated with THC. This selective binding may help modulate neurotransmitter release and inhibit the uptake of neurotransmitters like GABA and glutamate, which are pivotal in anxiety regulation. Consequently, the best THCA strains for anxiety are those high in THCA content and low in psychoactive THC. These strains can be harnessed to alleviate symptoms of anxiety without inducing undesirable mind-altering effects, offering a promising therapeutic option for individuals seeking natural alternatives to manage their conditions.

Dosage and Safety Precautions for THCA Flower Use in Anxiety Treatment

THCA, or Tetrahydrocannabinolic Acid, is a non-psychoactive cannabinoid found in hemp and cannabis plants that has shown promise in the realm of anxiety treatment. When heated, THCA converts to THC, the psychoactive component commonly associated with cannabis. However, in its raw form, THCA is being explored for its potential therapeutic effects without the psychoactive impact. For individuals considering THCA flower as a natural alternative to manage anxiety, understanding appropriate dosage and safety precautions is paramount.

Dosage for THCA flower can vary greatly depending on various factors such as body weight, tolerance, and the specific condition being treated. Generally, it’s advisable to start with a low dose, around 5-10 mg of THCA, to gauge individual sensitivity and effects. Experts suggest gradually increasing the dosage incrementally every few hours until the desired effect is achieved or up to a maximum dose that typically ranges from 25-100 mg per day for anxiety treatment. It’s crucial to note that individual responses can differ significantly; therefore, it’s important to proceed with caution and adjust according to personal experience.

Safety precautions are equally important when using THCA flower for anxiety. As with any substance, there is the potential for side effects, although THCA is generally considered safe. It’s recommended to consult with a healthcare provider before incorporating THCA into an anxiety treatment regimen, especially if taking other medications or have pre-existing health conditions. Additionally, users should be aware of potential side effects such as drowsiness, dry mouth, and increased anxiety at higher doses. Pregnant or breastfeeding individuals should avoid THCA due to insufficient evidence regarding its safety for these populations.

When selecting strains, some of the best THCA strains for anxiety include those with a high concentration of THCA and lower levels of THC to minimize psychoactive effects. Sour Space Candy, Doughhead OG, and Elev8 Hemp Flower are examples of strains that have been favored for their calming properties. It’s important to source THCA flower from reputable suppliers to ensure purity and safety. Always store the product properly to maintain its potency and effectiveness. With careful dosing and adherence to safety guidelines, THCA flower may serve as a valuable tool in the management of anxiety symptoms.

How to Select High-Quality THCA Flowers for Optimal Anxiety Relief

When seeking high-quality THCA flowers for optimal anxiety relief, it’s crucial to consider several factors that can influence their efficacy and safety. The best THCA strains for anxiety are those that have been carefully cultivated to maintain a high concentration of THCA and other beneficial compounds. Look for strains known for their anxiolytic properties, such as Sour Space Candy or ACDC. These strains often exhibit a balance of effects that can soothe the mind without overpowering psychoactive effects, which is particularly important for individuals sensitive to THC.

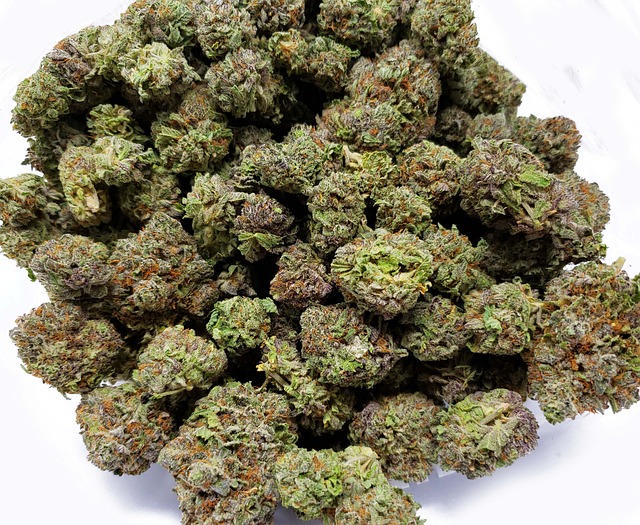

Additionally, the quality of THCA flowers can be determined by examining their terpene profile. Terpenes are aromatic compounds found in cannabis that contribute to its unique effects. Strains like Cherry Pie and Harlequin, which contain myrcene, limonene, and linalool, are often favored for their calming and relaxing properties. The presence of these terpenes can enhance the anxiety-relieving effects of THCA. Furthermore, the appearance of the flowers is a reliable indicator of quality. Opt for buds that are dense, with a vibrant color and a frosty coating of trichomes—this indicates high potency and freshness. Proper storage in a cool, dark place can preserve the quality of your THCA flowers, ensuring they remain effective for anxiety relief over time.

When exploring the potential benefits of THCA flower for anxiety relief, it’s clear that selecting the right strain and understanding its interaction with the endocannabinoid system is key. The top THCA strains for anxiety, such as those highlighted in our comprehensive overview, offer a promising avenue for many seeking natural ways to manage their condition. However, careful consideration of dosage and safety precautions is paramount when incorporating THCA flower into treatment plans. By choosing high-quality THCA flowers and adhering to best practices, individuals may find effective anxiety relief without the psychoactive effects associated with THC. As a result, THCA flower emerges as a compelling option for those interested in alternative treatments for anxiety, with its potential benefits backed by scientific research.