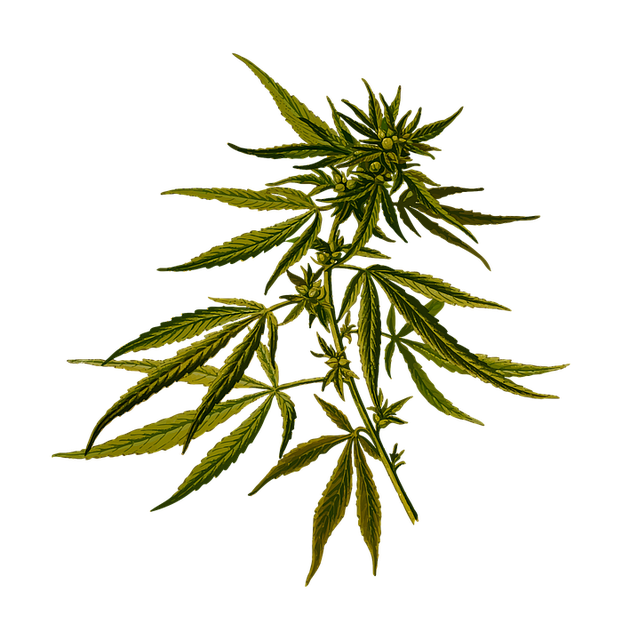

The THCA flower, a non-psychoactive form of cannabis, is gaining attention for its therapeutic potential and its role in the entourage effect when combined with CBD and terpenes. This synergy enhances wellness benefits without inducing a 'high,' offering anti-inflammatory, neuroprotective, and analgesic effects that are potentially more effective than isolating individual compounds. THCA's interaction with the endocannabinoid system targets various bodily functions like pain, inflammation, mood, and sleep by binding to CB1 and CB2 receptors without the psychoactive side effects of its decarboxylated form, THC. The distinct terpene profiles of different strains contribute to diverse aromas and flavors, which along with varying CBD contents, can modulate mood and inflammation response. The CBD synergy with terpenes in THCA flower is a focus of research due to its implications for a variety of health outcomes within medicinal cannabis, emphasizing the importance of responsible consumption and understanding its complex interactions for optimal health benefits.

Exploring the multifaceted nature of THCA flower, an emerging figure in the realm of cannabinoid wellness, this article delves into its unique properties and potential benefits. From its distinct chemical makeup to its therapeutic effects, we examine the science behind CBD synergy with terpenes and how they contribute to the overall experience. While highlighting the positive aspects of THCA flower consumption, we also address the importance of understanding its side effects. This discussion includes dosage considerations, legal implications, and interactions with other substances, ensuring a comprehensive view of this cannabinoid-rich plant. Join us as we navigate through the various dimensions of THCA flower, offering insights for both novice and experienced users to safely integrate it into their wellness routine.

Unveiling the Potential of THCA Flower: An Overview

Delta-9-tetrahydrocannabinolic acid (THCA) flower, a non-psychoactive precursor to the well-known THC, has garnered attention in various wellness circles due to its potential therapeutic properties. As researchers continue to explore its effects, an emerging body of evidence suggests that THCA may offer a range of benefits without the psychoactive ‘high’ associated with its decarboxylated form. One intriguing aspect of THCA flower is its synergy with CBD (cannabidiol) and terpenes, which together can enhance their individual effects in a phenomenon known as the ‘entourage effect.’ This synergy has been shown to contribute to a balanced well-being experience, promoting homeostasis within the body. The unique profile of each THCA flower strain is influenced by its distinct terpene composition and CBD content, which can influence the aroma, flavor, and potential effects of the flower. Consumers interested in harnessing the wellness properties of THCA are increasingly turning to products that highlight this synergy, recognizing the importance of terpenes such as myrcene, limonene, and caryophyllene in modulating mood and inflammation response. As interest in CBD-rich hemp derivatives grows, understanding the nuanced interactions within the cannabis plant becomes paramount for those seeking to leverage its full potential for health and wellness.

The Chemical Composition of THCA Flower and Its Implications

Cannabidiolic acid (CBDa) and tetrahydrocannabinolic acid (THCA) are two prominent cannabinoids found in the THCA flower, a form of cannabis that precedes the decarboxylation process which converts THCA into its psychoactive form, THC. The presence of these cannabinoids, alongside an array of terpenes and flavonoids, contributes to the unique chemical composition of the THCA flower. This complex profile not only influences the plant’s aromatic and flavor characteristics but also plays a crucial role in modulating the effects when consumed.

The synergy between CBDa, THCA, and the entourage of terpenes within the THCA flower can significantly impact its therapeutic potential. Studies suggest that the interaction between these compounds enhances the therapeutic benefits of each. For instance, terpenes are known to have anti-inflammatory and anti-anxiety properties and may work in conjunction with CBDa to amplify these effects. Similarly, THCA itself is non-psychoactive but is believed to possess analgesic and neuroprotective qualities. When combined with the full spectrum of cannabinoids and terpenes present in the flower, it is hypothesized that this synergy could offer broader therapeutic applications compared to isolating individual compounds. This CBD synergy with terpenes within the THCA flower is a subject of growing interest in the field of medicinal cannabis research, offering potential for a wide range of health and wellness applications.

THCA Flower's Effects on the Endocannabinoid System

The effects of THCA (Tetrahydrocannabinolic Acid), a non-psychoactive precursor to THC found in the cannabis plant, on the endocannabinoid system are a subject of growing interest within the realm of natural health and therapeutics. The endocannabinoid system (ECS) is a complex network within the human body that plays a crucial role in regulating homeostasis by mediating various physiological processes, including pain, inflammation, mood, memory, stress, and sleep. THCA interacts with the ECS through its affinity for cannabinoid receptors such as CB1 and CB2, influencing their activation without eliciting the psychoactive effects associated with its decarboxylated form, THC.

When consumed in a flower form, THCA is believed to offer potential health benefits due to its synergy with other cannabinoids, terpenes, and flavonoids present in the cannabis plant. This synergy, often referred to as the “entourage effect,” suggests that CBD (cannabidiol) and terpenes found in the THCA flower can enhance the therapeutic properties of each other. For instance, terpenes contribute to the modulation of inflammation and pain relief, while CBD has been studied for its role in reducing anxiety and improving certain types of epilepsy. The combination of these compounds may provide a broader spectrum of effects than any single cannabinoid or terpenoid alone, offering a more balanced and potentially more effective therapeutic experience. This synergy is particularly relevant for those seeking the wellness benefits of cannabis without the mind-altering effects of THC.

CBD Synergy with Terpenes in THCA Flower: A Closer Look

Delta-9-tetrahydrocannabinolic acid (THCA) flower, which is the raw, non-psychoactive precursor to the well-known psychoactive substance delta-9-tetrahydrocannabinol (THC), has garnered attention for its potential therapeutic benefits. When consumed in its raw form, THCA exhibits distinct properties that can complement the effects of other cannabinoids and terpenes within the cannabis plant. The synergy between THCA and cannabidiol (CBD) is particularly noteworthy. CBD, a non-psychoactive compound, interacts with the body’s endocannabinoid system, modulating various physiological processes. When combined with terpenes found in the THCA flower, this synergy can enhance or amplify the desired effects. Terpenes are aromatic compounds that contribute to the unique flavors and scents of cannabis and play a crucial role in modifying the pharmacokinetic properties of cannabinoids. They can influence how cannabinoids like THCA and CBD are absorbed, distributed, metabolized, and excreted by the body, potentially leading to more effective therapeutic outcomes. This synergy is not merely additive but often synergistic, where the combined effect is greater than the sum of its parts. For instance, certain terpenes can enhance CBD’s anti-inflammatory or analgesic properties, making it a potent combination for those seeking relief from pain and inflammation without the psychoactive effects associated with THC. As research continues to evolve, the intricate interplay between THCA, CBD, and terpenes holds promise for a wide range of potential health benefits, underscoring the importance of this natural synergy in the context of cannabis-based therapies.

Therapeutic Benefits of THCA Flower Beyond Psychoactive Effects

delta-9-tetrahydrocannabinolic acid (THCA) flour, which is the raw, non-psychoactive form of THC found in cannabis plants, has garnered attention for its therapeutic potential beyond psychoactive effects. Unlike its psychoactive counterpart, delta-9-tetrahydrocannabinol (THC), THCA exhibits a distinct profile of benefits when consumed in its natural state or extracted in product formulations. One of the notable aspects of THCA is its synergy with cannabidiol (CBD) and terpenes, which can enhance their individual effects. This synergy is often referred to as the ‘entourage effect,’ where the combined action of CBD and THCA, along with the diverse array of terpenes present in the flower, work cohesively to provide a broader spectrum of therapeutic benefits. Studies indicate that THCA may offer anti-inflammatory, neuroprotective, and antiemetic properties, which can be particularly beneficial for individuals suffering from chronic pain, neurodegenerative diseases, and chemotherapy-induced nausea, respectively. Additionally, the anti-proliferative effects of THCA are being explored for their potential in managing certain types of cancer cells. The presence of CBD in conjunction with THCA and terpenes can modulate the psychoactive properties if any THC is present, leading to a more balanced and potentially more effective therapeutic experience. This combination is also believed to enhance the analgesic effects, offering a holistic approach to pain management without the intoxicating high typically associated with cannabis consumption. As research continues to evolve, the therapeutic benefits of THCA flower in synergy with CBD and terpenes are becoming increasingly apparent, suggesting a promising avenue for natural and effective treatment options.

Understanding the Side Effects of THCA Flower Consumption

THCA flower, or tetrahydrocannabinolic acid flower, is a raw cannabinoid precursor to the well-known psychoactive compound THC. As interest in cannabis and its derivatives grows, so does the exploration of THCA’s effects and potential benefits. While THCA itself is non-psychoactive, it is being recognized for its therapeutic properties when consumed in its natural form or converted to THC through decarboxylation. One of the intriguing aspects of THCA flower consumption is its synergy with CBD (cannabidiol) and terpenes. This synergy can enhance the overall efficacy of the cannabis plant’s effects, as each component plays a role in the entourage effect.

Consumers should be cognizant of the potential side effects associated with THCA flower, particularly when it comes to dosage and individual sensitivity. Common side effects may include dizziness, dry mouth, and altered mood. The entourage effect, facilitated by CBD and terpenes, can amplify desired therapeutic outcomes, such as pain relief or anxiety reduction, while also potentially minimizing adverse effects. However, it is crucial to approach THCA flower with caution, as overconsumption can lead to more pronounced side effects. Users are advised to start with low doses and gradually adjust according to their body’s response, always adhering to recommended guidelines and legal regulations concerning cannabis consumption. Additionally, consulting with a healthcare professional before incorporating THCA flower into one’s wellness regimen is prudent, especially for those with pre-existing health conditions or those taking other medications. Understanding the nuanced effects of THCA flower requires careful consideration of its chemical composition and interaction with the human endocannabinoid system.

In conclusion, the exploration into the THCA flower’s effects on the endocannabinoid system and its therapeutic benefits, particularly when combined with CBD and terpenes, presents a promising avenue for natural health interventions. However, it is imperative to approach its consumption with caution, as side effects can arise. These may include mild psychoactive effects, although these are typically less pronounced than those of delta-9-THC. Users should also be aware of potential interactions with medications and individual sensitivity to cannabinoids. As research continues to evolve, it is crucial to stay informed on the latest findings regarding THCA flower’s CBD synergy with terpenes and their impact on well-being. With a growing body of evidence supporting its therapeutic properties, users are encouraged to consume responsibly and consult healthcare professionals for personalized guidance, ensuring a safe and beneficial experience with THCA flower.