Delta 9 THC Gummies: Legal Benefits and Usage in Nebraska

Delta 9 THC gummies are a popular and discreet way for adults aged 21 and over in Nebraska to experience the effects of cannabis, with the state's regulations ensuring safe consumption within defined legal limits. These gummies provide users with potential health benefits such as pain relief, reduced anxiety, and improved sleep quality, and are also facilitating research into their therapeutic effects. It's important for consumers to understand that while hemp-derived Delta 9 THC gummies containing less than 0.3% THC on a dry weight basis are legal under the 2018 Farm Bill and Nebraska state law, marijuana-derived Delta 9 gummies are not legal for recreational use outside of the medical cannabis program. Users must stay informed about the nuances of these regulations to comply with the law. These products offer a controlled dosage approach to managing pain and stress, with delta 9 THC's potential benefits being accessible to Nebraskans while ensuring safety and quality control. For those considering Delta 9 gummies as part of their wellness routine, it is crucial to consult healthcare professionals and purchase from reputable sources that clearly label their products. The legal status of these gummies in Nebraska is subject to change, highlighting the importance of staying updated on state laws regarding cannabis products.

Delta 9 gummies have emerged as a topic of interest for residents of Nebraska seeking alternative wellness solutions. This article delves into the multifaceted nature of Delta 9 gummies, from their legal standing in the state to potential benefits they offer. As we explore the composition and effects, it’s crucial to understand the legality surrounding them in Nebraska. We will examine how these gummies can serve as a stress reliever within the confines of the law, their role in pain management, and the essential regulations that govern their use. Whether you’re considering Delta 9 gummies for relaxation or pain relief, this comprehensive guide will provide valuable insights into this unique, legal option available in Nebraska.

- Exploring Delta 9 Gummies: The Legal and Beneficial Experience in Nebraska

- Understanding Delta 9 Gummies: Composition, Effects, and Legal Status in Nebraska

- Delta 9 Gummies as a Stress Reliever: How They Can Benefit Residents of Nebraska Legally

- The Role of Delta 9 Gummies in Pain Management: A Legal and Safe Option for Nebraskans?

- Navigating the Regulations: The Legality of Delta 9 Gummies in Nebraska and What Users Need to Know

Exploring Delta 9 Gummies: The Legal and Beneficial Experience in Nebraska

Delta 9 gummies have emerged as a popular consumption method for medical marijuana patients and recreational users alike, offering a discreet and palatable way to experience the effects of cannabis. In Nebraska, the legal landscape has undergone significant changes, with the state’s laws evolving to accommodate various forms of cannabis use. As of the latest legislation, Delta 9 THC gummies are legal within certain parameters, providing adults aged 21 and over with access to these products for both medicinal and recreational purposes. The state’s regulatory framework outlines strict guidelines to ensure responsible consumption and sale of these products, contributing to a safe environment for users. Nebraska’s patients and consumers can now benefit from the therapeutic properties of Delta 9 gummies, including relief from chronic pain, reduction in anxiety and stress levels, and an improvement in sleep quality, all within the confines of state law. The legalization of these products has also opened up opportunities for research into their potential benefits, further supporting the growing body of evidence that underscores the positive effects of cannabinoids on various health conditions. Users across Nebraska are encouraged to stay informed about local regulations and to consume Delta 9 gummies responsibly, as part of a balanced lifestyle and in accordance with medical advice when applicable.

Understanding Delta 9 Gummies: Composition, Effects, and Legal Status in Nebraska

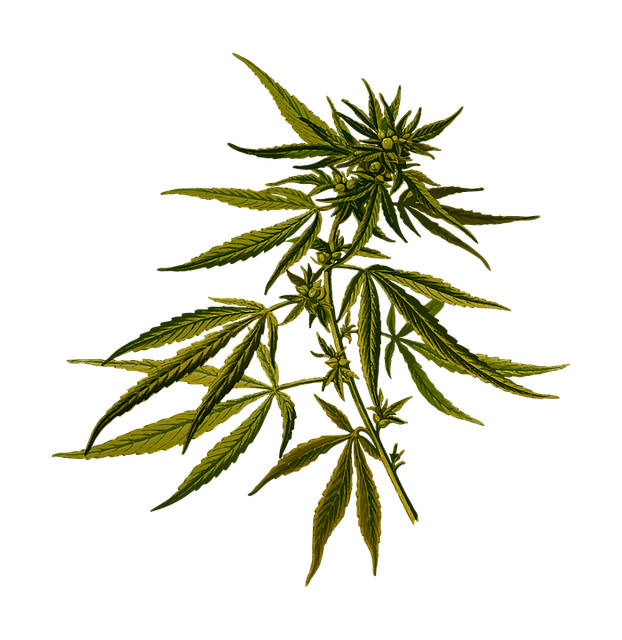

Delta 9 gummies are a popular edible form of cannabinoids, particularly for their relaxing and pain-relieving properties. These gummies contain Delta 9 tetrahydrocannabinol (THC), which is the primary psychoactive component found in cannabis. The composition of these gummies includes Delta 9 THC, sweeteners, colorings, and other ingredients that give them their texture, taste, and potency. Each gummy typically contains a specific dose of Delta 9 THC, allowing for precise dosing and control over the effects experienced.

The effects of Delta 9 gummies can vary based on individual physiology, the dosage consumed, and the specific strain of cannabis used in their production. Generally, users report feelings of euphoria, relaxation, and pain relief. These benefits make Delta 9 gummies a sought-after choice for those seeking medical or recreational use. In Nebraska, the legal status of Delta 9 THC is subject to ongoing legal interpretation. As of recent legislative changes, hemp-derived products containing less than 0.3% THC are legal at the federal level under the 2018 Farm Bill. However, Nebraska’s state laws are more stringent, and Delta 9 THC remains a controlled substance. It is crucial for consumers to stay informed about the evolving regulations surrounding these products, as possessing or using Delta 9 gummies in Nebraska can lead to legal consequences due to their classification under state law. Users should always ensure they are in compliance with local laws when purchasing and consuming Delta 9 gummies.

Delta 9 Gummies as a Stress Reliever: How They Can Benefit Residents of Nebraska Legally

Delta-9 tetrahydrocannabinol (THC) gummies offer a discreet and enjoyable way for residents of Nebraska to experience the potential benefits of cannabis, thanks to the state’s progressive laws regarding its use. Under Nebraska’s medicinal marijuana program, individuals with qualifying conditions can legally access Delta-9 THC products, which include gummies, to help manage their symptoms. As a stress reliever, these gummies have gained popularity for their ability to alleviate anxiety and promote relaxation. The endocannabinoid system within the body interacts with cannabinoids found in Delta-9 gummies, helping to regulate mood and reduce feelings of stress. For those living in Nebraska who are looking for legal options to unwind or cope with daily pressures, Delta-9 THC gummies can be a beneficial addition to their wellness routine. It’s important to note the recommended dosages and to purchase these products from reputable sources within the state to ensure safety and legality. As with any wellness regimen, individual experiences may vary, and consultation with healthcare professionals is recommended before incorporating Delta-9 THC gummies into one’s health practices.

The Role of Delta 9 Gummies in Pain Management: A Legal and Safe Option for Nebraskans?

Delta 9 gummies have emerged as a popular and effective method for pain management, offering a legal and safe alternative for residents of Nebraska seeking relief. With the legalization of delta 9 THC products under state law, many individuals are turning to these edibles as a non-pharmaceutical option to alleviate various types of chronic pain. The delta 9 compound found in cannabis is known for its psychoactive properties and has been studied for its potential analgesic effects. Unlike some traditional pain medications that come with a risk of side effects and addiction, delta 9 gummies provide an alternative that can be tailored to individual dosage needs, allowing for better control over one’s intake and pain levels.

The state of Nebraska has specific regulations regarding the use and possession of cannabis-derived products. Within these guidelines, delta 9 THC gummies are legal provided they contain less than 0.3% THC on a dry weight basis and are sold through licensed dispensaries. This legal status ensures that consumers have access to regulated products that undergo strict quality control measures, thereby ensuring safety and consistency in their effects. For those who experience pain from conditions like arthritis, fibromyalgia, or neuropathy, delta 9 gummies can offer a viable solution, with the added benefit of minimal psychoactive effects compared to smoking or vaping cannabis. This makes them an attractive option for those looking to manage their pain without impairment, yet still reap the therapeutic benefits associated with delta 9.

Navigating the Regulations: The Legality of Delta 9 Gummies in Nebraska and What Users Need to Know

Delta 9 gummies, a popular edible form of cannabinoids derived from hemp or marijuana plants, have gained significant attention due to their potential benefits and recreational effects. As of recent legislation changes, users in Nebraska are navigating the evolving regulations surrounding these products. In Nebraska, the legality of delta 9 gummies hinges on the source of THC—the psychoactive component found in cannabis plants. According to the 2018 Farm Bill, hemp-derived delta 9 THC is legal federally if it contains no more than 0.3% THC by dry weight. Nebraska aligns with this federal standard, allowing hemp-derived delta 9 products, including gummies, to be legally sold and possessed, provided they adhere to state and federal guidelines. However, users must be aware that delta 9 gummies derived from marijuana—which has a higher THC content—are illegal in Nebraska unless obtained through the state’s medical cannabis program. It is crucial for consumers to understand whether the delta 9 gummies they are purchasing are derived from hemp or marijuana, as this will dictate their legality and ensure compliance with state laws. Users interested in incorporating delta 9 gummies into their routine should prioritize products from reputable sources that clearly label their content and origin to avoid any legal implications.