Optimizing Your Retirement with Top-Rated Gold IRA Companies in Wyoming

Gold IRAs in Wyoming offer residents an opportunity to diversify their retirement portfolios by directly investing in gold, silver, platinum, and palladium within their IRA accounts. Wyoming's economic stability, favorable tax policies, and commitment to high regulatory standards make it an ideal location for Gold IRA investments, with companies providing secure, compliant storage solutions and adhering to both federal and state regulations. These firms are known for their exceptional customer service, transparency, competitive pricing, and educational resources to inform investors about the benefits of precious metals as a hedge against economic volatility. Wyoming Gold IRA companies stand out for their industry leadership, with a strong reputation for compliance, client satisfaction, and expertise in guiding investors through the process of transitioning to a precious metals-based retirement strategy. For those considering a Gold IRA, it's important to assess the credibility of these firms, their range of investment options, and their fee structures, ensuring that they align with your retirement objectives and adhere to Wyoming's specific regulatory requirements. The success stories and positive reviews from clients underscore the tangible benefits of a Gold IRA as part of a long-term retirement strategy in Wyoming.

Investing in a Gold IRA presents a strategic approach for securing wealth with the tangible value of precious metals. Wyoming, known for its financial privacy and minimal state taxes, emerges as an ideal location for individuals interested in diversifying their retirement portfolios with gold. This article delves into the top-rated Gold IRA companies based in Wyoming, offering insights into understanding the advantages these investments afford. We’ll explore the local regulations guiding Gold IRA investment, evaluate key factors to consider when selecting a provider, and analyze top services through a comparative lens. With real testimonials from Wyoming residents and a detailed guide on the rules and regulations governing these investments, readers will be well-equipped to make informed decisions about their retirement savings with Gold IRAs in Wyoming.

- Understanding Gold IRAs and Their Benefits in Wyoming

- Top-Rated Gold IRA Companies Based in Wyoming

- A Comprehensive Guide to Gold IRA Investment Rules and Regulations in Wyoming

- Evaluating the Best Gold IRA Companies: Factors to Consider for Residents of Wyoming

- Comparative Analysis of Gold IRA Services in Wyoming: A Side-by-Side Look

- Client Testimonials and Case Studies from Wyoming's Leading Gold IRA Companies

Understanding Gold IRAs and Their Benefits in Wyoming

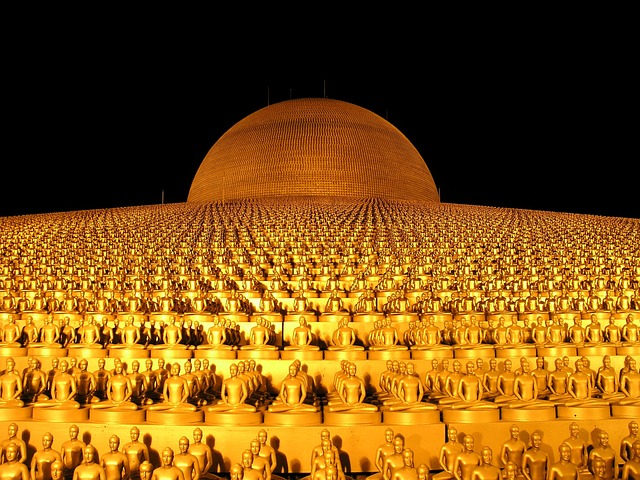

Gold Individual Retirement Accounts (IRAs) offer a unique and potentially advantageous investment option for those looking to diversify their retirement savings in Wyoming. Unlike traditional IRAs that typically invest in stocks, bonds, or mutual funds, a Gold IRA allows individuals to hold physical gold, silver, platinum, and palladium within their retirement accounts, providing a hedge against inflation and market volatility. This form of investment can be particularly appealing to residents of Wyoming, known for its economic stability and pro-business climate, which may encourage gold IRA companies to operate there due to favorable conditions.

Incorporating gold into an IRA provides a tangible asset that can act as a safe haven during economic uncertainty. It’s a strategy that aligns with the conservative investment approach favored by many Wyomingites who value financial security and independence. The benefits of a Gold IRA in Wyoming are manifold, including diversification of investment portfolios, protection against currency devaluation, and the potential for capital appreciation over the long term. Additionally, Wyoming’s tax-friendly environment can be advantageous for those investing in gold through an IRA, as it may offer tax benefits that complement the growth of these precious metal investments. Gold IRA companies operating in Wyoming are typically well-regarded due to the state’s commitment to financial services and its reputation for upholding high regulatory standards, ensuring a secure environment for investors.

Top-Rated Gold IRA Companies Based in Wyoming

When considering a Gold IRA, investors often seek out reputable and well-rated companies to handle their precious metals investments. Among the top-rated gold IRA companies based in Wyoming, several stand out for their exceptional service and customer satisfaction. These firms are not only compliant with all federal regulations but also offer a diverse range of investment options that align with the needs of those looking to diversify their retirement portfolios with physical gold, silver, platinum, and palladium. Wyoming’s gold IRA companies pride themselves on transparency, competitive pricing, and secure storage solutions, which are crucial for peace of mind. Investors in these firms benefit from the expertise of seasoned professionals who guide them through the process, ensuring that their investment is handled with care and expertise. The combination of Wyoming’s favorable regulatory environment, along with the state’s companies’ commitment to client service, positions them as key players in the Gold IRA market. This has led to high ratings across various review platforms, making them a trusted choice for those looking to include gold in their retirement savings strategy.

A Comprehensive Guide to Gold IRA Investment Rules and Regulations in Wyoming

In Wyoming, investors looking into Gold IRA companies have a regulatory framework that both safeguards their interests and provides clarity on investment rules and regulations. The state’s approach to retirement savings with a precious metals focus is structured to ensure that these investments are made within the confines of the law, offering a secure environment for gold IRAs. Wyoming’s laws align with federal regulations, specifically the Internal Revenue Service (IRS) guidelines that govern Individual Retirement Accounts (IRAs) and their ability to include gold and other precious metals. These rules dictate the types of metals allowed in an IRA, how they can be acquired, and how they should be held and stored. Investors must adhere to the purity standards set by the IRS for coins and bullion, with gold purity requirements typically at 24 karats or higher. Additionally, the physical storage of these assets must comply with IRS-approved depositories.

Gold IRA companies Wyoming operating within this framework offer a range of services from setting up an account to managing the purchase and custody of the metals. It’s crucial for investors to conduct due diligence and select reputable Gold IRA companies that maintain high ratings, ensuring compliance with both state and federal regulations. These firms often provide educational resources to guide investors through the process, highlighting the benefits of diversifying retirement portfolios with gold and other precious metals. By understanding the specific rules and regulations, Wyoming residents can make informed decisions about their Gold IRA investments, leveraging these assets as a hedge against inflation and market volatility.

Evaluating the Best Gold IRA Companies: Factors to Consider for Residents of Wyoming

When selecting a Gold IRA company in Wyoming, residents must carefully evaluate various critical factors to ensure their investment aligns with their retirement goals and the regulatory framework specific to the state. Firstly, it’s imperative to research the reputation and history of the gold IRA companies operating within Wyoming. Look for firms with a proven track record, positive client reviews, and high ratings that reflect their commitment to customer service and the secure handling of assets. A company’s experience in the industry can be a strong indicator of reliability and expertise in managing precious metals investments.

Furthermore, Wyoming residents should consider the types of precious metals available through a Gold IRA, as not all companies offer the same selection. The choice of metals often includes gold, silver, platinum, and palladium, each with its own market dynamics and investment characteristics. Additionally, the storage options provided by the company are crucial; Wyoming-based investors should preferably opt for a custodian that offers secure, insured, and compliant storage solutions within the state. This ensures compliance with both federal and state regulations while providing peace of mind regarding the safety of their investments. Investors must also examine the fees associated with setting up and maintaining a Gold IRA account, as these can vary significantly between companies. By carefully considering these factors, Wyoming residents can identify gold IRA companies that not only meet their investment needs but also adhere to the state’s regulatory environment.

Comparative Analysis of Gold IRA Services in Wyoming: A Side-by-Side Look

In Wyoming, discerning investors looking to diversify their retirement portfolios with precious metals have a range of options when it comes to Gold IRA companies. A comparative analysis reveals that these firms offer varying services and rates, each tailored to cater to different investor needs. Factors such as the types of precious metals accepted, storage solutions, fees, customer service, and reputation play a pivotal role in distinguishing one Gold IRA company from another within the state. Investors must consider the expertise and regulatory compliance of these companies, ensuring that their investment is both secure and compliant with federal regulations like the Internal Revenue Service (IRS) guidelines on self-directed retirement accounts.

Gold IRA companies in Wyoming are characterized by their commitment to customer education and the provision of transparent fee structures. For instance, some companies specialize in a broad array of gold products, including American Gold Eagles, Canadian Gold Maple Leafs, and Gold Buffalos, catering to those who prefer iconic coins. Others may emphasize rare or collectible coins for investors seeking more unique assets. Additionally, the secure storage options vary; some firms offer segregated storage where each investor’s metals are stored separately, while others provide allocated storage with specific amounts clearly allocated to each account holder. This diversity in offerings underscores the importance of a thorough evaluation when selecting a Gold IRA company in Wyoming that aligns with one’s investment goals and risk tolerance.

Client Testimonials and Case Studies from Wyoming's Leading Gold IRA Companies

In Wyoming, a state with a storied history in mining and a modern reputation for financial savvy, gold IRA companies have cultivated a client base that speaks volumes about their services. These leading gold IRA firms in Wyoming have garnered a wealth of positive client testimonials, showcasing the satisfaction and trust clients place in their stewardship of retirement savings. Many individuals have shared their experiences, highlighting the transparency and customer service excellence provided throughout the process of rolling over traditional retirement accounts into precious metals IRAs. These case studies often reflect a theme of reliability and expertise; clients note the companies’ ability to navigate complex financial landscapes with ease and provide personalized guidance tailored to each investor’s needs.

Furthermore, the case studies from Wyoming’s gold IRA companies often feature narratives of individuals who have seen tangible benefits from diversifying their portfolios with physical gold and other precious metals. These accounts underscore the real-world impact of investing in a gold IRA, illustrating how such investments can offer a hedge against inflation and market volatility. The companies’ track records in maintaining high ratings are not just numbers on a page but are evidenced by the real experiences of clients who have navigated the nuances of retirement savings with these Wyoming-based gold IRA providers.

When considering a Gold IRA in Wyoming, investors are well-served by researching the highest-rated gold IRA companies within the state. This comprehensive guide has outlined the benefits of incorporating precious metals into your retirement portfolio and provided a clear understanding of the investment rules and regulations specific to Wyoming. By evaluating top-rated gold IRA firms based on their services, compliance records, and client feedback, residents can make informed decisions that align with their financial goals. The comparative analysis and real-life testimonials included offer valuable insights into the performance and reliability of these companies. Ultimately, investing in a Gold IRA through a Wyoming-based company can be a strategic move for diversifying your retirement savings with physical gold and other precious metals, positioning you to potentially reap the tax advantages and protection against inflation that these investments offer.