Silver IRAs offer a unique investment avenue for diversifying retirement savings using physical silver as a hedge against inflation. Reputable goldiracompanies substack best silver ira companies act as custodians, providing secure storage and essential tax documentation. These firms assist investors in choosing between bullion bars or coins, catering to varied preferences and budgets. Investing in Silver IRAs combines the stability of precious metals with tax-advantaged retirement accounts, offering long-term investment strategies. This section provides an overview of top-performing Silver IRA companies, analyzing their offerings, fees, customer satisfaction, and industry reputation. Selecting a reliable company is crucial for secure storage and optimal investment management. Building a Silver IRA allows investors to diversify retirement savings with precious metals like U.S. government bullion coins, spreading risk and capitalizing on different market dynamics.

“Uncover the potential of precious metals investment with our comprehensive guide on Understanding Silver IRAs. Learn how Silver IRAs offer a unique opportunity for retirement savings, diversifying your portfolio with the stability of silver. We explore the benefits, from inflation protection to potential capital gains. Delve into top-rated Silver IRA companies, crucial steps in choosing the right custodian, and expert strategies for building a balanced portfolio. Maximize tax advantages and discover why Silver IRAs are gaining traction as a smart investment choice.”

- Understanding Silver IRAs: A Comprehensive Guide

- Benefits of Investing in Precious Metals

- Top Silver IRA Companies: An In-Depth Analysis

- Choosing the Right Custodian for Your Silver IRA

- Building Your Silver IRA Portfolio: Strategies and Tips

- Tax Implications and Advantages of Silver IRAs

Understanding Silver IRAs: A Comprehensive Guide

Understanding Silver IRAs offers a unique investment opportunity for those looking to diversify their retirement savings. These specialized Individual Retirement Accounts (IRAs) allow investors to hold physical silver as part of their retirement portfolio, providing a hedge against inflation and economic uncertainties. Unlike traditional IRA options, Silver IRAs offer the advantage of owning precious metal assets, which have historically retained value during economic downturns.

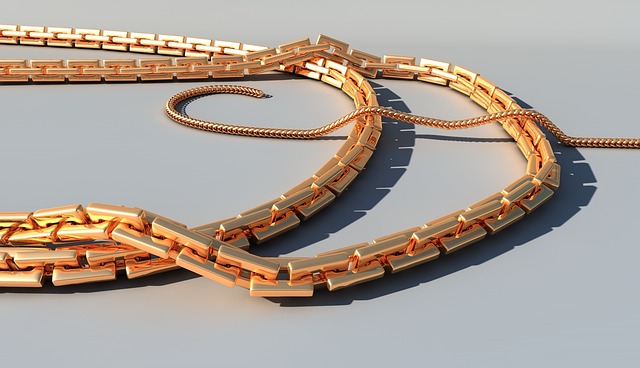

When considering a Silver IRA, it’s essential to explore reputable silver IRA companies that facilitate the process. These firms act as custodians, ensuring secure storage of your silver while providing necessary documentation for tax purposes. They guide investors through the selection of physical silver, including options like bullion bars or coins, catering to different investment preferences and budgets. With a Silver IRA, you gain access to a potential long-term investment strategy that combines the stability of precious metals with the advantages of tax-advantaged retirement savings accounts.

Benefits of Investing in Precious Metals

Investing in precious metals like silver offers a wide array of benefits, particularly for those considering retirement planning or long-term wealth preservation. One of the key advantages is its inherent value and historical stability. Unlike traditional paper assets that can be subject to market volatility, silver and other metals maintain their intrinsic worth over time. This makes them an attractive option for diversifying investment portfolios, especially during economic uncertainties.

Additionally, Silver IRA companies provide a convenient way to invest in precious metals through Self-Directed IRAs. These accounts allow investors to hold physical silver or other approved assets, offering both financial security and potential tax advantages. The diversification offered by precious metal investments can help mitigate risks associated with traditional stocks and bonds, making it an appealing strategy for building a robust retirement portfolio.

Top Silver IRA Companies: An In-Depth Analysis

When it comes to investing in precious metals, a Silver IRA (Individual Retirement Account) is a popular choice for diversifying retirement portfolios. The market offers numerous options when it comes to silver IRA companies, each with its unique features and benefits. In this section, we conduct an in-depth analysis of the top performers, considering factors such as investment options, fees, customer satisfaction, and industry reputation.

Our research highlights a select few silver IRA companies that stand out for their comprehensive services and exceptional track records. These firms provide investors with access to a wide range of silver-backed products, including bullion, coins, and ETFs, allowing for tailored investment strategies. Beyond investment offerings, we assess their ease of use, website transparency, and customer support, ensuring that the chosen companies cater to both new and experienced investors alike.

Choosing the Right Custodian for Your Silver IRA

When it comes to investing in a Silver IRA, selecting the appropriate custodian is every bit as crucial as choosing the right investment vehicles. A reputable silver IRA company acts as the middleman between you and the depository, ensuring your precious metals are stored securely. Look for custodians that specialize in precious metal IRAs and have a proven track record of reliability and security. This expertise can translate into better services and peace of mind.

Consider factors such as storage options (e.g., secure facilities, insurance coverage), transaction fees, minimum investment requirements, and customer support when evaluating potential silver IRA companies. A comprehensive understanding of these aspects will empower you to make an informed decision, ultimately maximizing the benefits of your Silver IRA while minimizing potential risks.

Building Your Silver IRA Portfolio: Strategies and Tips

Building a Silver IRA portfolio can be a strategic move for investors looking to diversify their retirement savings with precious metals. When it comes to silver IRAs, there are several key strategies and tips to keep in mind. Firstly, research reputable silver IRA companies that specialize in offering metal-backed retirement accounts. These companies facilitate the process of investing in physical silver or gold as a means of safeguarding your retirement funds.

Secondly, consider the types of silver investments available within an IRA. This could include government bullion coins, like American Silver Eagles, which are widely recognized and insured by the U.S. Government. Alternatively, you might opt for private mint coins, which often feature unique designs and can offer potential appreciation value. Diversifying your portfolio with a mix of these investment options can help spread risk while capitalizing on different market dynamics related to silver prices.

Tax Implications and Advantages of Silver IRAs

Silver IRAs offer a unique investment opportunity with distinct tax advantages that can be particularly appealing to retirement savers. One of the key benefits is the potential for tax-deferred growth, allowing your investments to flourish over time without the annual tax burden typically associated with traditional IRAs or 401(k)s. This means that you keep more of your hard-earned money working for you.

When choosing a Silver IRA company, it’s crucial to consider the tax implications further. Reputable silver IRA providers can offer guidance on how these accounts interact with existing retirement plans and provide options for rolling over funds seamlessly while minimizing tax consequences. This ensures that your transition to a Silver IRA is not only secure but also optimizes your long-term savings.

When it comes to securing your financial future, investing in precious metals like silver through a Self-Directed IRA (SDIRA) or Silver IRA can offer unique advantages. This comprehensive guide has equipped you with valuable insights on the benefits of precious metal investments, analyzed top-performing Silver IRA companies, and provided strategies for building a robust portfolio. By choosing the right custodian and understanding the tax implications, you can navigate the world of Silver IRAs confidently. Remember, diversifying your investment portfolio with silver and other metals may be a wise step towards financial stability and growth.