A 401(k) to Gold IRA rollover is a strategic investment move, allowing diversification with precious metals like gold while preserving tax advantages. The process involves careful documentation and transfer of qualified funds, maintaining compliance with IRS regulations. Post-rollover, optimizing the strategy through regular portfolio review, contributions, and market awareness ensures maximized retirement savings. Target keyword: 401k to gold ira rollover.

Thinking of transforming your retirement savings? Discover the power of a Gold IRA through this comprehensive guide on rolling over your 401(k). We’ll break down the intricate process, revealing the benefits and considerations unique to this precious metal option. From understanding the legalities to executing the rollover step-by-step, you’ll grasp the ins and outs. Furthermore, learn how to optimize your strategy post-rollover for maximum gold investment potential.

- Understanding the 401k to Gold IRA Rollover Process

- Benefits and Considerations for a Gold IRA Rollover

- Step-by-Step Guide to Executing the Rollover

- Optimizing Your Post-Rollover Strategy

Understanding the 401k to Gold IRA Rollover Process

The process of rolling over a 401k to a Gold IRA is a strategic move for retirement savings, offering an alternative investment option in precious metals. It involves carefully transferring your qualified retirement funds from your existing 401k plan to a new Gold IRA account. This transition allows investors to diversify their portfolios by investing in gold, which has historically been a storehouse of value and a hedge against inflation. The rollover process is designed to be seamless, ensuring that your hard-earned savings are protected during the transition.

During the 401k to Gold IRA rollover, you initiate the transfer by providing necessary documentation to both your current 401k administrator and the new Gold IRA custodian. This includes forms for tax reporting and account details. The custodian will facilitate the movement of funds, ensuring that the gold assets are properly valued and securely transferred to your new IRA account. It’s a crucial step in gaining access to the potential benefits of gold as an investment, while also maintaining the tax-advantaged status of your retirement savings.

Benefits and Considerations for a Gold IRA Rollover

A 401k to Gold IRA rollover offers investors a unique opportunity to diversify their retirement portfolio with tangible assets. One of the key benefits is the potential for preservation and growth, as gold has historically maintained its value over time, even during economic downturns. This shift from traditional paper investments to physical gold can provide a hedge against inflation, ensuring your hard-earned savings retain purchasing power in retirement.

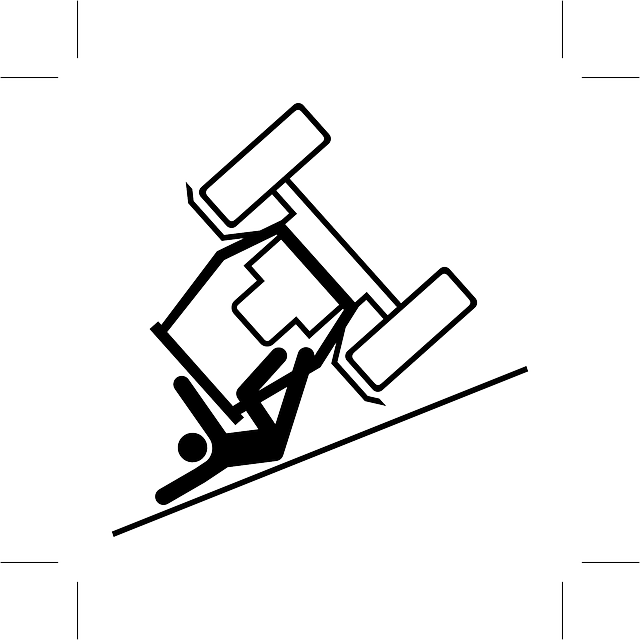

Considerations for this rollover include understanding the tax implications and potential penalties if not handled correctly. It’s essential to consult with financial advisors and experts in IRA rollovers to ensure compliance with IRS regulations. Additionally, tracking and securing physical gold assets requires careful management, but reputable custodians can provide secure storage solutions, giving you peace of mind.

Step-by-Step Guide to Executing the Rollover

Executing a 401(k) to Gold IRA rollover is a straightforward process, but it requires careful navigation. Here’s your step-by-step guide:

1. Initiate the Process: Begin by contacting both your current 401(k) administrator and the Gold IRA provider. Inform them of your intention to rollover your funds. Ensure they have all necessary documents and account details for a smooth transition.

2. Prepare Required Documentation: Gather essential paperwork, including the Form 8639 (for tax-free rollovers) or relevant IRS forms, depending on your specific situation. Your current 401(k) plan may also require additional documentation to facilitate the transfer.

3. Complete Rollover Transaction: With all documents in order, instruct your 401(k) administrator to transfer your funds directly to your newly established Gold IRA account. This transaction should be handled electronically or via a direct wire transfer, ensuring no taxes are incurred during the process.

4. Confirm and Verify: After the rollover, verify that the funds have successfully transferred and that your Gold IRA account reflects the full amount. Double-check with both institutions to ensure accuracy.

Optimizing Your Post-Rollover Strategy

After successfully completing a 401k to Gold IRA rollover, optimizing your post-rollover strategy is crucial for maximizing retirement savings. This involves regularly reviewing and adjusting your investment portfolio to align with your financial goals and risk tolerance. Diversifying across various asset classes, such as precious metals, stocks, and bonds, can help mitigate risks associated with market fluctuations. Regular contributions to your Gold IRA, especially during years with lower earnings, ensure steady growth of your retirement funds.

Additionally, staying informed about market trends and economic indicators enables you to make informed decisions regarding your investments. Consider working with a financial advisor who specializes in IRAs to navigate complex regulations and optimize tax benefits. Regularly assessing and rebalancing your portfolio ensures that your assets remain allocated according to your risk profile, allowing for optimal long-term growth within the framework of your 401k to Gold IRA rollover strategy.

A 401(k) to Gold IRA rollover can be a strategic move for retirement planning, offering unique benefits like diversification and potential preservation of wealth. By following the step-by-step guide outlined in this article, you can navigate this process effectively. Remember that careful consideration of tax implications and investment choices is key. Optimizing your post-rollover strategy ensures you make the most of your retirement savings. For those seeking an alternative investment approach, a Gold IRA rollover may be worth exploring, potentially adding a valuable component to your overall financial strategy.