Gold IRA Companies Guide: Top Picks & Considerations in Wyoming

401(k) rollover into a goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira with Wyoming’s Gold IRA companies offers investors a chance to diversify their retirement savings by including physical gold and other precious metals. These IRAs provide an inflation hedge and portfolio stability against market fluctuations within an IRS-approved framework, allowing direct ownership of gold bullion, coins, or bars. Wyoming residents have access to top-rated Gold IRA companies like GoldCo and Augusta Precious Metals, known for their exceptional customer service, educational resources, compliance with regulations, secure storage solutions, competitive pricing, and commitment to customer satisfaction. It’s crucial to conduct due diligence on a company’s track record, customer reviews, precious metals offerings, and adherence to state and federal statutes, including IRS regulations. Wyoming’s regulatory environment ensures the integrity of Gold IRA investments through Division of Banking supervision and strict custody arrangements for physical metals. Investors should compare fees carefully, considering Wyoming’s advantageous tax climate and the impact of service charges on long-term investment growth. Real-world experiences from fellow Wyomingites can guide potential investors in selecting a reputable Gold IRA company that meets their financial objectives and risk profiles, emphasizing the advantages of incorporating tangible assets into retirement planning.

Exploring the robust world of retirement savings, this article serves as a comprehensive guide to Augusta reviews https://www.linkedin.com/pulse/augusta-gold-ira-reviews-precious-metals-2024-metals-resgoldira-wsxqc . We delve into the essence of Gold IRAs and their pivotal role in diversifying retirement portfolios. With a focus on the Cowboy State, we present a curated list of top-rated Gold IRA firms tailored to Wyoming’s residents. Key factors influencing the choice of a Gold IRA provider are examined, along with the state’s regulatory framework governing these investments. A critical evaluation of fees and costs associated with Gold IRA services in Wyoming ensures informed decision-making. Real insights from Wyoming residents’ experiences and success stories round out this essential read for anyone considering the tangible benefits of a Gold IRA.

- Understanding Gold IRAs and Their Role in Retirement Planning

- Top-Rated Gold IRA Companies in Wyoming

- Factors to Consider When Choosing a Gold IRA Company in Wyoming

- The Legalities of Gold IRAs in the State of Wyoming

- Comparing Fees: Cost Analysis of Gold IRA Services in Wyoming

- Customer Reviews and Success Stories from Wyoming Residents

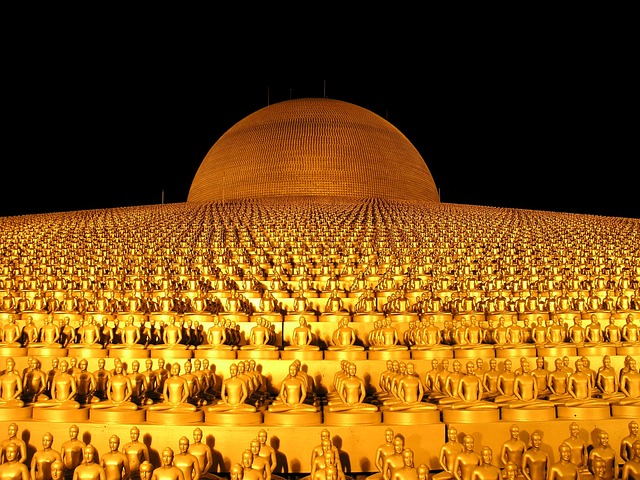

Understanding Gold IRAs and Their Role in Retirement Planning

Gold IRAs serve as a specialized retirement savings vehicle that allows individuals to diversify their investment portfolios by including physical gold, along with other precious metals. Unlike traditional Individual Retirement Accounts (IRAs) that primarily invest in stocks, bonds, and mutual funds, a Gold IRA is designed to hold actual gold bullion, coins, or bars within an IRA framework, offering a tangible asset component to one’s retirement strategy. This form of investment can act as a hedge against inflation and market volatility, potentially preserving purchasing power over time. In the context of retirement planning, Gold IRAs offer a unique opportunity for risk mitigation and portfolio diversification.

Selecting the right Gold IRA company is crucial, and gold IRA companies in Wyoming are amongst the reputable options available to investors. These firms specialize in facilitating the process of rolling over existing retirement funds into a Gold IRA, as well as providing secure storage solutions for the physical gold. They ensure compliance with Internal Revenue Service (IRS) regulations, which dictate the types of precious metals eligible for investment within a Gold IRA, and the proportion of each metal type that can be held. Investors considering a Gold IRA should carefully evaluate Wyoming-based companies, examining their track record, customer service reputation, and the security measures they employ to safeguard assets. A well-managed Gold IRA can be an invaluable part of a retirement portfolio, offering potential benefits that extend beyond traditional investment avenues.

Top-Rated Gold IRA Companies in Wyoming

In Wyoming, investors looking for top-rated gold IRA companies have several reputable options to consider for diversifying their retirement portfolios with precious metals. Among these, GoldCo and Augusta Precious Metals stand out as leaders in the industry. GoldCo is renowned for its exceptional customer service and a wide array of precious metal products that cater to various investment strategies. The company’s transparent approach and educational resources make it an ideal partner for those new to gold IRAs, providing guidance on how to navigate the process with confidence. Augusta Precious Metals also garners high praise for its expertise in gold IRAs, with a focus on customer education and a commitment to compliance and transparency. Both companies are known to facilitate the rollover process seamlessly, ensuring that clients’ investments are handled with care and precision. Investors in Wyoming who select either GoldCo or Augusta Precious Metals will find a trusted partner equipped with the resources and knowledge to help secure their financial future through a gold IRA. These companies not only offer competitive rates but also prioritize customer satisfaction, making them top-rated choices for residents of the Cowboy State.

Factors to Consider When Choosing a Gold IRA Company in Wyoming

When exploring reputable Gold IRA Companies in Wyoming, investors must consider several critical factors to make an informed decision. The first factor is the company’s track record and reputation within the state. Wyoming has specific regulations and market conditions that can impact the operation of a Gold IRA, so it’s crucial to select a company with ample experience in handling such investments within the state’s legal framework. Investors should examine the company’s history, customer reviews, and its standing with regulatory bodies like the Better Business Bureau.

Another important aspect is the range of precious metals available. Wyoming Gold IRA Companies should offer a diverse selection of gold, silver, platinum, and palladium products to diversify your investment portfolio effectively. This diversity allows investors to balance their holdings according to their risk tolerance and financial goals. Additionally, consider the company’s storage options. Secure, insured, and readily accessible storage solutions are vital for peace of mind, knowing that your investments are safeguarded against theft, loss, or natural disasters. Lastly, evaluate the level of customer service and support provided by the company. The ability to have knowledgeable assistance when managing your Gold IRA is paramount, as it ensures that any questions or concerns can be addressed promptly and professionally. By carefully assessing these factors, investors in Wyoming can identify a Gold IRA Company that aligns with their investment objectives and provides a secure and reliable platform for their precious metals IRA.

The Legalities of Gold IRAs in the State of Wyoming

In the State of Wyoming, Gold IRAs are governed by a set of rules and regulations that ensure their legal integrity within the framework of retirement savings. The Equality State, known for its mining heritage and resource-rich lands, offers a favorable environment for individuals looking to include physical gold, silver, platinum, and palladium in their Individual Retirement Accounts (IRAs). Wyoming’s regulatory landscape is structured to accommodate these alternative investments as part of self-directed IRAs. The Wyoming Division of Banking oversees trust companies that administer such accounts, ensuring they comply with federal and state laws, including those set forth by the Internal Revenue Service (IRS). This oversight is crucial for maintaining the integrity of Gold IRA Companies operating within Wyoming’s borders, providing peace of mind to investors who choose to diversify their retirement portfolios with precious metals.

Gold IRA Companies Wyoming must adhere to the strict guidelines that dictate how these investments can be held in an IRA. These companies are required to maintain proper custody arrangements for the physical metals, ensuring they are stored securely and separately from other assets. The state’s regulations also stipulate the types of precious metals eligible for inclusion in a Gold IRA, typically including gold bullion, silver bullion, platinum bars, and palladium bars that meet specific fineness requirements. Investors in Wyoming can leverage these guidelines to make informed decisions when selecting from among the Gold IRA Companies operating within the state, ensuring their investments are both legally compliant and strategically sound for their long-term financial goals.

Comparing Fees: Cost Analysis of Gold IRA Services in Wyoming

When considering a Gold IRA in Wyoming, comparing fees is a pivotal step in your financial planning journey. The Cowboy State offers a favorable tax environment, which can enhance the appeal of investing in precious metals through an IRA. Prospective investors must scrutinize the fee structures of gold IRA companies operating within Wyoming’s borders to ensure they are making a well-informed decision. These fees encompass annual maintenance charges, administrative costs, transaction fees for buying and selling, as well as storage fees, which can significantly impact your investment’s net performance over time.

The transparency of these fees varies between gold IRA companies in Wyoming; some may present seemingly lower fees but could have additional hidden costs. It is imperative to consider not just the upfront expenses but also the long-term implications of these charges. A comprehensive cost analysis will reveal the true cost of owning a Gold IRA with each provider, allowing for an apples-to-apples comparison. Investors should prioritize companies that offer clarity in their fee structures and competitive rates without compromising on essential services such as secure storage and reputable custodial support. By carefully evaluating gold IRA companies Wyoming based on their fee schedules, you can navigate your investment with confidence, knowing you have made a cost-effective choice for safeguarding your financial future.

Customer Reviews and Success Stories from Wyoming Residents

When considering a Gold IRA in Wyoming, potential investors often look to the experiences of their peers within the state. The Cowboy State’s residents have shared numerous customer reviews and success stories that highlight the performance of various gold IRA companies. These testimonials provide valuable insights into the reliability and efficiency of these firms. For instance, many Wyomingites praise the transparency and customer service of some gold IRA companies, noting the ease with which they navigated the process of rolling over their traditional IRAs into precious metals. Success stories abound of individuals who have seen their investment portfolios diversify effectively thanks to the inclusion of physical gold, silver, and other precious metals. These narratives often underscore the prudence of diversifying one’s retirement savings with tangible assets in times of economic uncertainty. Local residents’ experiences with Gold IRA companies Wyoming-based investors trust are a testament to the importance of due diligence and selecting a reputable firm that aligns with their financial goals and risk tolerance. Prospective investors in Wyoming can learn from these real-life examples, which demonstrate the potential benefits of incorporating gold and other precious metals into their retirement accounts as part of a well-rounded investment strategy.

When considering a Gold IRA as part of your retirement strategy in Wyoming, it’s crucial to explore the top-rated gold IRA companies that operate within the state. This article has delved into the essential aspects of Gold IRAs and their strategic role in diversifying your retirement portfolio. By examining the leading gold IRA companies in Wyoming, understanding the legal framework governing these investments in the state, and comparing fees and services, investors can make informed decisions tailored to their financial objectives. The insights provided, along with customer reviews and success stories from fellow Wyoming residents, underscore the value of careful selection and due diligence when choosing a gold IRA provider. Ultimately, the right company can offer peace of mind and a more secure financial future.

Maximizing Retirement Savings: Top Gold IRA Companies in Wyoming

Gold IRAs offer a way to diversify and protect retirement savings by investing in physical gold and other precious metals, especially during economic downturns or inflation. Wyoming-based goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira providers are attractive due to their favorable regulatory framework and expertise in precious metals investments, adhering to compliance standards and offering robust customer support. These companies assist with setting up Gold IRAs, ensuring they comply with Internal Revenue Service (IRS) regulations, and provide secure storage solutions. Wyoming’s gold IRA industry is characterized by its investor-friendly policies, absence of state taxes on precious metals, and commitment to reliability and security. Notable companies like GoldCo and Augusta Precious Metals have established strong reputations within the state for their educational resources, clear investment approaches, and access to a range of IRS-compliant gold products. Investors should conduct thorough research to select a trustworthy company based on history, customer service, and the breadth of investment options available. Wyoming’s regulatory system for Gold IRAs is designed to offer both oversight and investor protection, making it an optimal jurisdiction for these investments. Prospective investors should consider factors like the firm’s background, compliance with ERISA regulations, storage security, customer service quality, and assistance with rollovers when choosing a company. By opting for a Gold IRA in Wyoming, investors can leverage the state’s supportive environment for informed decision-making and financial stability within the precious metals market.

When considering a robust and varied retirement portfolio, incorporating physical gold through a Gold IRA can be a strategic move. With Wyoming emerging as a hub for reputable gold IRA companies, investors are turning to the Equality State for its favorable regulatory environment and the security it offers. This article delves into the top Augusta Precious Metal Guides operating within Wyoming’s borders, examining factors pivotal to selecting the right firm for your investment needs. From understanding the benefits of a Gold IRA to setting up an account with a Wyoming-based provider, navigate the intricacies of this alternative investment opportunity. Key insights into Wyoming’s regulatory framework for gold IRA investments and a detailed comparative analysis of leading companies will equip you with the knowledge to make informed decisions regarding your retirement savings.

- Understanding Gold IRAs and Their Role in Diverse Portfolios

- The Top Gold IRA Companies Operating Out of Wyoming

- Factors to Consider When Choosing a Gold IRA Company in Wyoming

- Wyoming’s Regulatory Framework for Gold IRA Investments

- Comparative Analysis: Leading Gold IRA Companies in Wyoming

- How to Set Up a Gold IRA with a Company Based in Wyoming

Understanding Gold IRAs and Their Role in Diverse Portfolios

Gold Individual Retirement Accounts (IRAs) offer a unique and time-tested investment option that can complement a diverse retirement portfolio. These accounts allow individuals to invest in physical gold, along with other IRS-approved precious metals, providing a hedge against inflation and market volatility. By incorporating a Gold IRA within your retirement strategy, you’re not only diversifying your assets but also potentially safeguarding your wealth against currency devaluation and economic uncertainty.

Choosing the right Gold IRA company is crucial for navigating the complexities of this investment type. Companies based in Wyoming, known for their favorable regulatory environment and strong reputation in precious metals investments, stand out as reliable options. These firms specialize in guiding clients through the process of establishing a Gold IRA, from account setup to selection of compliant gold products. With expertise in compliance and a commitment to customer service, Wyoming-based companies offer peace of mind for those looking to secure their financial future with this alternative asset class.

The Top Gold IRA Companies Operating Out of Wyoming

When considering a Gold IRA for retirement, investors often look to states with favorable regulatory environments and economic stability. Wyoming stands out as a prime location for gold IRA companies due to its robust legal framework and minimal state taxes on precious metals. Among the leading gold IRA companies operating out of Wyoming are those that have carved a reputation for reliability, security, and customer service. These firms offer investors the ability to diversify their retirement portfolios with physical gold, silver, platinum, and palladium coins and bars that comply with IRS regulations.

One such company is GoldCo, which has established itself as a top contender in the industry, providing Wyoming residents with personalized service and a comprehensive selection of rare-earth metals. Another notable company is Augusta Precious Metals, known for its educational resources and transparent approach to investing in gold IRAs. Both companies have a strong presence in Wyoming, catering to those seeking a hedge against inflation and market volatility with a tangible asset. Investors looking into Gold IRA options in Wyoming will find these companies at the forefront of the industry, offering peace of mind and a strategic approach to securing their financial future.

Factors to Consider When Choosing a Gold IRA Company in Wyoming

When contemplating the integration of precious metals into your retirement portfolio through a Gold IRA in Wyoming, it’s imperative to conduct due diligence and select a reputable company. Factors such as the company’s track record, customer service quality, and the variety of gold products offered are crucial in determining the best fit for your investment needs. Opt for companies with a strong history and established reputation within Wyoming’s regulatory framework. A reliable Gold IRA company should provide transparent fee structures and clear guidance on compliance with Internal Revenue Service (IRS) regulations. Additionally, consider the level of security they offer for storage options, whether it’s through insured depositories or segregated accounts. It’s also beneficial to assess their expertise in precious metals and their ability to facilitate the rollover process from your existing retirement accounts seamlessly. By carefully evaluating these aspects with gold IRA companies operating in Wyoming, you can make an informed decision that aligns with your long-term financial objectives.

Wyoming’s Regulatory Framework for Gold IRA Investments

In Wyoming, a state known for its commitment to fiscal responsibility and economic freedom, the regulatory framework for Gold IRA investments is robust yet accommodating for investors. The state’s regulatory environment ensures that gold IRA companies operating within its borders adhere to stringent standards set forth by both state and federal laws. This includes the Wyoming Division of Banking overseeing financial entities, ensuring they maintain transparency and integrity in their operations. Gold IRA companies Wyoming-based are required to comply with the Employee Retirement Income Security Act (ERISA) regulations when managing individual retirement accounts, providing a level of protection for investors’ savings. The state’s pro-business stance is evident in its streamlined processes and supportive regulatory framework, making it an attractive location for gold IRA companies to establish their presence, offering investors a secure and compliant avenue to invest in precious metals as part of their retirement portfolio. Investors looking into Gold IRA investments in Wyoming can rest assured that the state’s regulations are designed to facilitate trustworthy practices and foster a market conducive to informed decision-making and financial security.

Comparative Analysis: Leading Gold IRA Companies in Wyoming

In the strategic location of Wyoming, a number of leading gold IRA companies have established their presence, each offering a distinct suite of services tailored to the needs of investors looking for a stable and diversified retirement portfolio. When evaluating these gold IRA companies in Wyoming, it’s crucial to consider factors such as the variety of precious metals available, the security of storage options, and the company’s reputation for customer service. Among the top contenders, GoldCo and Regal Assets stand out with their comprehensive approach to retirement planning. GoldCo, with its robust educational resources and personalized client support, has earned a reputation for guiding investors through the intricacies of self-directed IRAs. On the other hand, Regal Assets distinguishes itself with competitive pricing and additional perks like a free investment kit and a price match guarantee. These companies not only cater to Wyoming residents but also offer expertise in navigating the specific regulatory landscape that governs gold IRAs within the state. Investors interested in diversifying their retirement funds with physical gold, silver, platinum, or palladium will find these companies well-equipped to facilitate their investment goals. It’s advisable for potential investors to conduct a comparative analysis of GoldCo and Regal Assets, among others, considering their unique offerings and how they align with individual investment strategies and long-term financial objectives.

How to Set Up a Gold IRA with a Company Based in Wyoming

When considering the establishment of a Gold IRA, choosing a reputable company is paramount. Among the top contenders for this purpose, gold IRA companies in Wyoming stand out due to their favorable regulatory environment and strong reputation within the industry. To set up a Gold IRA with one of these Wyoming-based firms, you’ll need to follow a series of steps that ensure compliance with both federal and state regulations. The process typically begins with selecting a self-directed IRA custodian from among those approved to hold gold in an IRA. These custodians are adept at handling the unique requirements associated with Gold IRAs, including the necessary paperwork and adherence to Internal Revenue Service (IRS) guidelines. Once you’ve chosen a custodian, you’ll fund your new account through a rollover or transfer from an existing retirement plan, or by making a cash contribution if eligible.

After funding, you can proceed to invest in gold by purchasing IRS-approved gold coins, bars, or other precious metal products that meet the purity standards set forth in IRS Publication 590. Wyoming-based gold IRA companies often have established relationships with reputable dealers and refiners, facilitating the acquisition of these assets. It’s crucial to work closely with your chosen company’s representatives throughout this process to ensure that all transactions are transparent, compliant, and aligned with your retirement objectives. By setting up a Gold IRA with a Wyoming-based company, you gain access to their expertise and the benefits of their operational framework within one of the most gold-friendly states in the nation.

When considering a Gold IRA for retirement, discerning investors often turn to reputable companies based in states known for their favorable regulatory environments and strong support for precious metals investment. Wyoming stands out as a prime location, home to some of the leading gold IRA companies that offer robust services and security for investors’ future. This article has explored the role of Gold IRAs within diverse portfolios, identified top-performing firms in Wyoming, and outlined crucial considerations for selecting a reliable Gold IRA company. With Wyoming’s comprehensive regulatory framework safeguarding investments, individuals can confidently navigate the process of establishing a Gold IRA with ease. Prospective investors should take advantage of the insights provided to make informed decisions that align with their retirement planning goals.

Optimizing Retirement Savings: Top Gold IRA Companies in Wyoming and Key Considerations

Gold IRA investments offer a diversification strategy for retirement savings, providing protection against inflation and market fluctuations by allowing direct investment in physical gold, bars, and coins. Wyoming-based goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira firms are well-suited for this purpose, offering robust services including account setup, asset custody, and transaction oversight, all while adhering to IRS regulations. These companies are situated in a state with a favorable environment for precious metals investments, characterized by strong legal protections and financial privacy laws. Investors can benefit from Wyoming’s regulatory framework, which aligns federal standards with state statutes to ensure consumer protection and asset integrity within Gold IRAs. Top Wyoming Gold IRA companies like Birch Gold Group, Regal Assets, and Augusta Precious Metals provide a range of IRS-approved precious metals, educational resources, and personalized investment counseling. When choosing a Gold IRA company in Wyoming, it’s crucial to consider factors such as reputation, customer service quality, security and storage options, transparent fee structures, and the diversity of precious metals offerings to ensure a secure and beneficial addition to your retirement portfolio. Conduct thorough research to make an informed decision that leverages the advantages of investing in a Gold IRA through Wyoming’s reputable firms.

When envisioning a secure financial future, diversification often includes precious metals like gold. For residents of Wyoming, leveraging Gold IRAs can be a strategic move for retirement planning. This article delves into the top Gold IRA companies based in Wyoming, providing insights into the factors that make these firms stand out. We’ll explore the regulatory environment that governs these investments and offer a comparative analysis of leading Gold IRA companies within the state. With a focus on Augusta Precious Metal Guide, readers will be equipped to make informed decisions about their retirement portfolios.

- Understanding Gold IRAs and Their Role in Retirement Planning

- Top Gold IRA Companies Based in Wyoming

- Factors to Consider When Choosing a Gold IRA Company in Wyoming

- Regulatory Framework Governing Gold IRAs in Wyoming

- Benefits of Investing in Gold IRAs with Wyoming-Based Companies

- Comparative Analysis: Leading Gold IRA Companies in Wyoming

Understanding Gold IRAs and Their Role in Retirement Planning

Gold IRAs serve as a strategic component within the realm of retirement planning, offering investors a hedge against inflation and market volatility. These accounts are traditional Individual Retirement Accounts that allow for the investment in physical gold, gold bars, and gold coins, providing a diversified portfolio that can complement stocks and bonds. When considering a Gold IRA, it’s prudent to explore reputable companies with expertise in precious metals, such as those based in Wyoming—a state known for its favorable regulatory environment for such investments. Gold IRA companies operating in Wyoming often provide comprehensive services that include account setup, asset custody, and transaction management, ensuring compliance with Internal Revenue Service (IRS) regulations. By incorporating gold into an Individual Retirement Account, investors can potentially safeguard their retirement savings from currency devaluation and economic uncertainty, making it a thoughtful addition to a well-rounded retirement strategy. Choosing a company experienced in Gold IRAs is crucial, as they can guide you through the process, from initial rollover procedures to ongoing management of your gold assets.

Top Gold IRA Companies Based in Wyoming

When considering the top Gold IRA companies based in Wyoming, investors often look for a blend of security, reliability, and exceptional service. Wyoming stands out as a favorable location for these entities due to its robust legal framework and commitment to financial privacy. Among the reputable firms operating within this state are those that have established themselves as leaders in the precious metals IRA industry. These companies offer a range of services including asset diversification with gold, silver, platinum, and palladium, as well as guidance through the process of rolling over existing retirement accounts into Gold IRAs. With Wyoming’s strong regulatory environment and these firms’ adherence to high standards, investors can trust that their investments are safeguarded and managed with expertise. The state’s strategic location and infrastructure also support efficient handling of transactions and secure storage options for the physical metals, making it an ideal place for gold IRA companies to thrive and serve clients effectively. Investors looking for Gold IRA companies in Wyoming have access to a select group of firms that are well-versed in navigating the unique aspects of investing in precious metals within a self-directed retirement account framework.

Factors to Consider When Choosing a Gold IRA Company in Wyoming

When exploring gold IRA companies in Wyoming, it’s crucial to conduct thorough research to ensure your investment aligns with your financial goals and risk tolerance. One of the primary factors to consider is the company’s reputation; look for firms with a proven track record in the state, as Wyoming-based companies may have specific knowledge of state regulations and tax laws that can benefit IRA investors. Additionally, examine the range of precious metals they offer. A reputable gold IRA company should provide a diverse selection of approved assets by the Internal Revenue Service (IRS), such as American Gold Eagles, Canadian Gold Maple Leafs, and other IRS-approved bullion and coins.

Another important aspect is the level of customer service and support. Since managing a Gold IRA involves ongoing transactions, you’ll want a company that offers transparent, accessible customer care to guide you through the process. This includes assistance with account setups, rollovers from existing retirement accounts, and purchasing and storing precious metals. Also, consider the security measures and storage options provided by the company. Wyoming has favorable conditions for secure storage facilities, so choose a company that partners with insured and compliant depositories within the state to safeguard your investments. Lastly, review their fee structure; understanding all associated costs, from setup fees to annual maintenance charges, will help you make an informed decision. Opting for a Gold IRA company in Wyoming can be a strategic choice, but ensure that the company you select adheres to high standards of service and compliance to safeguard your retirement savings.

Regulatory Framework Governing Gold IRAs in Wyoming

In Wyoming, the regulatory framework governing Gold IRAs is robust and comprehensive, ensuring that investors can trust their financial decisions within a secure legal environment. The state’s regulations are aligned with federal guidelines provided by the Internal Revenue Service (IRS), which dictates the types of assets eligible for Individual Retirement Accounts (IRAs). Wyoming Statutes Title 31 establishes the framework for retirement and trust accounts, including specific provisions for self-directed IRAs that allow for investment in precious metals like gold. These statutes require that Gold IRA companies operating within Wyoming adhere to strict standards for asset custody, transaction reporting, and consumer protection. The Wyoming Department of State Treasurer oversees these regulations, ensuring that investors’ interests are safeguarded. Additionally, the U.S. Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) provide oversight for aspects of Gold IRA transactions to prevent fraudulent activities and promote market integrity. Investors in Wyoming can confidently choose from a variety of reputable Gold IRA companies, knowing that their investments are governed by a comprehensive regulatory framework designed to protect their savings and ensure the authenticity and security of their gold holdings.

Benefits of Investing in Gold IRAs with Wyoming-Based Companies

Incorporating gold into your Individual Retirement Account (IRA) through Wyoming-based companies offers a multitude of advantages for investors looking to diversify their retirement portfolios. These firms specialize in self-directed IRAs with a focus on precious metals, providing clients with the opportunity to invest in physical gold, silver, platinum, and palladium within a tax-advantaged framework. Wyoming’s regulatory environment is particularly conducive to gold IRA investments, with robust legal protections for asset custody and clear guidelines that ensure transparency and security in transactions. Investors benefit from the state’s pro-business stance and its reputation for financial privacy. Moreover, Wyoming-based companies often have access to high-quality precious metals, ensuring that investors can acquire genuine, investment-grade bullion and coins. This not only hedges against inflation and market volatility but also serves as a tangible asset that can act as a financial safety net during economic uncertainty.

Choosing a Wyoming-based company for your gold IRA investment means leveraging the expertise of firms well-versed in the intricacies of precious metals investing. These companies typically offer personalized services, guiding investors through each step of the process, from account setup to acquisition and storage of gold assets. With a strong commitment to customer education and satisfaction, Wyoming’s gold IRA companies stand out for their dedication to client success. Investors can rest assured that their retirement savings are managed with a high level of professionalism and integrity in one of the most stable and business-friendly states in the nation.

Comparative Analysis: Leading Gold IRA Companies in Wyoming

When considering a Gold IRA in Wyoming, investors are presented with a selection of reputable companies that offer these investment services. A comparative analysis of leading Gold IRA companies operating within the state reveals that these firms vary in their approach to customer service, investment options, and fees. For instance, one may find companies like Birch Gold Group and Regal Assets particularly well-regarded for their comprehensive suite of gold and precious metals IRAs tailored to Wyoming residents. These companies excel at guiding clients through the process of rolling over traditional retirement accounts into a self-directed IRA that allows for investment in physical gold, silver, platinum, and palladium coins and bars that meet the IRS’s stringent standards. Another notable company, Augusta Precious Metals, is known for its educational resources and personalized approach to investment strategy, which can be particularly valuable for those new to Gold IRAs. Each of these companies has its own set of advantages, with factors such as customer reviews, the range of precious metals available, and the level of customer support playing a significant role in their standings. Investors looking into Gold IRA companies in Wyoming should weigh these aspects carefully to make an informed decision that aligns with their financial goals and retirement planning needs. It’s important for potential investors to conduct thorough research and consider factors such as the company’s reputation, customer feedback, and the types of precious metals they offer, as well as the associated costs and storage solutions. This due diligence is crucial in navigating the Gold IRA landscape in Wyoming and choosing a company that provides both security for your investment and growth potential for your retirement savings.

When considering a Gold IRA for retirement savings, discerning investors often look to Wyoming’s esteemed gold IRA companies for their expertise and robust services. With a comprehensive understanding of the benefits and regulatory landscape specific to this state, individuals can make informed decisions that align with their long-term financial goals. The top-tier firms based in Wyoming, as outlined in this article, offer competitive advantages, from exceptional customer service to secure investment opportunities. As such, those seeking a reliable partner in their retirement planning should seriously consider the gold IRA companies in Wyoming, where a blend of experience and regulatory compliance creates a favorable environment for precious metals investment. The information provided here serves as a valuable resource for anyone looking to diversify their portfolio with physical gold, silver, and other precious metals through a self-directed IRA account.

Optimizing Retirement with Top-Rated Gold IRA Companies in Wyoming

Investors in Wyoming have a selection of top-rated goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira companies that excel in managing self-directed IRAs with tangible assets like gold, silver, platinum, and palladium. These companies are regulated under Wyoming’s robust legal framework, which offers advantageous tax benefits and stringent privacy protections. They provide a secure and compliant environment for precious metals investment, with a focus on client security, transparency, and personalized services. Wyoming’s progressive trust laws and commitment to financial privacy enhance the appeal of these companies, making them an attractive option for those looking to diversify their retirement portfolios with gold and other metals. Investors should evaluate Gold IRA providers based on their reputation, customer service, educational resources, compliance with IRS regulations, and the variety of precious metals they offer. The state’s strategic location in terms of regulatory clarity and tax-favorable conditions positions these companies as a superior choice for investors aiming to secure and grow their retirement savings with precious metals.

Exploring the robust landscape of retirement savings, this article sheds light on the premier gold IRA companies in Wyoming, recognized for their high ratings and exceptional service. We delve into the nuances of these financial institutions, providing insights that cater to individuals seeking a reliable and diversified investment strategy. From understanding the specific advantages of opting for a Wyoming-based provider to navigating the state’s unique regulatory environment, this comprehensive guide is designed to empower readers with the knowledge needed to make informed decisions regarding their gold IRA options. Join us as we explore Augusta Precious Metals gold in Wyoming and the benefits they offer.

- Understanding Gold IRA Companies in Wyoming: A Comprehensive Overview

- Top-Rated Gold IRA Companies Headquartered in Wyoming

- The Benefits of Choosing a Wyoming-Based Gold IRA Provider

- Comparing the Best Gold IRA Services Available in Wyoming

- Navigating Regulations: Wyoming’s Stance on Gold IRAs

- Expert Insights: Selecting a Reliable Gold IRA Company in Wyoming

Understanding Gold IRA Companies in Wyoming: A Comprehensive Overview

In Wyoming, gold IRA companies offer investors a unique opportunity to diversify their retirement portfolios with physical gold and other precious metals. These firms specialize in facilitating self-directed Individual Retirement Accounts that allow for the investment in tangible assets as part of one’s retirement savings strategy. The Equality State, known for its favorable tax environment and robust financial services sector, provides a conducive legal framework for gold IRA companies to thrive. Investors often choose Wyoming-based gold IRA firms due to the state’s reputation for financial privacy and security, underpinned by its progressive trust laws. These companies adhere to strict regulatory standards, ensuring that they operate transparently while providing clients with a range of precious metal options, including gold bullion, coins, bars, silver, platinum, and palladium. By partnering with Wyoming’s gold IRA companies, investors can capitalize on the long-term stability of gold as a hedge against inflation and market volatility, all within the framework of a regulated retirement savings plan.

When considering a gold IRA in Wyoming, it is crucial to evaluate the reputation, customer service, and range of services offered by each company. The best gold IRA companies in Wyoming stand out for their expertise, competitive pricing, and comprehensive approach to client education. They provide valuable resources that help investors understand the nuances of investing in precious metals within an IRA, ensuring compliance with IRS regulations. Furthermore, these firms offer personalized services tailored to individual investment goals and risk tolerance, guiding clients through the process of setting up and managing their gold IRAs effectively. Investors looking for a reliable and transparent way to invest in gold through a retirement account would benefit from considering Wyoming’s gold IRA companies, which are renowned for their high ratings and dedication to client satisfaction.

Top-Rated Gold IRA Companies Headquartered in Wyoming

When exploring top-rated Gold IRA companies, investors often consider those headquartered in Wyoming for their strong regulatory framework and favorable tax environment. This region is home to several reputable firms that specialize in precious metals IRAs, offering services that cater to a variety of investment strategies. Among these, gold IRA companies from Wyoming stand out for their commitment to client security and transparency. They adhere to strict industry standards and often provide a range of precious metal options, including gold, silver, platinum, and palladium. These firms ensure that their clients’ investments are held in custody by an independent depository, adding an additional layer of security to the assets under management. With Wyoming-based gold IRA companies, investors benefit from personalized service and expert advice tailored to their financial goals and risk tolerance. The state’s deep commitment to privacy laws also ensures that clients’ information is protected with the utmost confidentiality. For those looking for a secure and compliant investment vehicle, Wyoming’s gold IRA companies represent an excellent choice for safeguarding and diversifying retirement portfolios with precious metals.

The Benefits of Choosing a Wyoming-Based Gold IRA Provider

When considering a Gold IRA, selecting a reputable provider is paramount for safeguarding your retirement savings with precious metals. Among the states offering favorable conditions for such investments, Wyoming-based gold IRA companies stand out due to their strategic location and regulatory framework that favors security and asset protection. Wyoming’s legal landscape provides a robust platform for these entities, ensuring compliance with stringent standards while offering investors a secure environment for their gold investments. Furthermore, the state’s tax policies are conducive to the growth of these companies, as they often do not impose income tax on dividends or capital gains, which can translate into potential savings and benefits for investors. By choosing a Wyoming-based Gold IRA provider, individuals gain access to a stable jurisdiction with a reputation for financial privacy and security, making it an attractive option for those looking to diversify their retirement portfolios with gold and other precious metals. The combination of regulatory certainty, favorable tax conditions, and a commitment to top-tier service makes Wyoming gold IRA companies a compelling choice for discerning investors.

Comparing the Best Gold IRA Services Available in Wyoming

When considering a Gold IRA in Wyoming, investors have access to a variety of reputable gold IRA companies that stand out for their high ratings and exceptional services. These firms not only comply with the stringent regulations set forth by both federal and state governments but also offer competitive rates and a selection of precious metals to choose from. Among the top-rated gold IRA companies serving Wyoming, investors will find robust options that cater to a range of investment strategies and financial goals. These companies excel in providing educational resources, personalized customer service, and secure storage solutions tailored to meet the needs of those looking to diversify their retirement portfolios with physical gold, silver, platinum, and palladium.

Selecting the best Gold IRA company in Wyoming involves a careful comparison of services, fees, and the types of precious metals available. Companies like Goldco, Noble Gold, and Birch Gold are frequently highlighted for their excellent customer service, transparent fee structures, and vast inventory of IRS-approved precious metals. Each firm offers unique advantages, whether it be competitive pricing, a user-friendly online platform, or exceptional expertise in self-directed IRAs. Investors in Wyoming can benefit from the expertise of these companies to navigate the complexities of investing in precious metals within their retirement accounts, ensuring a secure and diversified financial future.

Navigating Regulations: Wyoming’s Stance on Gold IRAs

In the realm of retirement savings, Gold IRA Companies operating in Wyoming stand out due to the state’s favorable regulatory environment. Wyoming’s legislature has established a legal framework that supports the use of physical gold and other precious metals within self-directed Individual Retirement Accounts (IRAs), allowing for diversification beyond traditional financial instruments. This supportive stance is underscored by legislation that provides clarity and security for investors looking to include these assets in their retirement portfolios. The state’s regulations are designed to protect consumers while facilitating the transactional aspects of investing in gold, ensuring that Gold IRA Companies adhere to strict standards. As a result, Wyoming has emerged as a preferred location for those seeking to invest in gold IRAs, with a number of reputable companies offering services tailored to the unique needs of these investors. The combination of clear regulations and the presence of well-rated Gold IRA Companies in Wyoming makes it an attractive destination for individuals looking to incorporate gold into their retirement strategies. Investors are encouraged to conduct thorough due diligence and select companies with a proven track record, robust security measures, and transparent operations when considering a Gold IRA in Wyoming.

Expert Insights: Selecting a Reliable Gold IRA Company in Wyoming

In the pursuit of a secure and diversified investment portfolio, Wyoming residents increasingly turn to Gold IRA Companies as a means to hedge against market volatility. Expert insights emphasize the importance of selecting a reputable entity when considering a Gold IRA in Wyoming. The Equality State’s favorable tax environment and its stance on financial privacy make it an attractive location for such investments. Prospective investors should look for companies with a proven track record, high customer satisfaction ratings, and transparent fee structures. In Wyoming, where the landscape of investment options can be as vast as its landscapes, Gold IRA Companies with high ratings stand out. These firms not only offer the precious metals necessary to comply with IRS guidelines for a Gold IRA but also provide robust customer service and education on the benefits of gold as an asset class within retirement planning. For Wyoming residents, it is crucial to align with a Gold IRA Company that navigates the unique regulatory considerations of the state while ensuring compliance with federal regulations regarding self-directed IRAs. This due diligence can lead to peace of mind and confidence in one’s financial future. When evaluating Gold IRA Companies Wyoming, investors should scrutinize the company’s history, customer feedback, and the variety of precious metals they offer, ensuring that their choice aligns with both short-term goals and long-term investment strategies.

When considering the prudent diversification of retirement savings, individuals often explore options like a Gold IRA. Wyoming stands out as a favorable jurisdiction for such investments, home to several esteemed Gold IRA companies. This article has delved into the intricacies of these financial instruments, highlighting top-rated providers in the Cowboy State and the unique advantages they offer. The benefits of aligning with a Wyoming-based Gold IRA service are manifold, from regulatory clarity to exceptional service quality. Prospective investors can confidently evaluate their options, armed with expert insights and a clear understanding of the local market dynamics. Ultimately, a Gold IRA in Wyoming represents a sound investment strategy for those looking to safeguard their financial future against inflation and market volatility.

Navigating Gold IRA Options in Wyoming: Top-Rated Companies & Investment Insights

In Wyoming, residents have access to reputable goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira companies that offer diversification of investments with precious metals like gold, silver, platinum, and palladium. These firms assist with compliance for Individual Retirement Accounts under IRS regulations while emphasizing financial privacy and asset protection. With a focus on tailored services, customer support, and secure storage solutions, companies such as Noble Bullion and American Hartford Gold cater to Wyoming’s investment landscape, which values financial independence and resource management. Investors should scrutinize fee structures and compare service offerings to ensure their choice aligns with their retirement planning goals, considering the state’s advantageous tax policies and stringent regulatory environment for Gold IRA investments. The state’s legal framework ensures a secure investment process, making Wyoming an attractive location for those looking to safeguard their savings against economic uncertainties. Personal testimonials from residents attest to the security, reliability, and financial reassurance provided by these Gold IRA companies, underscoring the importance of including physical gold in retirement portfolios as a hedge against inflation and market volatility.

Exploring the prudent avenues for retirement savings, gold IRAs have emerged as a beacon of stability and diversification for investors in Wyoming. This article delves into the significance of these accounts, highlighting top-rated gold IRA companies within the Cowboy State’s robust financial ecosystem. We dissect the varying fee structures to aid informed decision-making and navigate Wyoming’s regulatory framework governing these investments. By examining client testimonials and case studies from local gold IRA holders, potential investors can discern which firms stand out in service and performance. Join us as we traverse the landscape of Augusta Precious Metal silver in Wyoming to help you secure your financial future.

- Understanding Gold IRAs and Their Significance in Wyoming

- The Top-Rated Gold IRA Companies in Wyoming

- Comparing Fees: Cost Structures of Gold IRA Companies in the Cowboy State

- Wyoming’s Regulatory Framework for Gold IRA Investments

- How to Choose the Best Gold IRA Company for Wyoming Residents

- Client Testimonials and Case Studies: Real Stories from Wyoming Gold IRA Holders

Understanding Gold IRAs and Their Significance in Wyoming

Incorporating a Gold IRA into one’s retirement portfolio can be a strategic financial move, especially for residents of Wyoming who are looking to diversify their investments and hedge against inflation and market volatility. Gold IRAs offer a tangible asset within an Individual Retirement Account that can appreciate over time, providing a security blanket against economic uncertainties. The significance of these accounts is magnified in states like Wyoming, which often boast favorable tax environments and a strong respect for individual financial sovereignty. Investors in this region may find that including physical gold, silver, platinum, and palladium in their IRAs can complement their investment strategy, particularly when paired with traditional stocks, bonds, and mutual funds.

Wyoming’s strategic location and regulatory framework make it a conducive environment for Gold IRA companies to thrive. These companies specialize in facilitating the setup and management of Gold IRAs, guiding investors through the process of acquiring precious metals that meet IRS standards for inclusion in an IRA. By partnering with reputable gold IRA companies Wyoming residents can navigate the specific rules and regulations governing these accounts, ensuring compliance while taking advantage of the benefits of owning gold as part of their retirement savings. With a selection of Gold IRA companies Wyoming investors have access to a range of services, from initial account setup to ongoing management and diversification options, all within a jurisdiction that supports financial privacy and asset protection.

The Top-Rated Gold IRA Companies in Wyoming

When considering a Gold IRA in Wyoming, investors have access to some of the top-rated gold IRA companies that cater to the state’s residents. These firms are renowned for their exceptional service, robust security measures, and transparent fee structures. Noble Bullion, for instance, stands out with its comprehensive suite of services, including precious metals IRA accounts, storage solutions, and expert advice tailored to Wyoming’s investment landscape. Another key player in the region is American Hartford Gold, which offers a user-friendly platform and personalized support to help individuals navigate the process of diversifying their retirement portfolios with gold and other precious metals. Both companies are well-versed in the regulations governing self-directed IRAs and are committed to helping clients make informed decisions that align with their financial goals. When selecting a Gold IRA company in Wyoming, it’s important to evaluate their reputation, customer service, range of services, and the security of their storage options to ensure a reliable and compliant investment experience.

Comparing Fees: Cost Structures of Gold IRA Companies in the Cowboy State

In Wyoming, where prudent financial planning often aligns with the state’s emphasis on independence and resource management, gold IRA companies play a significant role in investors’ portfolios. When considering a gold IRA as part of a diversified investment strategy within the Cowboy State, it’s crucial to compare the fee structures of these gold IRA companies. These fees can significantly impact the long-term value of your retirement savings. Typically, costs associated with gold IRAs in Wyoming encompass an array of charges, including setup fees, annual maintenance fees, custodian fees, and transaction fees for purchasing and selling precious metals. Some companies may offer competitive rates on storage or have lower buy/sell spreads; others might charge higher all-in costs but provide additional services or more personalized advice. Investors in Wyoming should scrutinize the fee schedules of gold IRA companies, as these can vary widely and affect both initial investment outlay and long-term asset growth. By carefully evaluating each company’s fee structure, Wyoming residents can make informed decisions that align with their financial goals and risk tolerance when incorporating physical gold or other precious metals into their retirement accounts.

Wyoming’s Regulatory Framework for Gold IRA Investments

Wyoming’s regulatory environment for Gold IRA investments is characterized by a robust and transparent framework that positions it as a favorable locale for gold IRA companies operating within its borders. The state’s regulatory bodies, such as the Wyoming Division of Banking and the Department of Revenue, oversee the operations of these entities to ensure compliance with state laws, including those pertaining to precious metals investments. This oversight includes strict guidelines on the storage, handling, and transactional processes associated with Gold IRA investments, providing investors with a level of security and confidence in their transactions. Wyoming’s gold IRA companies are required to adhere to specific standards that ensure the integrity and transparency of investment products. These stringent regulations not only protect investors but also uphold the state’s reputation as a secure and reliable jurisdiction for precious metals investments, thereby attracting reputable gold IRA companies Wyoming to establish their operations there. Investors considering Gold IRAs in Wyoming can take solace in the knowledge that their investments are governed by a comprehensive regulatory framework designed to safeguard their assets and promote fair market practices.

How to Choose the Best Gold IRA Company for Wyoming Residents

When exploring the best Gold IRA companies for Wyoming residents, it’s crucial to consider factors that align with your financial goals and the regulatory framework governing retirement accounts within the state. Wyoming, known for its favorable tax environment and robust financial laws, presents a conducive setting for individuals interested in diversifying their retirement portfolios with precious metals. To select a reputable Gold IRA company from the myriad of options available to Wyomingites, start by researching firms that specialize in gold IRAs and have a strong presence in the region. Look for companies with a proven track record of client satisfaction, transparent fee structures, and a comprehensive selection of precious metals. Additionally, ensure that the Gold IRA company is well-versed in the specific legalities pertinent to Wyoming residents, such as tax implications and reporting requirements. It’s also advisable to choose a company that provides educational resources on gold investment strategies, market trends, and the benefits of including physical gold in your retirement savings. By carefully vetting Gold IRA companies for their expertise in serving Wyoming clients, you can make an informed decision that aligns with your long-term financial objectives. Remember to compare the services offered, such as rollover assistance, account management, and secure storage options, to identify a company that stands out for its customer care and commitment to facilitating a reliable and efficient Gold IRA experience.

Client Testimonials and Case Studies: Real Stories from Wyoming Gold IRA Holders

Wyoming’s reputation as a stronghold for gold IRA investments is bolstered by the experiences and insights of its residents who have entrusted their savings with reputable gold IRA companies. These individuals, hailing from various walks of life, have shared their journeys and the outcomes of their decisions to invest in precious metals through Individual Retirement Accounts. Their testimonials paint a vivid picture of security, reliability, and satisfaction with the services rendered by top-tier gold IRA companies in Wyoming. One such story recounts a local rancher who, after years of hard work, sought a retirement plan that could weather economic fluctuations. Choosing a well-regarded gold IRA company from Wyoming, he found solace in the tangible asset backing his retirement savings and the transparency of transactions. Another case study involves a retiree who was wary of market volatility and paper assets; she opted for a gold IRA as a hedge against inflation and currency devaluation. Her experience with a Wyoming-based firm has been one of empowerment, as she now feels confident in the long-term value and stability of her investment portfolio. These real stories from Wyoming gold IRA holders serve as testaments to the effectiveness of these investments and the reliability of the companies that facilitate them.

When considering a Gold IRA in Wyoming, investors are well-served by understanding the landscape of the most reputable gold IRA companies operating within the state. This article has delved into the significance of Gold IRAs and provided an informed analysis of the top-rated options available to residents, highlighting key considerations such as fee structures and the local regulatory environment. With Wyoming’s favorable stance on precious metals and its robust framework for investment protection, investors can approach gold IRA investments with confidence. By comparing the offerings of these companies and considering the experiences shared by fellow Wyomingites, prospective investors have a clearer path to making an informed decision. Ultimately, the best Gold IRA company for Wyoming residents aligns with their individual financial goals and provides a secure and transparent investment experience.

Optimizing Retirement Savings: Top Wyoming Gold IRA Companies and Investment Insights

Investing in a Gold IRA through Wyoming’s reputable firms offers a diversified approach to retirement savings by incorporating physical gold, silver, platinum, and palladium. These precious metals can act as a buffer against inflationary pressures and market volatility, particularly in economically uncertain times. Wyoming stands out for its investor-centric regulatory environment that ensures security and transparency within the Gold IRA industry. Top firms like Wyoming Gold & Precious Metals and American Hartford Gold provide comprehensive services with a focus on transparency and adherence to IRS regulations, offering investors a range of precious metals to diversify their retirement portfolios. The state’s Division of Banking closely monitors these companies to maintain market stability and investor confidence. For those looking for a trustworthy Gold IRA company in Wyoming, it’s essential to select one with a strong reputation for compliance, customer service, and personalized attention. The process involves opening a self-directed IRA account, funding it via a rollover from an existing retirement plan, and selecting from a variety of IRS-compliant gold products for secure storage until retirement. Opting for a Gold IRA with a Wyoming provider can be a strategic move to enhance the robustness and stability of your financial strategy in the long term.

Investing in a Gold IRA can be a strategic move for a diversified and secure retirement portfolio. For those considering this precious metal investment, understanding the role of Gold IRAs is crucial. Among the states, Wyoming stands out as a hub for reputable augusta precious metal gold ira companies, offering investors a range of benefits and robust regulatory protections. This article delves into the top-rated Gold IRA firms based in Wyoming, exploring what sets them apart from competitors. We will examine Wyoming’s favorable regulatory framework, compare services across the industry, and outline the steps to set up a Gold IRA with a Wyoming-based provider. Discover how these companies can enhance your retirement savings with the security and growth potential of gold.

- Understanding Gold IRAs and Their Role in Diverse Portfolios

- Top-Rated Gold IRA Companies Based in Wyoming

- A Closer Look at Wyoming’s Regulatory Framework for Gold IRA Investments

- Comparing Services: What Sets Wyoming’s Gold IRA Firms Apart?

- The Benefits of Choosing a Wyoming-Based Gold IRA Provider

- Steps to Set Up a Gold IRA with a Company Headquartered in Wyoming

Understanding Gold IRAs and Their Role in Diverse Portfolios

Investing in a Gold IRA can be a strategic move for individuals looking to diversify their retirement portfolios. Unlike traditional IRAs that invest primarily in stocks, bonds, and mutual funds, a Gold IRA allows for the inclusion of physical gold, silver, platinum, and palladium as part of an individual’s retirement savings. These precious metals can serve as a hedge against inflation and market volatility, providing a potential safeguard for your financial future. The leading goldiracompanies substack gold ira companies in Wyoming offer a range of services from account setup to secure storage options for these tangible assets. They guide investors through the process of allocating a portion of their retirement funds into these valuable metals, ensuring compliance with IRS regulations. This diversification can be particularly advantageous in a financial landscape characterized by economic uncertainties and currency devaluation risks, making Gold IRAs a prudent consideration for a robust retirement strategy. Investors interested in such investment vehicles should consider the expertise and reputable services provided by Wyoming’s Gold IRA companies, which have established themselves as authorities in this niche market. These firms prioritize security, transparency, and customer education to help investors make informed decisions that align with their long-term financial goals.

Top-Rated Gold IRA Companies Based in Wyoming

When considering the top-rated Gold IRA companies based in Wyoming, investors often look for firms with a strong reputation for security and customer service. Among these, Wyoming Gold & Precious Metals stands out as a leader. This company not only offers a robust selection of gold and precious metal IRAs but also prides itself on its commitment to transparency and compliance with IRS regulations. Clients appreciate the firm’s meticulous approach to account management, ensuring that their investments are handled with the utmost care and diligence.

Another prominent Gold IRA company from Wyoming is American Hartford Gold. They provide a user-friendly platform for investors to diversify their retirement portfolios with physical gold, silver, platinum, and palladium. Their expertise in precious metals combined with a client-centric approach has earned them a reputation as a reliable and trusted partner for those looking to invest in gold IRAs. Both Wyoming Gold & Precious Metals and American Hartford Gold exemplify the high standards of service and professionalism that define the best Gold IRA companies based in Wyoming, catering to investors who seek stability and growth potential through precious metals within their retirement strategies.

A Closer Look at Wyoming’s Regulatory Framework for Gold IRA Investments

Wyoming’s regulatory framework for Gold IRA investments is distinguished for its robust and investor-friendly approach, making it an attractive jurisdiction for those seeking to diversify their retirement portfolios with precious metals. The state’s regulations are designed to provide clear guidelines for gold IRA companies operating within its borders, ensuring a level of transparency and accountability that is conducive to both market stability and investor confidence. Wyoming’s legislative environment is particularly favorable, with laws that facilitate the allocation of retirement funds into physical gold, silver, platinum, and palladium. This regulatory structure not only safeguards investors but also encourages gold IRA companies to establish a presence in the state, thereby fostering a competitive marketplace where consumers can choose from a variety of reputable service providers. The state’s Division of Banking oversees these entities, ensuring compliance with federal and state laws, including those that govern the storage and handling of precious metals. Investors in Wyoming can thus trust that their Gold IRA investments are regulated by a comprehensive framework designed to protect their financial interests while providing access to one of the most liquid and secure markets for gold IRAs.

Comparing Services: What Sets Wyoming’s Gold IRA Firms Apart?

In the realm of retirement planning, Wyoming’s gold IRA firms have carved out a distinct niche within the gold ira companies landscape. These firms are distinguished not only by their offering of physical gold and other precious metals as part of individual retirement accounts but also by their tailored services that cater to investors seeking diversification beyond traditional paper assets. Unlike many national gold IRA companies, Wyoming-based entities often provide a more personalized approach, with customer service that emphasizes direct communication and local expertise. This localized attention can be particularly advantageous for clients who prefer a more hands-on relationship with their investment firm, ensuring their retirement savings are managed with a level of care and understanding that aligns with the unique aspects of investing in precious metals. Moreover, these firms frequently highlight their compliance with state and federal regulations, offering peace of mind to clients concerned about legal and tax implications associated with gold IRAs. This commitment to regulatory adherence, coupled with their robust selection of precious metal options, positions Wyoming’s gold IRA firms as a standout choice for those looking to secure their financial future with tangible assets.

The Benefits of Choosing a Wyoming-Based Gold IRA Provider

When considering a Gold IRA for retirement, opting for a Wyoming-based provider offers distinct advantages that can significantly enhance your investment strategy. Wyoming, known for its favorable economic climate and robust legal framework for precious metals investments, stands out as an ideal location for gold IRA companies to operate. For investors, this means greater security and regulatory certainty, as the state’s laws are conducive to protecting assets within retirement accounts. Additionally, Wyoming’s proximity to significant gold mining operations allows these providers to potentially offer competitive pricing and direct access to a wide array of investment-grade bullion and coins. The state’s reputation for privacy and asset protection further underscores its appeal, as investors can enjoy peace of mind knowing their retirement savings are safeguarded within a jurisdiction that respects individual rights and financial autonomy. Choosing a Wyoming-based gold IRA company like Gold IRA Companies Wyoming could be a strategic decision for those looking to diversify their retirement portfolio with physical gold and other precious metals, leveraging the state’s infrastructure and legal advantages to secure their financial future.

Steps to Set Up a Gold IRA with a Company Headquartered in Wyoming

When considering a Gold IRA for retirement, selecting a reputable company is paramount. Among the top choices for investors looking to diversify their portfolios with physical gold and other precious metals, companies headquartered in Wyoming stand out due to their favorable regulatory environment and strong financial infrastructure. To set up a Gold IRA with a company based in Wyoming, follow these steps:

Initiate the process by researching and selecting a reliable Gold IRA provider from Wyoming that aligns with your investment goals and has a track record of transparency and customer satisfaction. Once you’ve chosen your Gold IRA company, contact them directly to express your interest and gather initial information. They will guide you through their account opening process, which typically involves completing an application form online or via mail. Be prepared to provide personal identification, proof of address, and other necessary documentation to comply with Know Your Customer (KYC) regulations.

After submitting the application, the company will set up a self-directed IRA in your name. At this juncture, you’ll need to fund your new IRA account by rolling over or transferring funds from an existing retirement account, such as a 401(k) or traditional IRA, while ensuring compliance with IRS rules and regulations regarding tax-deferred or tax-free transfers. The Gold IRA company will provide you with the necessary forms to initiate this rollover process.

Once your account is funded, you can proceed to select the types of precious metals you wish to include in your Gold IRA. Wyoming companies often offer a diverse range of gold products compliant with IRS standards, including American Gold Eagles, Canadian Gold Maple Leafs, and various other gold bullion coins and bars. The company will arrange for the purchase and secure storage of these metals in an IRS-approved depository until your retirement, ensuring your investment is both safe and accessible when you are ready to make withdrawals. Throughout this process, customer service representatives from the Wyoming Gold IRA company will assist you with any questions or concerns, making sure your investment journey is smooth and informed.

In conclusion, exploring the landscape of Gold IRA investments, particularly those based in Wyoming, offers investors a unique opportunity to diversify their retirement portfolios with physical gold. Wyoming’s Gold IRA companies stand out for their robust services and adherence to stringent regulatory standards, ensuring peace of mind for clients. The state’s favorable environment for precious metals investment is reflected in the top-rated firms operating within its borders. By choosing a Wyoming-based provider, individuals can benefit from a blend of regulatory clarity and exceptional service offerings that set these companies apart. For those considering adding gold to their IRA, understanding the local framework and comparing services are pivotal steps towards making an informed decision. Ultimately, with careful consideration and due diligence, investors can leverage Gold IRA companies in Wyoming to enhance their retirement savings with a tangible asset that has withstood the test of time.

Optimizing Retirement Savings: Top-Rated Gold IRA Companies in Wyoming

In Wyoming, residents considering diversifying their retirement savings with a goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira can leverage local gold IRA companies that specialize in investment in physical gold, silver, platinum, and palladium, all compliant with IRS standards. These companies offer secure storage solutions, personalized service, and guidance through the process of incorporating precious metals into retirement portfolios within Wyoming's economic landscape, which is characterized by advantageous tax laws and a secure regulatory environment. Notably, GoldCo and Augusta Precious Metals are among the top-performing gold IRA companies in Wyoming, renowned for their exceptional customer service, competitive pricing, clear fee structures, and extensive educational resources. They ensure compliance with both federal and state regulations, including IRS purity standards for gold holdings, and operate within Wyoming's business-friendly climate. These firms are equipped to assist investors with account establishment and diversification planning, offering a robust investment opportunity that hedges against inflation and market volatility, with gold often acting as a safe-haven during economic instability. Prospective investors should carefully evaluate these companies based on their reputation, client feedback, the range of precious metals available, and secure storage options to make an informed decision that aligns with their retirement planning objectives in Wyoming.

Investing in a Gold IRA can be a strategic move for securing your financial future, particularly for residents of investment-savvy states like Wyoming. This article delves into the top-rated Gold IRA companies operating within Wyoming’s borders, providing a clear understanding of their offerings and the benefits they bring to your retirement portfolio. We explore Gold Investment Rules and Regulations specific to the Cowboy State, enabling you to navigate this niche market with confidence. By comparing services from leading Gold IRA firms and offering insights into choosing the best provider, coupled with real-life client testimonials and case studies, this guide aims to empower Wyomingites to make informed decisions for their retirement planning with gold IRAs.

- Understanding Gold IRAs and Their Benefits for Wyoming Residents

- Top-Rated Gold IRA Companies Operating in Wyoming

- A Comprehensive Guide to Gold Investment Rules and Regulations in Wyoming

- Comparing the Services and Offerings of Leading Gold IRA Companies in Wyoming

- How to Choose the Best Gold IRA Company for Your Retirement Planning in Wyoming

- Client Testimonials and Case Studies: Real Experiences with Gold IRA Companies Based in Wyoming

Understanding Gold IRAs and Their Benefits for Wyoming Residents