Discover the enduring allure of precious metals in retirement planning through a Precious Metals IRA. This financial instrument offers investors a unique avenue to diversify their retirement portfolios with tangible assets like gold, silver, platinum, and palladium. Our comprehensive guide delves into the intricacies of incorporating these metals into your IRA, covering eligibility criteria, contribution limits, and the allowed types of precious metals. We also explore effective strategies for integrating these time-tested assets to safeguard and enhance your retirement savings against market volatility. Whether you’re a seasoned investor or new to the concept, this article will provide valuable insights into leveraging precious metals in your IRA for a more resilient financial future.

- Understanding Precious Metals IRA Investment

- Top Precious Metals IRA Companies

- Eligibility and Contribution Limits for Precious Metals IRAs

- Types of Precious Metals Allowed in an IRA

- Strategies for Incorporating Precious Metals into Your Retirement Portfolio

Understanding Precious Metals IRA Investment

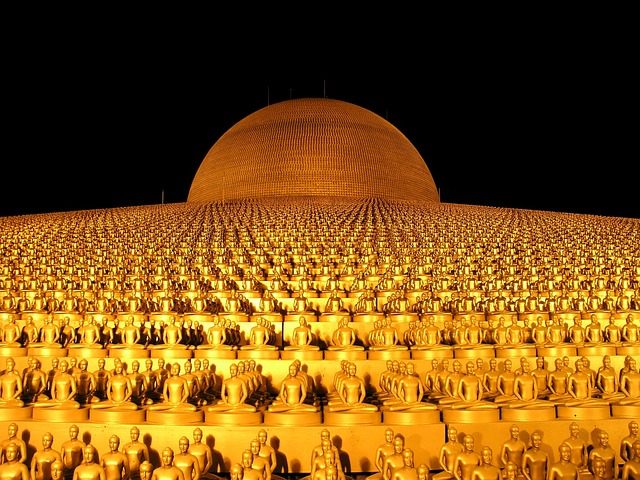

Precious metals IRAs offer a distinctive investment avenue within retirement portfolios, allowing for the inclusion of physical gold, silver, platinum, and palladium. These investments are often sought after for their potential to hedge against inflation and economic uncertainty. Investors in such accounts can benefit from the historical stability associated with these metals, which can act as a counterbalance to paper assets during volatile market conditions.

To engage with precious metals IRAs, it is crucial to comprehend the types of metals permitted, storage regulations, and the process for acquiring and managing these holdings within an IRA framework. The Internal Revenue Service (IRS) mandates specific guidelines that dictate how these metals must be held—typically through a third-party custodian approved by the IRS. This ensures the purity and authenticity of the precious metals while safeguarding the investor’s retirement savings. Investors must also consider the different forms of precious metals available, such as coins, bars, and bullion, each with its own benefits and rules for inclusion in an IRA. Understanding these details is key to making informed decisions and successfully integrating precious metals into a retirement strategy.

Top Precious Metals IRA Companies

When considering the top precious metals IRA companies, investors often evaluate a range of factors including reputation, customer service, variety of offerings, and competitive pricing. Among these firms, Regal Assets stands out for its comprehensive approach to precious metals investments, providing educational resources alongside a diverse selection of gold, silver, platinum, and palladium products. Another prominent player in the field is Birch Gold Group, which has established itself through expert knowledge and a focus on customer-centric services. They guide investors through the process of diversifying their retirement portfolios with physical precious metals, emphasizing security and tax advantages.

Another reputable option, Augusta Precious Metals, is known for its client-focused approach and educational commitment. The company offers personalized consultations to help clients make informed decisions about their investments in precious metals IRAs. Meanwhile, Goldco directs its efforts towards simplifying the investment process with a user-friendly platform and straightforward advice. Each of these top precious metals IRA companies brings a unique set of services and expertise to the table, enabling investors to confidently include physical precious metals as part of their retirement planning strategy.

Eligibility and Contribution Limits for Precious Metals IRAs

Precious metals IRAs are a unique investment vehicle that allows individuals to diversify their retirement portfolios by including physical gold, silver, platinum, and palladium. To be eligible for a precious metals IRA, investors must have an existing IRA or 401(k) account that can be rolled over into a self-directed IRA capable of holding physical precious metals. The Internal Revenue Service (IRS) sets strict guidelines on the types and purity of metals allowed within these accounts to ensure they are compliant with IRS regulations.

Contribution limits for Precious Metals IRAs are in line with traditional IRAs and are subject to annual adjustments based on cost-of-living adjustments. For 2023, the contribution limit for those under 50 years of age is $6,500, while those 50 and older can contribute up to $7,500 thanks to the catch-up provision. These limits apply regardless of the type of IRA, including those that invest in precious metals. It’s important for potential investors to consult with a financial advisor or the IRS guidelines to understand the specific rules and contribution limits that apply to their situation, as these figures are subject to change and may vary based on individual circumstances and changes in legislation.

Types of Precious Metals Allowed in an IRA

Investors seeking to diversify their retirement portfolios with precious metals have several options within the confines of an Individual Retirement Account (IRA). The Internal Revenue Service (IRS) stipulates that for metals to be included in an IRA, they must meet specific purity standards. Among the most commonly invested-in precious metals are gold and silver. For gold, coins or bars that are 99.5% pure or better are permissible, with American Gold Eagles, Canadian Gold Maple Leafs, and Austrian Gold Philharmonics being popular choices. Similarly, for silver, the IRS accepts coins and bars that are 99.9% pure, with the American Silver Eagle being a widely recognized option.

Platinum and palladium also have their places in IRA-allowed precious metals. Platinum products must be 99.95% pure, and while palladium has lower purity requirements for IRA investment at 99.95%, it is a less common choice compared to the more traditionally recognized gold and silver. Investors interested in these latter two metals typically find products like the Canadian Platinum Maple Leaf and various palladium bars that meet the necessary IRS standards. Each of these metals offers different risk and return profiles, which can serve as a hedge against inflation and market volatility within an investor’s retirement strategy.

Strategies for Incorporating Precious Metals into Your Retirement Portfolio

When considering strategies for incorporating precious metals into your retirement portfolio, it’s crucial to understand the rules and regulations that govern such investments, particularly under an IRA framework. The IRS stipulates specific conditions for the types of precious metals allowed within a self-directed IRA, ensuring they are genuine and meet purity standards. To start, investors should select a reputable IRA custodian specializing in precious metals, as this entity will store your investments securely and facilitate all transactions according to IRS guidelines.

Once you have established a relationship with a qualified custodian, you can proceed with the allocation process. A common approach is to diversify your holdings across different types of precious metals. Gold and silver are traditional favorites due to their historical value and relative stability against inflation. Platinum and palladium, while perhaps more volatile, offer potential for growth and can serve as a hedge against economic uncertainty. It’s advisable to consult with a financial advisor or a precious metals specialist to determine the optimal mix based on your retirement goals, risk tolerance, and market outlook. Additionally, consider regular contributions to your precious metals IRA, akin to making consistent investments in stocks or mutual funds. This disciplined approach can help smooth out market fluctuations over time, allowing your precious metals portfolio to grow steadily alongside your other retirement assets.