Residents of Wyoming interested in incorporating physical gold, silver, platinum, and palladium into their retirement savings can explore goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com goldiracompanies.substack.com gold ira options that offer protection against inflation and market volatility. When choosing a Gold IRA company in Wyoming, investors should consider the firm's reputation, customer service quality, and the range of precious metals available, all while ensuring adherence to strict IRS guidelines and clear fee schedules. Wyoming's companies excel in managing self-directed IRAs with a focus on precious metals, providing educational resources and excellent service within a legal framework that ensures the integrity of retirement savings. The state's favorable tax environment and pro-business stance enhance investment efficiency and cost-effectiveness. Investors must carefully evaluate fee structures, ranging from annual maintenance to transaction costs, as these can impact returns. Gold IRA companies in Wyoming also offer secure storage solutions that comply with both state and federal regulations, positioning them as reliable choices for a diversified retirement portfolio. The comprehensive regulatory framework in Wyoming supports these companies by mandating stringent operational standards, which ensure consumer safeguards, industry transparency, and uphold the state's reputation as a hub for reputable gold IRA investments.

- Understanding Gold IRAs and Their Benefits for Wyoming Residents

- Top-Rated Gold IRA Companies Operating in Wyoming

- Comparing Fees and Services of Gold IRA Providers in Wyoming

- The Process of Rolling Over to a Gold IRA with Wyoming-Based Companies

- Key Factors to Consider When Choosing a Gold IRA Company in Wyoming

- How Wyoming's Regulatory Framework Influences Gold IRA Services and Security

Understanding Gold IRAs and Their Benefits for Wyoming Residents

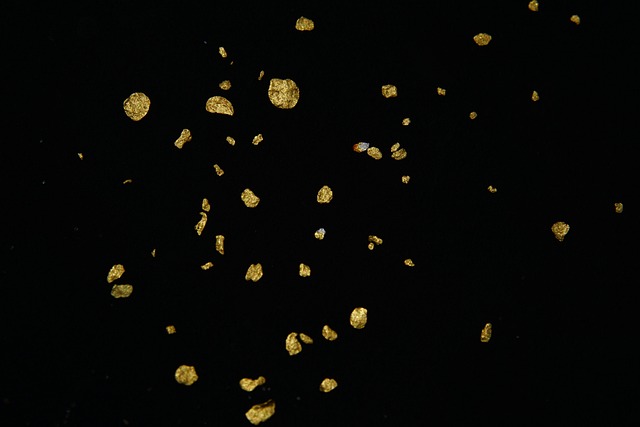

Gold IRAs offer Wyoming residents a unique avenue for diversifying their retirement portfolios with precious metals, which can serve as a hedge against inflation and market volatility. Unlike traditional Individual Retirement Accounts that invest in stocks, bonds, or mutual funds, Gold IRA companies in Wyoming allow individuals to hold physical gold, silver, platinum, and palladium within their retirement accounts, providing a tangible asset component to their savings. This alternative investment strategy can be particularly beneficial for Wyoming residents looking to balance their investment portfolio with non-correlated assets that may appreciate independently of the stock market’s performance.

When considering Gold IRA companies in Wyoming, it’s crucial to evaluate their reputation, customer service, and the range of precious metals they offer. These companies must comply with Internal Revenue Service (IRS) regulations and provide transparent fee structures. They should also guide Wyoming residents through the process of rolling over existing retirement funds into a Gold IRA, ensuring compliance with the IRS rules regarding tax-deferred or tax-free growth of investments. By partnering with reputable Gold IRA companies in Wyoming, investors can capitalize on the long-term stability and potential for growth that precious metals offer as part of a robust retirement strategy.

Top-Rated Gold IRA Companies Operating in Wyoming

When considering a Gold IRA in Wyoming, investors have access to some of the top-rated gold IRA companies that offer robust services and secure investment opportunities. These firms are known for their exceptional customer service, competitive fees, and a wide array of precious metals to choose from. They comply with state and federal regulations, ensuring that your retirement savings are managed within a legal framework designed to protect investors. Wyoming’s gold IRA companies stand out for their expertise in facilitating self-directed IRAs with gold, silver, platinum, and palladium, catering to the diverse needs of investors looking to diversify their portfolios with physical precious metals. Their reputation for reliability and transparency is well-established within the industry, making them a preferred choice for those seeking a Gold IRA company in Wyoming. Additionally, these companies often provide educational resources to help investors make informed decisions about their investments in gold and other valuable metals. This commitment to education and service excellence ensures that clients are well-equipped to navigate the complexities of precious metals investment within a self-directed IRA framework.

Comparing Fees and Services of Gold IRA Providers in Wyoming

When considering a Gold IRA in Wyoming, it’s crucial to compare the fees and services offered by various gold IRA companies. Residents of the Cowboy State have unique advantages, such as favorable tax laws and a pro-business environment that can impact the overall cost and efficiency of their investment. Prospective investors should scrutinize the detailed fee structures provided by these companies, which include annual maintenance fees, storage fees, and transaction costs. These charges can vary significantly between firms, affecting both short-term and long-term returns. Additionally, Wyoming’s strategic position in precious metals mining and refining makes it an ideal location for those looking to invest in gold with tangible benefits. Evaluating the range of services, from customer support to the variety of precious metals available for investment, is equally important. Some companies specialize in educational resources and personalized advice, while others offer competitive rates on buying and selling. By carefully considering both fees and services, investors can make informed decisions that align with their financial goals and the benefits of investing through Gold IRA companies in Wyoming. It’s advisable to request detailed fee schedules from each provider and compare them alongside the quality of customer service and the selection of precious metals they offer. This due diligence will ensure that investors choose a Gold IRA company that provides both value and the security of their investment in Wyoming.

The Process of Rolling Over to a Gold IRA with Wyoming-Based Companies

When transitioning traditional retirement savings into a Gold IRA, particularly with Wyoming-based companies, the process of rolling over your existing retirement account is both straightforward and regulated to ensure compliance with IRS rules. The first step involves contacting your current retirement plan administrator to initiate the rollover process. You will request a direct rollover to your chosen Gold IRA provider in Wyoming. It’s crucial to ensure that the funds are transferred directly to the custodian of your new Gold IRA account to avoid any taxable event, as per IRS regulations. The Wyoming-based Gold IRA companies typically provide clear instructions and forms to facilitate this process. Once the funds are received by the Wyoming custodian, they will purchase the gold or other precious metals according to your investment preferences and the IRS guidelines that stipulate what types of metals can be held in a Gold IRA. It’s important to align with these standards as set forth by the Internal Revenue Service to maintain the tax-advantaged status of your retirement savings. Working with a Wyoming-based company can offer investors the benefit of their expertise and adherence to strict state and federal regulations, ensuring a secure and compliant investment experience in precious metals.

Key Factors to Consider When Choosing a Gold IRA Company in Wyoming

When exploring the best Gold IRA companies in Wyoming, investors should carefully consider several critical factors to make an informed decision. Firstly, evaluate the reputation and reliability of each company. Research their history, customer feedback, and regulatory compliance status. A reputable Gold IRA company in Wyoming will have a track record of transparent dealings and a history of satisfied clients. Additionally, scrutinize the range of precious metals available, as diversity can offer more opportunities for diversification within your retirement portfolio. Ensure that the firm offers a selection of gold, silver, platinum, and palladium products to meet various investment objectives and risk profiles.

Another vital aspect is the level of customer service and support provided. A top-tier Gold IRA company should offer comprehensive assistance throughout the process, from initial setup to ongoing management. This includes accessible communication channels, educational resources on precious metals investing, and clear guidance on compliance with Internal Revenue Service (IRS) regulations. Furthermore, consider the storage solutions offered. Wyoming has specific storage requirements for Gold IRAs, so it’s crucial to choose a company that provides secure, IRS-approved storage facilities either in-state or through an alliance with a trusted third party. By focusing on these factors, investors can select a Gold IRA company in Wyoming that aligns with their investment goals and offers a robust framework for a secure retirement portfolio.

How Wyoming's Regulatory Framework Influences Gold IRA Services and Security

Wyoming’s regulatory framework provides a robust and favorable environment for gold IRA companies to operate, enhancing the security and reliability of services offered. The state’s legislature has established clear guidelines that govern precious metals transactions, which not only protect consumers but also facilitate transparency and compliance within the industry. This regulatory clarity is crucial for gold IRA companies in Wyoming, as it allows them to efficiently manage their operations while adhering to stringent standards set forth by state and federal authorities. As a result, investors can have confidence in the integrity of their investments with these companies, knowing that their assets are handled according to established legal protocols. The state’s commitment to maintaining a stable and predictable regulatory landscape is instrumental in positioning Wyoming gold IRA companies as reliable entities within the broader financial sector. This stability is further underscored by the state’s supportive policies towards the mining and storage of precious metals, which ensure that gold IRA companies can provide secure and verifiable assets to their clients.

When considering a Gold IRA in Wyoming, it’s crucial to evaluate the leading gold IRA companies operating within the state. This article has broken down the essential aspects, from the benefits of a Gold IRA to the top-rated service providers and their fee structures. Wyoming residents have unique advantages due to the state’s favorable regulatory environment, which ensures robust security for these investments. By comparing the services and fees across reputable companies in the region, investors can make informed decisions tailored to their financial goals. Ultimately, the choice of a Gold IRA company in Wyomer should align with your investment strategy and take full advantage of the state’s supportive framework for such assets. With the right guidance and due diligence, investing in a Gold IRA through a Wyoming-based company can be a sound addition to a diversified retirement portfolio.