Rolling over a 401(k) to a Gold IRA offers retirement benefits including diversification and inflation protection. This process requires careful navigation of rules, tax implications, and potential penalties. Planning involves identifying your current plan, choosing a reputable provider, initiating the rollover, and monitoring transfer progress for accurate record-keeping. Essential considerations include evaluating 401(k) performance, researching Gold IRA providers, and understanding tax effects to ensure a successful transition.

Looking to streamline your retirement savings? A 401(k) to Gold IRA rollover might be the strategic move you need. This comprehensive guide delves into the intricate details of these powerful investment vehicles, offering a clear understanding of their unique benefits and processes.

We’ll explore why rolling over your 401(k) to a Gold IRA makes financial sense, walk you through the step-by-step process, and highlight key factors to consider before making this important decision.

- Understanding 401k and Gold IRA Rollover: A Comprehensive Guide

- Benefits of Rolling Over to a Gold IRA

- The Process: How to Seamlessly Conduct a 401k Rollover

- Top Factors to Consider Before Initiating a Gold IRA Rollover

Understanding 401k and Gold IRA Rollover: A Comprehensive Guide

When considering a 401k gold IRA rollover, it’s essential to grasp the fundamentals of both retirement vehicles. A 401(k) is a defined contribution plan offered by employers, allowing employees to contribute pre-tax dollars and potentially gain tax advantages. These contributions, along with any investment growth, are taxed upon withdrawal in retirement. On the other hand, a Gold IRA (Individual Retirement Account) is a self-directed retirement account that invests in physical gold or gold funds. This unique option offers a hedge against inflation and economic uncertainty.

A comprehensive guide to 401k gold IRA rollover involves understanding the rules and regulations governing both types of accounts. It’s crucial to know when and how to initiate a rollover, considering tax implications and potential penalties. This process allows investors to seamlessly transition their retirement savings from one account to another, potentially enjoying the benefits of gold as an asset class within their retirement portfolio.

Benefits of Rolling Over to a Gold IRA

Rolling over your 401k to a Gold IRA offers several significant advantages for your retirement savings. One of the key benefits is diversification, as gold is considered a hedge against inflation and economic uncertainties. This precious metal has historically maintained its value—or even increased—during periods of economic downturn, ensuring that your retirement funds remain robust.

Additionally, a Gold IRA provides tax advantages. Unlike traditional 401k plans, contributions to a Gold IRA are often tax-deductible, allowing you to reduce your taxable income and potentially lower your tax liabilities. This can be especially beneficial if you’re in a higher tax bracket now but expect to be in a lower one during retirement.

The Process: How to Seamlessly Conduct a 401k Rollover

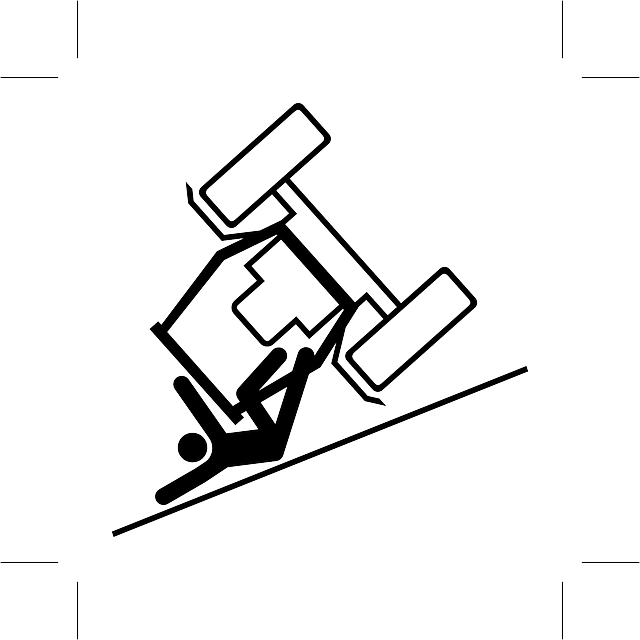

Conducting a 401(k) Gold IRA rollover can seem daunting, but with careful planning and the right steps, it can be a smooth process. First, identify your current 401(k) plan administrator and obtain all necessary documents, including a detailed statement of your account balance. Next, choose a trusted Gold IRA provider that offers rollovers. Ensure they are reputable and have experience handling such transactions to avoid any complications.

Once selected, initiate the rollover process by requesting a distribution from your 401(k) plan. This will involve completing relevant forms and providing necessary documentation to both your current plan administrator and new Gold IRA custodian. After approval, transfer the funds directly from your 401(k) account to your newly established Gold IRA account. Regularly monitor the process to ensure timely completion and accurate record-keeping for tax purposes.

Top Factors to Consider Before Initiating a Gold IRA Rollover

Before initiating a Gold IRA rollover, several top factors should be carefully considered to ensure a smooth transition and maximize your retirement savings potential. Firstly, evaluate the current state of your 401k plan. Understand the investment options available, fees associated with your existing funds, and the overall performance of your assets. This assessment will help you make informed decisions about the rollover process.

Secondly, research Gold IRA providers thoroughly. Compare their fees, investment choices, reputation, and customer service. Ensure the provider is reputable and in compliance with relevant regulations. Additionally, consider tax implications carefully. Consult a financial advisor or tax professional to understand potential tax savings or consequences associated with the rollover. Understanding these factors will empower you to make a well-informed decision regarding your 401k gold IRA rollover.

A 401k gold IRA rollover offers a unique opportunity for financial growth and diversification. By carefully navigating this process, individuals can access the potential benefits of gold as an investment while ensuring a smooth transition from their traditional retirement savings. Understanding the factors involved and following a structured approach will empower investors to make informed decisions, ultimately enhancing their long-term financial well-being. This comprehensive guide has provided valuable insights into the 401k gold IRA rollover, serving as a starting point for those seeking to explore this alternative investment strategy.