The 401k Gold IRA rollover is a strategic investment strategy enabling individuals to diversify retirement savings by transferring funds from traditional 401k plans into a Gold IRA, investing in physical gold. This method offers potential long-term growth, protection against market volatility, and greater control over investments with various gold products. It requires careful planning, including evaluating current 401k plans, selecting a reputable provider during low market volatility, and navigating the rollover process with assistance from administrators. Thoroughly comparing options, reviewing client testimonials, assessing track records, and ensuring transparency are crucial for a successful rollover that minimizes expenses, maximizes investment potential, and secures financial future.

“Uncover the power of diversifying your retirement portfolio with a 401k Gold IRA rollover. This comprehensive guide explores the strategic move of shifting funds from traditional 401k plans to Gold IRAs, offering significant advantages in terms of investment potential and financial security.

We’ll navigate the process step-by-step, from understanding the basics of 401k and Gold IRAs to the benefits and considerations for a successful rollover. By the end, you’ll be equipped with the knowledge to make informed decisions regarding your retirement savings.”

- Understanding 401k and Gold IRA Rollovers

- Advantages of Gold IRA Rollover

- Navigating the Rollover Process

- Reviews and Considerations for Success

Understanding 401k and Gold IRA Rollovers

When considering retirement savings, understanding different investment options is crucial. One such option that has gained popularity in recent years is the 401k Gold IRA rollover. This strategy allows individuals to move their retirement funds from a traditional 401k plan into a Gold IRA (Individual Retirement Account), offering a unique way to diversify investments with precious metals like gold.

The 401k Gold IRA rollover provides an alternative investment avenue, especially for those who want to explore non-traditional assets. By converting your 401k to a Gold IRA, you gain access to potential long-term growth and protection against market volatility. This method allows investors to hold physical gold within their retirement account, offering a tangible asset that can serve as a hedge against economic uncertainties.

Advantages of Gold IRA Rollover

A 401k gold IRA rollover offers numerous advantages for individuals looking to diversify their retirement savings. One key benefit is the potential for better investment returns, as gold has historically shown a strong performance compared to traditional paper assets like stocks and bonds. This can help protect your retirement portfolio against market volatility and ensure a more secure financial future.

Additionally, rolling over a 401k into a Gold IRA allows for greater control over your investments. You can choose from various types of gold products, such as bullion, coins, or even gold-backed ETFs, catering to different risk appetites and investment goals. This flexibility empowers you to tailor your retirement strategy according to your preferences, making it an attractive option for those seeking alternative asset classes in their retirement planning.

Navigating the Rollover Process

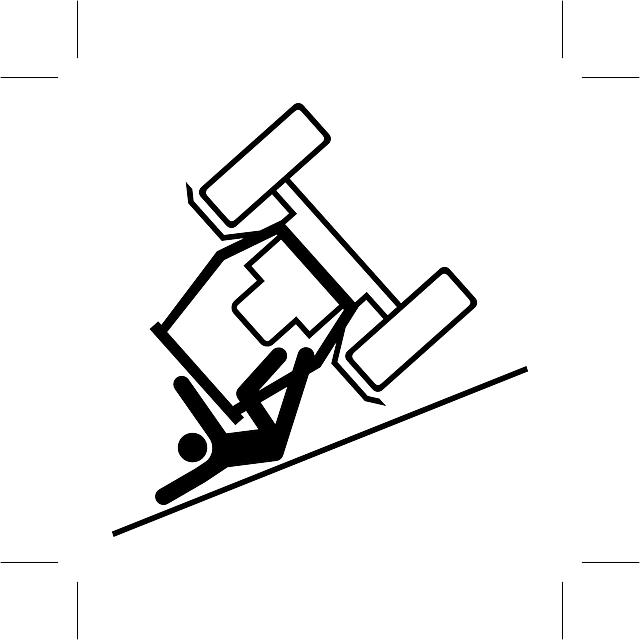

Navigating the goldiracompanies substack 401k to gold ira rollover Process involves careful planning and understanding the steps required to ensure a smooth transition. The first step is evaluating your current 401k plan, considering any fees associated with the rollover and identifying the best time to make the transfer, typically during periods of low market volatility. It’s crucial to choose a reputable Gold IRA provider who can facilitate the rollover process and offer competitive rates.

Next, you’ll need to initiate the rollover by submitting a request to your current 401k administrator. They will guide you through the necessary paperwork, which may include tax forms and beneficiary designations. Once approved, funds are transferred from your 401k account into your newly established Gold IRA account. This process ensures that your retirement savings are diversified in precious metals, offering potential protection against market fluctuations.

Reviews and Considerations for Success

When considering a 401k to Gold IRA rollover, it’s crucial to sift through reviews and considerations that ensure your financial success. Start by evaluating the reputation and expertise of the gold IRA rollover company; read client testimonials and check their track record for smooth transactions and excellent customer service. The process should be straightforward, with minimal hassle, so look for firms that offer transparent communication and educational resources to guide you every step of the way.

Additionally, understand the fees associated with the rollover. Compare them against industry standards to ensure you’re getting a fair deal. A reputable company will provide detailed cost breakdowns, allowing you to make an informed decision. Remember, a successful 401k gold IRA rollover not only minimizes expenses but also maximizes your investment potential, securing your financial future.

When considering a 401k to Gold IRA rollover, understanding the process and its benefits is key. By navigating the rollover with care, you can leverage the advantages of diversifying your retirement portfolio with precious metals. Reviews and successful considerations ensure a smooth transition, allowing you to maximize tax efficiency and potential long-term gains associated with Gold IRAs. This strategic move could be a game-changer in building a robust retirement savings plan.