A 401(k) to Gold IRA rollover allows individuals to diversify retirement savings, invest in alternative assets like gold, and access unique tax advantages. To transition, investors must meet IRS eligibility criteria, select a reputable provider, complete forms accurately, and communicate with both parties for a smooth transfer. This process offers increased investment choices, potential long-term growth, and protection against inflation and market volatility, but involves risks and penalties if not managed properly.

Looking to diversify your retirement portfolio? A 401(k) to Gold IRA rollover could be a strategic move. This comprehensive guide breaks down the process, from understanding these retirement accounts to seamlessly transferring your funds. We’ll explore eligibility requirements, benefits, and key considerations post-rollover. Maximize your savings and secure your future with this essential step-by-step resource for 401(k) to Gold IRA rollovers.

- Understanding 401k and Gold IRA Rollovers

- Eligibility and Requirements for a Rollover

- Steps to Seamlessly Transfer Your Funds

- Benefits and Considerations Post-Rollover

Understanding 401k and Gold IRA Rollovers

A 401(k) to Gold IRA rollover is a strategic move that allows individuals to diversify their retirement savings and potentially enhance their investment portfolio. Understanding this process involves grasping two distinct retirement accounts: 401(k)s, offered by employers, and Individual Retirement Accounts (IRAs), which are personal accounts. The 401(k) is a popular choice for employer-sponsored retirement plans, providing tax advantages and often matching contributions from the employer. On the other hand, IRAs, such as the Gold IRA, offer individuals more control over their investments, including the ability to invest in alternative assets like gold.

When considering a 401(k) to Gold IRA rollover, individuals aim to unlock the potential benefits of diversifying their retirement savings. Gold IRAs allow investors to hold physical gold or gold-backed securities within their retirement accounts. This diversification can serve as a hedge against inflation and economic uncertainties, which are common concerns among retirees. By rolling over funds from a 401(k) to a Gold IRA, individuals can access new investment opportunities while navigating the potential tax advantages associated with each account type.

Eligibility and Requirements for a Rollover

To initiate a goldiracompanies substack 401k to gold ira rollover, an individual must first meet certain eligibility criteria set by the Internal Revenue Service (IRS). This process is designed to encourage retirement savings and allow for more diverse investment options in a tax-efficient manner. Typically, anyone with a 401k plan can roll it over into a Gold IRA, provided they are not currently participating in another IRA plan. The rollover is particularly beneficial for those seeking alternative investment vehicles beyond traditional stocks and bonds.

The requirements for eligibility include being at least 18 years old, having earned income from employment or self-employment, and not being a dependent of another person who files a joint tax return. It’s essential to ensure that the 401k plan is qualified under IRS rules, meaning it meets certain criteria regarding tax treatment and benefits. During the rollover, careful consideration must be given to avoid potential penalties and taxes by following the guidelines set forth by the IRS for such transactions.

Steps to Seamlessly Transfer Your Funds

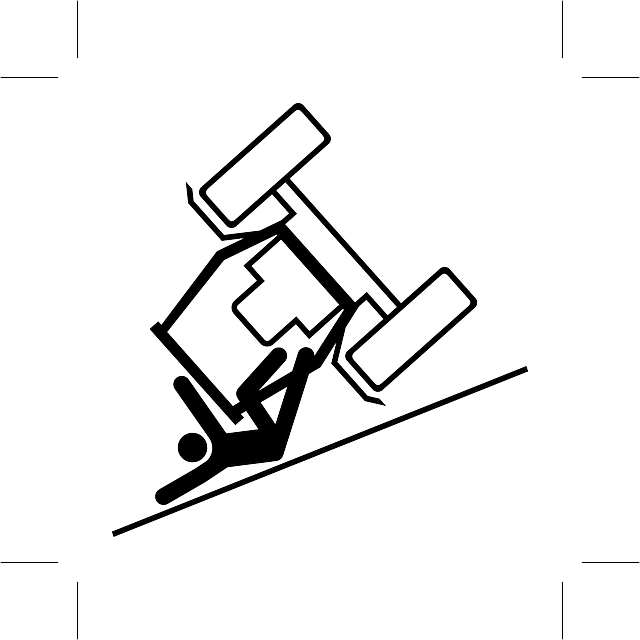

When rolling over your 401k to a Gold IRA, a structured and organized approach is key to ensuring a smooth transition for your funds. Begin by identifying a reputable Gold IRA provider that aligns with your financial goals. Compare their fees, investment options, and reputation in the market to make an informed decision. Once chosen, request a rollover form from both your current 401k administrator and the new Gold IRA custodian. Fill out these forms accurately and completely, ensuring all necessary documentation is submitted on time. This usually involves transferring funds directly between the accounts, avoiding any taxable events.

Next, carefully review the terms and conditions of the rollover to understand any potential tax implications or restrictions. Ensure that your 401k distribution complies with IRS regulations to avoid penalties. Efficient communication with both parties is vital. Regularly check in with your administrator and IRA custodian to track the progress of your rollover and address any questions or concerns promptly. By following these steps, you can seamlessly transfer your funds from a 401k to a Gold IRA, paving the way for potential benefits such as diversification of assets and gold’s historical role as a hedge against inflation.

Benefits and Considerations Post-Rollover

After completing a 401k to Gold IRA rollover, individuals can expect several benefits. One significant advantage is increased investment options, as Gold IRAs offer access to precious metals not typically available in traditional retirement accounts. This diversification can potentially enhance long-term growth and protect against market volatility. Additionally, rolling over to a Gold IRA may provide tax advantages, allowing contributions to grow tax-deferred until withdrawal, which can result in substantial savings over time.

However, there are considerations to keep in mind. The value of precious metals like gold fluctuates, so investors assume the risk of potential losses. Furthermore, early withdrawals from a Gold IRA may incur penalties and taxes, so it’s crucial to plan for long-term investment. Proper research and consultation with financial advisors ensure that a 401k to Gold IRA rollover aligns with individual retirement goals and risk tolerance.

Rolling over your 401k to a Gold IRA can be a strategic move for retirement savings. By understanding the process, eligibility criteria, and benefits, you can make an informed decision. This guide has outlined the essential steps to ensure a seamless transition, allowing you to diversify your investment portfolio with precious metals. Remember, when navigating a 401k to Gold IRA rollover, it’s crucial to consult professionals for personalized advice tailored to your financial goals and circumstances.