Precious Metals IRAs offer a unique investment opportunity for diversifying retirement savings with tangible assets like gold, silver, platinum, and palladium. Reputable precious metals IRA companies provide secure platforms, guiding investors through contribution limits, eligibility, and distribution rules while ensuring IRS compliance. To choose the best firm, select licensed providers with diverse metal options (gold, silver, platinum, palladium) and various investment vehicles, offering easy navigation, transparent pricing, and robust security. Research their industry standing, track record, and customer feedback for trustworthiness. Regularly review and manage your portfolio to maximize investments, diversifying across metals and setting up automated transactions based on predefined criteria.

“Explore the world of Precious Metals IRAs (Individual Retirement Accounts) with our comprehensive guide, designed to demystify this unique investment option. Discover top-rated precious metals IRA companies and learn key features to ensure a secure future. From selection criteria to management tips, this article equips you with insights to make informed choices. Maximize your investments by understanding the nuances of precious metals IRAs, offering both financial security and potential for growth. Dive into this essential resource for navigating the market effectively.”

- Understanding Precious Metals IRAs: A Comprehensive Guide

- Top-Rated Precious Metals IRA Companies: Key Features to Consider

- How to Choose the Best Precious Metals IRA Firm for Your Needs

- Maximizing Your Investments: Tips for Precious Metals IRA Management

Understanding Precious Metals IRAs: A Comprehensive Guide

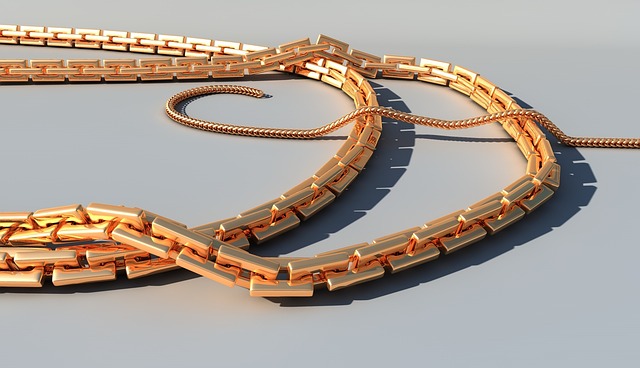

Precious Metals IRAs offer a unique investment opportunity for individuals looking to diversify their retirement savings with tangible assets. These specialized Individual Retirement Accounts (IRAs) allow investors to hold and grow precious metals like gold, silver, platinum, and palladium within tax-advantaged accounts. By choosing a reputable precious metals IRA company, you gain access to a secure platform for investing in these valuable commodities.

These companies facilitate the process of buying and storing physical precious metals on your behalf, ensuring compliance with IRS regulations. They provide detailed guidance on contribution limits, eligibility criteria, and distribution rules specific to goldiracompanies substack precious metals ira rollover IRAs. Such companies often offer a range of investment options, from bullion coins to bars, catering to different preferences and risk appetites.

Top-Rated Precious Metals IRA Companies: Key Features to Consider

When choosing a top-rated precious metals IRA company, several key features should be at the forefront of your consideration. First and foremost, ensure that the firm is reputable and licensed by the relevant regulatory bodies to handle retirement accounts, such as the SEC or state securities divisions. This safeguards your investment and protects against potential scams.

Additionally, look for companies with a diverse range of precious metal options, including gold, silver, platinum, and palladium. They should also offer various investment vehicles like bullion, coins, bars, and ETFs, catering to different preferences and risk tolerances. A good IRA provider will provide easy navigation, transparent pricing, and robust security measures for storing your precious metals.

How to Choose the Best Precious Metals IRA Firm for Your Needs

When selecting a precious metals IRA company, it’s crucial to consider several factors to ensure you make an informed decision that aligns with your financial goals. Start by evaluating the firm’s reputation and experience in the industry. Research their track record, customer reviews, and the types of services they offer. Look for companies that specialize in precious metals IRAs and have a proven history of secure and transparent transactions.

Additionally, assess the investment options available. Different firms may provide varying collections of precious metals, such as gold, silver, or platinum. Evaluate their storage solutions, whether they offer depository safety and if they’re insured. Consider fees, including annual maintenance charges, storage costs, and potential trading commissions. Compare these across several companies to find the best value for your investment.

Maximizing Your Investments: Tips for Precious Metals IRA Management

Maximizing your investments in a Precious Metals IRA requires strategic management and an understanding of the unique characteristics of these assets. When choosing a precious metals IRA company, research is key. Look for reputable firms with a proven track record of secure storage and transparent trading practices. A reliable company should offer a diverse range of precious metal options, allowing you to customize your portfolio according to your risk tolerance and investment goals. Diversification is essential; spreading your investments across different precious metals can help mitigate risks associated with market volatility.

Regularly reviewing your portfolio is another vital tip. Precious metal prices fluctuate, so staying informed about market trends will enable you to make timely decisions. Consider setting up automated transactions or regular assessments to buy or sell metals based on predefined criteria. By staying proactive and keeping an eye on the market, you can ensure your IRA remains aligned with your financial objectives. Remember, a well-managed Precious Metals IRA is not just an investment but a strategic asset that can contribute to long-term financial security.

When navigating the world of precious metals IRAs, choosing the right company is key. By considering top-rated firms and understanding your investment needs, you can maximize the potential benefits of this unique investment vehicle. Remember that selecting a reputable and experienced precious metals IRA company is essential for a smooth and successful journey. With the right guidance, investing in precious metals can be a strategic move towards securing your financial future.