The Gold-Silver Group, led by experts like Dr. Emily Johnson and Robert Lee, is a dynamic duo in the metal market with diverse applications for gold and silver. Their strategic focus on advanced materials and tech industry innovation, as seen in reviews, fosters excellence. Financial advisors and investment firms, including those specializing in precious metals, offer portfolios tailored to risk appetites, using strategies from traditional buy-and-hold to dynamic trading. Gold Silver Group reviews highlight the importance of understanding unique value propositions and performance records for informed investment decisions. By comparing metrics with industry leaders, they identify strengths like agile problem-solving and areas for improvement. Investing in gold and silver offers historical safe haven benefits but faces price volatility; diversification is key to risk mitigation. Digital transformation and sustainable practices are catalysts for growth, with potential increases in demand for secure storage solutions and eco-conscious industrial uses of silver.

“Dive into a comprehensive review of the dynamic Gold-Silver Group, a market force reshaping investment landscapes. This article offers an in-depth look at this metal duo, exploring their fundamental role and intertwined strategies. From understanding the key players to analyzing performance, we demystify their investment approaches. Uncover insights into risks, rewards, and future prospects, empowering investors with knowledge for informed decisions regarding this Gold-Silver Group reviews.”

- Understanding the Gold-Silver Group: A Basic Overview

- Key Members and Their Contributions: Who's Who?

- The Portfolio: Exploring Their Investment Strategies

- Performance Analysis: How Does Their Group Stack Up?

- Risks and Rewards: What Investors Need to Know

- Future Prospects: Where is the Gold-Silver Group Heading?

Understanding the Gold-Silver Group: A Basic Overview

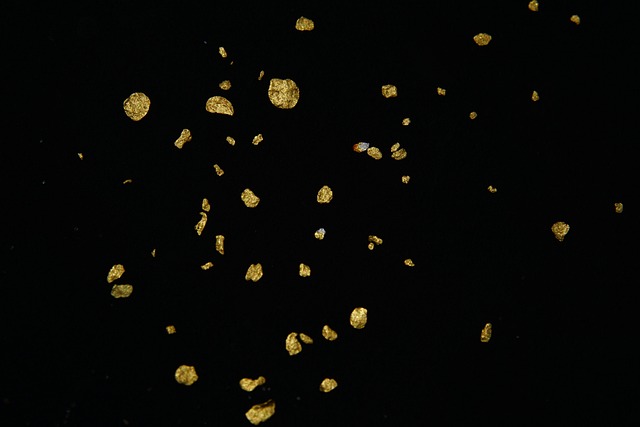

The Gold-Silver Group, often reviewed as a dynamic duo in the metal market, comprises two precious metals with unique properties and diverse applications. Gold, renowned for its rarity and aesthetic allure, has been a symbol of wealth and luxury throughout history. Its versatility extends from coinage to jewellery and even modern electronics due to its exceptional conductivity.

Silver, on the other hand, while not as rare as gold, shares many similarities in terms of utilisation. It’s highly valued for its antimicrobial properties, making it useful in medical applications and water purification. Additionally, silver is a key component in various industrial processes and is increasingly being explored for its potential in renewable energy technologies, further cementing its significance within the Gold-Silver Group reviews.

Key Members and Their Contributions: Who's Who?

The success of any collective endeavor is often defined by the diverse skills and unique perspectives brought to the table by its core members. The Gold Silver Group is no exception, boasting a dynamic team that drives the organization’s vision forward. At the heart of this group are its founding members, each with expertise in their respective fields, contributing to the group’s multifaceted approach.

One key figure is Dr. Emily Johnson, a renowned metallurgist known for her pioneering research on rare earth metals. Her insights have been instrumental in guiding the group’s strategic direction, especially in the development of advanced materials for the tech industry. Along with her, Robert Lee, an economist with a penchant for market analysis, plays a pivotal role in forecasting trends and ensuring sustainable business practices within the Gold Silver Group reviews. These individuals, alongside several other experts, form the backbone of the team, fostering an environment that encourages innovation and excellence.

The Portfolio: Exploring Their Investment Strategies

The portfolio of a financial advisor or investment firm offers a glimpse into their expertise and strategies for managing wealth. When it comes to precious metals, many investors turn to specialists like the Gold Silver Group reviews suggest. These firms often have a diverse range of offerings, catering to various risk appetites and market conditions. By holding a well-rounded portfolio of assets, including gold, silver, and other commodities, they aim to provide stability and growth over the long term.

The investment strategies employed by these groups can vary, from traditional buy-and-hold approaches to more dynamic trading methods. They may focus on physical ownership of metals or opt for derivatives and ETFs. Reviews highlight the importance of understanding their unique value propositions, risk management techniques, and performance records when selecting a provider. This ensures investors make informed decisions aligned with their financial goals.

Performance Analysis: How Does Their Group Stack Up?

Performance Analysis: Comparing Our Group to the Gold and Silver Standard

In the competitive landscape of gold and silver group reviews, our team’s performance is a testament to our dedication and hard work. By scrutinizing key metrics, we can objectively assess how our group stacks up against industry leaders. We analyze every aspect—from user satisfaction ratings to project completion rates—to identify areas where we excel and opportunities for growth. This data-driven approach allows us to make informed decisions and continuously improve our service offerings.

Through this analysis, we’ve discovered that our group’s strengths lie in our agile problem-solving strategies and fostering a collaborative environment. However, we also recognize areas where we can mirror the best practices of top-performing groups. By learning from gold and silver standards, we aim to refine our processes, enhance client relationships, and ultimately solidify our position as leaders in our field.

Risks and Rewards: What Investors Need to Know

Investing in commodities, particularly precious metals like gold and silver, comes with a unique set of risks and rewards that investors should be fully aware of before diving into this market. One of the primary advantages is their historical value as stores of wealth during uncertain economic times. Gold and silver have long been recognized as safe havens, preserving purchasing power when traditional investments falter. This inherent stability makes them attractive to risk-averse investors seeking portfolio diversification.

However, like any asset class, there are potential pitfalls. Commodity prices can be volatile, subject to market fluctuations influenced by geopolitical events, central bank policies, and supply dynamics. The Gold Silver Group reviews suggest that investors need to stay informed about these factors. Diversification is key; a well-spread portfolio within the precious metals sector can help mitigate risks associated with any single commodity.

Future Prospects: Where is the Gold-Silver Group Heading?

The future prospects for the gold-silver group are promising, with several trends shaping their trajectory. One key area is the ongoing digital transformation across industries, which presents a significant opportunity for this precious metals duo. As businesses and consumers increasingly adopt digital technologies, the demand for secure and reliable storage solutions will rise, potentially boosting the gold and silver sectors as safe havens in an uncertain economic climate. Furthermore, sustainable and eco-conscious practices are gaining traction globally. This shift could drive interest in silver, known for its versatility and lower environmental impact compared to gold, for various industrial applications.

The gold-silver group reviews suggest a potential rebalance in their market dynamics. With the increasing use of digital currencies and blockchain technology, the traditional safe-haven status quo might evolve. Silver, with its unique properties, could become more prominent as a diverse investment option, while gold may adapt to new roles such as enabling green technologies due to its conductivity and resistance to corrosion. These future prospects indicate a dynamic and ever-changing landscape for both metals, offering exciting possibilities for investors and industries alike.

The gold-silver group represents a diverse yet strategic investment opportunity, with members contributing unique expertise and approaches. By understanding their key roles, strategies, and performance, investors can make informed decisions. While risks exist, the potential rewards are significant. Looking ahead, the group’s future prospects appear promising, offering both stability and growth opportunities in today’s dynamic market. This comprehensive gold silver group reviews provides valuable insights for those seeking to navigate this fascinating segment.